Trend following Bonds back in bear mode

Post on: 24 Июль, 2015 No Comment

Switzerland

Global Picture

Despite the rather boring currency markets of late, overall this was a positive week for trend followers. The agricultural complex was mixed thanks to a net-positive contributor to the bottom line, while the bull run in equities continued. As usual, healthy equity markets are good for trends in general. Precious metals went strongly against the trends, eating up some profits before being stopped out, but it is bonds that look interesting as the bear market has returned.

Agricultural commodities

We’ve seen a mix in the agricultural performance this week, however, the net result was positive for those who were in all the trends. Corn, wheat and rapeseed did very well, while cocoa continued its positive trend. Sugar went against the trend, as did orange juice.

Source: CSI Data, adjusted corn futures continuation.

The dollar is starting to turn in the short run. The fundamentals might indicate a renewed rally in the USD, but that’s not what systematic traders act on. So far, there is no clear direction on the USD from a trend point of view. Generally speaking, currency markets are not very interesting at this time. Perhaps they will be soon, but for now there is not much going on here.

Source: CSI Data, adjusted dollar index chart.

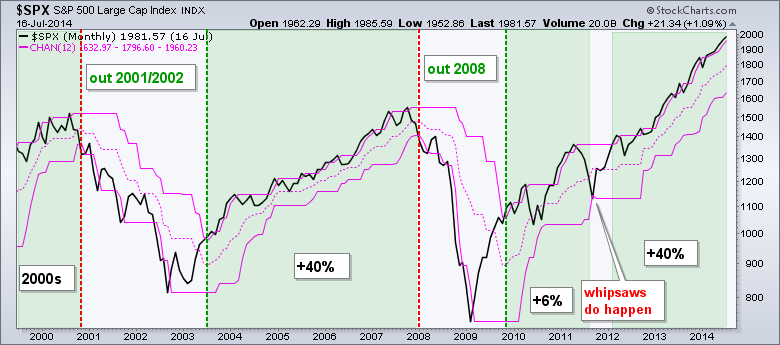

Equities are green all around. Every major market index is showing a positive trend now and this sector is generating good money for systematic traders. The Nikkei lost a little this week, going against the trend, but this was more than made up for by the others. The best performer was Hong Kong’s Hang Seng Index, which gained more than 3 percent.

Source: CSI Data, adjusted Hang Seng futures continuation.

Non-agricultural commodities

The metals showed large moves against the trend this week. Although the trends are still negative, short precious metals positions saw many stops hit this week. There will likely be a good opportunity soon to re-enter shorts on higher levels. Don’t forget the direction of the dominant trend.

Energies, however, did well. Oil-based markets gained and natural gas lost, as the trends dictated.

Source: CSI Data, adjusted natural gas continuation.

This is where the big action was this week. The bear market in bonds is back. The big story of the year is the decline in bond prices and there are no signs of this ending just yet. All major so-called higher-quality sovereigns are falling hard. Keep your shorts on. This could go much further.

Source: CSI Data, adjusted US30 bond continuation.

Trend Overview

Andreas F. Clenow is a hedge fund manager and principal at ACIES Asset Management. He is also the author of the best-selling book Following the Trend (Wiley 2012) .