Tsipras Extends Syriza Olive Branch on Greece’s Economy Bloomberg Business

Post on: 16 Март, 2015 No Comment

Syriza party leader Alexis Tsipras, center, is surrounded by supporters as he arrives for a pre-election rally at the Palais des Sports stadium in Thessaloniki. Four days before a general election, polls suggest Syriza is poised to defeat Prime Minister Antonis Samaras’s New Democracy party. Photographer: Konstantinos Tsakalidis/Bloomberg

(Bloomberg) — Greece’s opposition Syriza leader Alexis Tsipras said his party will respect European Union fiscal rules and commit to targets on eliminating the deficit, in a further olive branch to the country’s creditors as he moves closer to winning power.

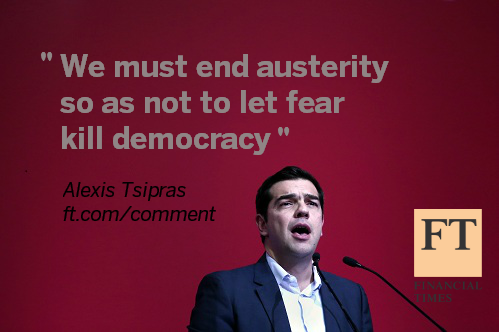

Tspiras, 40, writing in an op-ed published in today’s Financial Times, said Syriza will guarantee a “new social contract” including an end to austerity that will lead to “political stability and economic security.”

“A Syriza government will respect Greece’s obligation, as a eurozone member, to maintain a balanced budget, and will commit to quantitative targets,” Tsipras said.

Four days before a general election, polls suggest Syriza is poised to defeat Prime Minister Antonis Samaras’s New Democracy party. While voters are attracted by a platform which includes opposing the terms attached to Greece’s bailout, investors have been spooked by the uncertainty over the implications of a potential Syriza victory.

Greek bonds have delivered the worst returns in the last month among 34 sovereign securities tracked by Bloomberg’s World Bond Indexes, while Greece’s benchmark Athens Stock Exchange is the worst performing of all the major equity indexes over the same period.

Open, Honest

Tsipras said negotiations to meet a campaign pledge for a writedown on Greece’s public debt needn’t be dramatic. “We have a duty to negotiate openly, honestly and as equals with our European partners,” he said. “There is no sense in each side brandishing its weapons.”

Euro area leaders including German Finance Minister Wolfgang Schaeuble have said repeatedly that the debt cut Tsipras is seeking isn’t on the table.

“There’s no political support to write off Greek debt,” Dutch Finance Minister Jeroen Dijsselbloem said in an interview on RTLZ television in the Netherlands yesterday. Greece’s creditors are willing to discuss easier repayment terms for Greek debt “when it’s necessary from a financial-economic point of view,” said Dijsselbloem, who also chairs meetings of euro-area finance ministers.

Tsipras insists that the Greek economy needs fiscal space to breath, and only a write-off on the nominal value of Greek debt and a moratorium on repayments will allow the next government to ease austerity measures. “We demand repayment terms that do not cause recession and do not push the people to more despair and poverty,” he said in the FT.

European Challenge

The Syriza leader, who wrote a similar op-ed in Germany’s Handelsblatt this month, burnished his European credentials, saying that his party’s platform, which would “put the middle class back on its feet,” is the only way “to strengthen the eurozone and make the European project attractive” to its citizens. Without such change, the field will be open for the National Front in France and its allies to capitalize, he said.

Samaras says Tsipras’s demands will perpetuate uncertainty over Greece’s relations with its euro-area peers and could lead the country out of the currency bloc. Polls for the Jan. 25 election suggest that his arguments have yet to resonate with an electorate battered by a six-year slump that left more than a quarter of the workforce without a job.

“If the Greek people entrust us with their votes, implementing our economic programme will not be a ‘unilateral’ act, but a democratic obligation,” Tsipras said. “We must end austerity so as not to let fear kill democracy.”

To contact the reporter on this story: Nikos Chrysoloras in Athens at nchrysoloras@bloomberg.net

To contact the editors responsible for this story: Alan Crawford at acrawford6@bloomberg.net ; Vidya Root at vroot@bloomberg.net Ben Sills