Trouble in Puerto Rican Bonds Could Haunt

Post on: 16 Март, 2015 No Comment

Photograph by Christian Heeb/laif/Redux

San Juan, Puerto Rico

Puerto Rico is many things: a vacation hot spot, a hub for colonial history, ancestral homeland of CHiPs hunk Erik Estrada. But a big financial player? Not so much—the entire economy is smaller than two Facebooks (FB ) .

So why should Wall Street care? Because Puerto Rico, a U.S. territory that enjoys our preferential municipal bond tax privileges. is actually embedded into a good chunk of financial products here. Like so many other market trends these days, that’s thanks in large part to the voracious quest for income.

Following a dozen consecutive annual budget deficits, Puerto Rico is treacherously close to not being able to pay its bills. A default that blindsides U.S. bond investors—many of whom are unwittingly in Puerto Rican issues via mutual funds that have chowed on its debt—could rock the normally serene $3.7 trillion muni market. Even another leg down in the territory’s credit ratings has the potential to spook forced selling by bond managers.

In his December note. “Watch Out for Puerto Rico,” Morningstar’s (MORN ) Steven Pikelny reported that of the 117 state-oriented muni closed-end funds he follows—most of which say nothing about Puerto Rico in their names—107 have at least a small allocation to Puerto Rico; four of which, meanwhile, are in the double digits. In the open-end muni fund category, he found a stunning 320 of 384 offerings in Puerto Rican debt, with 60 toting double-digit percent exposure.

While this may come across as mission-creep, the Securities and Exchange Commission allows mutual funds to advertise single-state products (say, BondShop Tax-Exempt North Carolina) even with a 5 percent to 10 percent slice of the portfolio committed to Puerto Rico. Morningstar calculates that the top 10 state-specific muni funds that hold Puerto Rico bonds yield 4.6 percent, compared with the broader state-specific average of 3.4 percent. “This is a fairly obvious ploy to more aggressively generate income,” Pikelny writes.

Andrew Clinton, president of Clinton Investment Management, a fixed income shop in Stamford, Conn. says that credit concerns about Puerto Rico have had him avoiding the destination for clients for some time. “We continue to follow the situation closely,” Clinton wrote in an e-mail. “We firmly believe many investors are unknowingly exposed to Puerto Rico either through their mutual fund holdings and/or direct exposure to individual bonds held in passive buy-and-hold or ‘buy and-hope’ strategies.”

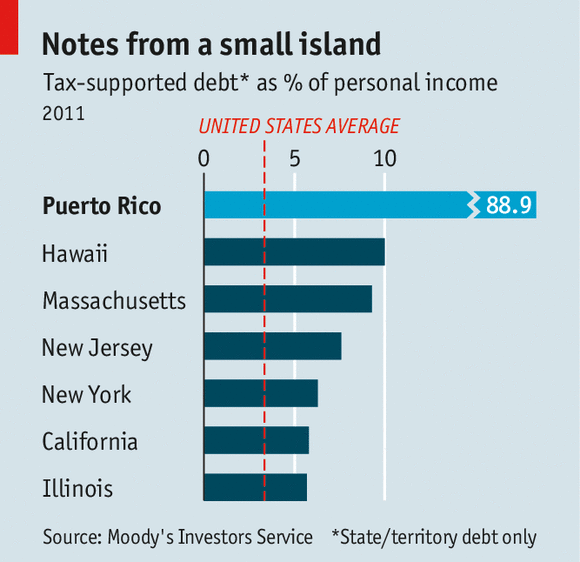

The market’s anxiety is already showing. A Standard & Poor’s (MHP ) index of municipal debt sold by Puerto Rico lost 1.44 percent on March 22, the biggest single-day drop since Wall Street’s September 2008 meltdown. The benchmark has been volatile ever since, with traders waiting to see how San Juan renegotiates its budget obligations. All three major rating companies grade the island of 3.5 million one notch above junk with a negative outlook, meaning it’s at high risk for an imminent downgrade. According to Moody’s (MCO ). Puerto Rico’s projected deficit for the current fiscal year has almost doubled, to $2.2 billion. Its main retirement system is projected to run out of assets next year. Like Greece and Cyprus, the territory must race to cut to keep access to semi-affordable credit.

While no one is panicking yet, debt downgrades could set into effect a vicious cycle. Puerto Rico’s borrowing costs would spike at the worst possible time—further limiting its restructuring options—while fund managers whose mandate limits them to investment-grade debt would have to sell out of what has been rendered territorial junk. If too many investors rush to the exits at the same time, managers may have to sell at significantly impaired prices—and perhaps, ominously, dump much more than just their Puerto Rican bonds.