Treasury Bonds How to Invest in US Government Bonds

Post on: 7 Июнь, 2015 No Comment

Here is a video introduction to Treasury Bonds. You can find the longer text version with more information and links below the video.

You’re in the right place!

Intro to Treasury Bonds

Treasury bonds are issued and backed by the federal government, which makes them among the safest investments in the world. While there are many different types of Treasury Bonds, they all fall into 4 distinct categories:

Treasury Bills Also known as T Bills, treasury bills are US government debt that matures in 1 year or less. They are issued in increments of $100, with maturities of 4 weeks, 13 weeks, 26 weeks, and 52 weeks. A key feature of treasury bills is that they do not pay interest, but rather are sold at a discount to their face value. This means that if you bought a T Bill which matures in one year, and pays an interest rate of 2%, you would pay $98 today in order to get $100 back in 1 year.

Because it is backed by the US Government and the shortest issue, T Bills are considered by many to be the world’s least risky investment.

Treasury Notes Also known as T Notes, treasury notes are US Government debt that matures in 1 to 10 years. Treasury notes are issued in denominations of $1000, and pay an interest payment, (which is known as a “coupon”) every six months. This means that, unlike T Bills, you pay the full price upfront and then receive an interest payment every six months.

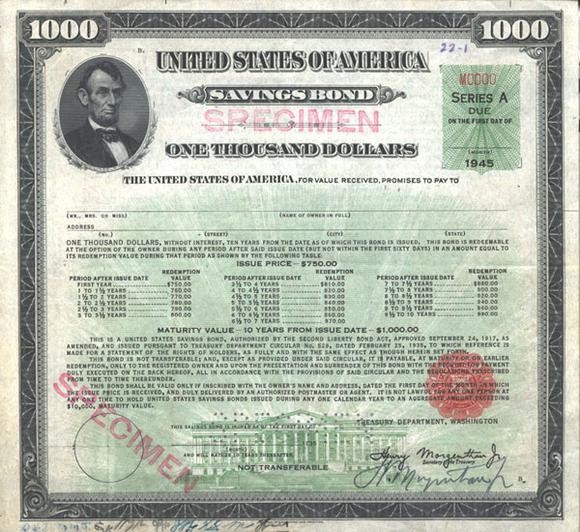

Treasury Bonds Also known as T Bonds, treasury bonds are US Government Debt which matures in 10 to 30 years. The most common maturity of a treasury bond is 30 years, and like treasury notes, treasury bonds have a coupon payment every 6 months.

Treasury Inflation Protected Securities Also known as TIPS, Treasury Inflation Protected Securities are US Government bonds which are designed as a protector against inflation. TIPS are issued with maturities of 5, 10, and 30 years. While the coupon interest rate you receive on TIPS stays constant, the principal, (the amount you would get back at maturity) adjusts up and down with inflation. You can learn more about TIPS here .

While not issued by the US Government, there is another type of bond which is associated with Government agencies, which you can learn more about in our article on agency bonds .

Treasury Bonds, Interest Rates, and The FED

Treasury bonds are considered by most to be free of default risk. so they are the benchmark to which all other types of bonds are compared. The Federal reserve also pays particular attention to interest rates on treasury bonds, and raise and lower interest rates for everyone by buying and selling treasuries. The first thing they watch when doing so is how high or low interest rates on treasury bonds with different maturities are, which is also referred to as the yield curve. The second is inflation which they measure through the consumer price index .