Unconstrained Bond Funds Out Of The Frying Pan Into The Fire

Post on: 1 Ноябрь, 2016 No Comment

Follow Comments Following Comments Unfollow Comments

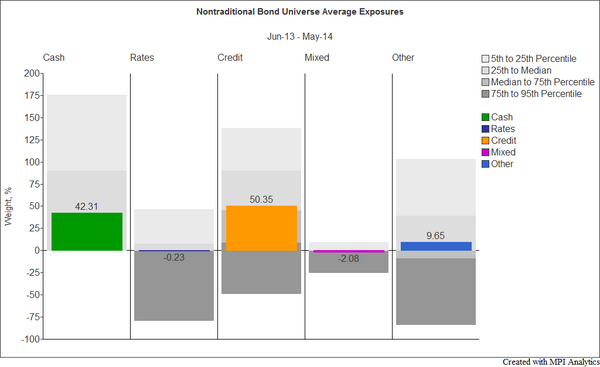

One big attraction of unconstrained bond funds is that they’re supposed to offer more interest-rate protection than traditional strategies. Many of them currently own a lot of high-yield bonds, prompting the question: “Wait: aren’t you just replacing interest rate risk with credit risk?” The MacKay Shields Global Fixed Income (GFI) team’s answer would be: “we are replacing uncompensated risk with compensated risk.”

In an expanding economy, the GFI team argues that owning credit is an appropriate position to have. But at a time of higher rates and a weakening economy, an unconstrained strategy would typically sell credit and move back into interest-rate exposure (for example sell high yield and buy Treasurys.) Different types of bonds outperform in different environments and an unconstrained approach should take into account the changing landscape.

Why high yield now? From a macroeconomic perspective, credit tends to do well in periods of economic expansion. Dan Roberts, who heads the MacKay Shields Global Fixed Income Team, believes the current expansion has not yet hit its crescendo. “The U.S. economy is growing, but that growth trajectory is relatively slow. Slow growth can persist for a long time, and we think it will continue even as the U.S. Federal Reserve starts raising interest rates. We think it will take sometime before we reach a true inflection point where the Fed has tightened too much and it’s choking off growth,” says Dan.

Source: MacKay Shields, Global Fixed Income Team

In the spectacular credit rally after 2009, tightening credit spreads generated huge capital gains. Going forward, it’s going to be more about “coupon clipping:” interest income rather than big capital gains. Dan believes investors are still getting acceptable compensation for high yield risk, and he believes that spreads can stay tight for some time.

Until we see much more evidence that the economic cycle is turning, he thinks that having a portfolio weighted towards credit exposure instead of interest rate exposure offers the best chance of investment success.

_____

This material is distributed for informational purposes only. The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all MacKay Shields Portfolio Management Teams.