Treasury InflationProtected Securities (TIPS) Investment U

Post on: 26 Июль, 2015 No Comment

by Alexander Green. Chief Investment Strategist, The Oxford Club Monday, May 10, 2010. Issue #1256 Wisdom of Wealth

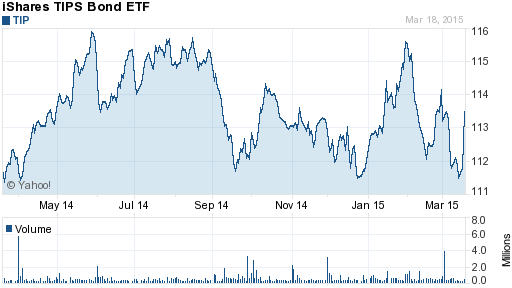

Two weeks ago, I wrote a column recommending Treasury Inflation-Protected Securities (TIPS) as protection against potential inflation down the road.

It prompted a flood of questions and challenges. I want to address those, but let me start by briefly re-stating my case:

I don’t know what the odds of this happening are — and neither does anyone else. But I think investors would be foolish not to at least consider the possibility.

Inflation or Deflation? Hedge Your Bets This Way.

Respondents who disagreed generally fell into one of two camps.

Let me handle the former objection first: Is deflation more likely than inflation? Perhaps. No one can say. You should probably own a good slug of Triple-A insured municipal bonds just in case. (Because future tax rates are almost certainly going higher.)

By all means, make some plans for a deflationary scenario. But plan for the possibility of inflation, too. This is what diversification is all about. Hedge your bets.

But why use TIPS as your hedge, rather than a traditional inflation hedge like precious metals? In my view, you should use both. But remember, gold and silver are less than perfect hedges.

They have both performed exceptionally well over the last 10 years, for example. Gold has more than quadrupled. Silver has done even better. But the 20 years before that were an unmitigated disaster.

But no matter whether inflation is low or high, TIPS will protect you. How?

The Benefits of Buying Treasury Inflation-Protected Securities

There are three good ways to buy inflation-protected Treasuries:

I recommend TIPS for two primary reasons.

I know that some libertarians and laissez-faire capitalists will refuse to buy Treasury securities, period. But as I’ve pointed out, other inflation hedges sometimes don’t work. So there is no small risk taking another approach.

In sum, there is only one investment that guarantees a return that exceeds inflation in the years ahead: TIPS .

And in my view, that makes them an indispensable part of your portfolio.