Treasury Bills Notes and Bonds Definition How They Work

Post on: 10 Август, 2015 No Comment

What’s the Difference, and How Do They Work?

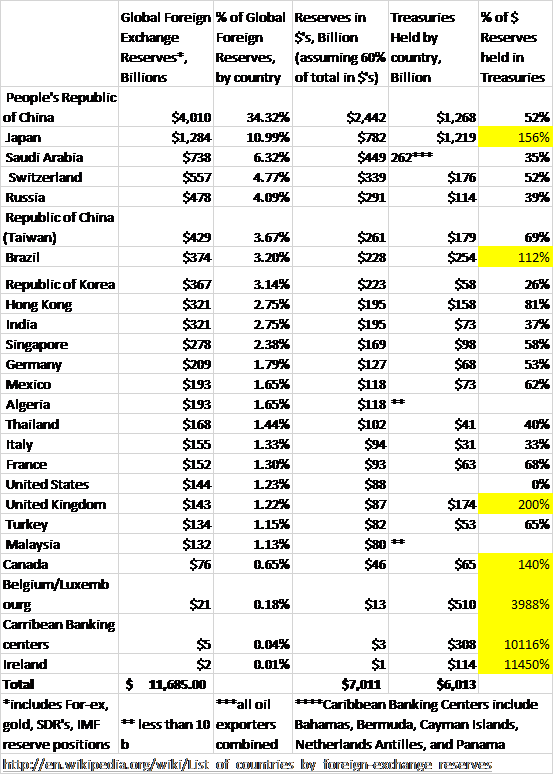

Treasury bills, notes and bonds are sold by the U.S. Treasury Department. These are the safest investments in the world, since they are backed by the U.S. Government. Since they are so safe, they tend to have the lowest interest rates.

Treasury bills, notes and bonds are sold at auction. This means they can be bought for more or less than the face value, depending on demand. For example, when demand is high, bidders will pay more than face value. Bidders know Treasury bills, notes and bonds can be resold on the secondary market. This means the price can fluctuate further.

In fact, Treasuries reached record-high demand levels on June 1, 2012. That’s when the 10-year Treasury yield dropped to 1.442 percent, the lowest level in more than 200 years. Investors fled to ultra-safe Treasuries in response to the eurozone debt crisis. For more, see Treasury Yields .

How Are Treasury Bills, Notes and Bonds Paid?

The interest rate is paid every six months, and does not change throughout the term of the product. If you hold onto them until term, you will get back the face value plus the interest that was paid over the life of the bond, no matter what you paid for them at auction. The minimum investment amount is $100, placing them well within reach for many individual investors .

The interest rate paid should not be confused with the Treasury yield. This is the total return over the life of the bond. Since Treasuries are sold at auction, Treasury yields change every week. Here’s how it works: If demand is low, notes are sold below face value, which is similar to getting them on sale. Therefore, the yield is high. The buyers get more for their money. When demand is high, they are sold at auction above face value, and the yield is low. The buyers had to pay more for the same interest rate, so they get less for their money.

Investors can buy a Treasury note in one of two types of auctions. If they know they want the note, and are willing to accept any yield, they use a non-competitive bid. That’s the method most individual investors would use, because they can just go online to TreasuryDirect to complete their purchase.

However, those who are only willing to buy a Treasury if they get a certain yield must use competitive bidding through a bank or broker.In any auction, a single investor can buy as much as $5 million in notes by non-competitive bidding or as much as 35% of the initial offering amount, if he or she uses competitive bidding.

The Difference Between Treasury Bills, Notes and Bonds

The difference between bills, notes and bonds are the length until maturity:

- Treasury bills are issued for terms less than a year.

- Treasury notes are issued in terms of 2, 3, 5, and 10 years.

- Treasury bonds are issued in terms of 30 years, and were reintroduced in February 2006.

Often Treasury bills, notes and bonds are simply called Treasuries for short. They are also often referred to simply as Treasury bonds, although this is a misnomer. The most commonly referred-to Treasury is the 10-year note.

How Do Treasury Bills, Notes and Bonds Affect the Economy?

Treasuries affect the economy in two important ways. First, they fund the U.S. debt. The Treasury Department issues enough bills, notes and bonds to pay ongoing expenses that aren’t covered by incoming tax revenue. If the U.S. defaulted on its debt. then these expenses would not be paid. This means military and government employees wouldn’t receive their salaries or benefits, and recipient of Social Security. Medicare, and Medicaid would go without. This almost happened in the summer of 2011 during the U.S. debt ceiling crisis.

Second, they affect interest rates. Since Treasury notes are the safest investment, they offer the lowest rate of return, or yield. However, there are investors who are willing to take on a little more risk to receive a little more return. If that investor is a bank, they would issue loans to businesses or homeowners. If it’s an individual investor. they would buy securities backed by the business loans or mortgage.

If Treasury yields increase, then the interest paid on these riskier investment must increase in lock-step. Otherwise, no one would take on the added risk if they didn’t get a higher return. For more, see Relationship Between Treasury Notes and Mortgage Interest Rates. Article updated February 10, 2015.