Treasuries A better safe haven than gold

Post on: 25 Июль, 2015 No Comment

May 21, 2014

Investors are taking the bumpy first months of the year as a cue that it may be time to buckle up for greater volatility, or at least be ready for it. Rumblings about frothy valuations, conflicting economic data, emerging market instability, and the Federal Reserve’s tapering policy are among the reasons investors are on the hunt for a safe haven.

This has some market commentators touting gold as a great portfolio diversifier, convincing investors that the precious metal could benefit their portfolio.

Green is the new gold

There may be better alternatives than gold if the motivation is to find a hedge for economic uncertainty or political unrest, according to Chris Philips, senior analyst in Vanguard Investment Strategy Group. During periods of market stress for equities, the asset that has performed most consistently across time is U.S. Treasuries.

Even if clients are considering the asset for diversification purposes, Philips cautions investors from jumping in headfirst. Investing in gold comes with significant risks that should be weighed carefully.

Risks of gold as an investment

The biggest drawback to gold is its volatility, which since 1968 has exceeded that of stocks, at 20% versus 16%. 1

Highlights

Gold, much like other commodities, is a volatile asset with significant trade-offs.

Treasuries have been a more consistent performer versus gold during periods of economic uncertainty.

A diversified strategy of stocks and bonds versus reactive shifts in the portfolio is a better defense for long-term investors.

Throughout history, the asset class has shown itself prone to boom-bust cycles. In the last half century, gold experienced a bear market that lasted nearly 21 years. The price of gold went from a high of $670 a troy ounce in mid-1980 to $258 by early 2001, losing nearly two-thirds of its valueeven before accounting for inflation. 2

That could be enough to tarnish some of its luster, especially among clients looking for safety.

Buy high and sell low?

For clients who remain steadfastly captivated by the glitter of gold in their portfolio, Philips offers another word of caution. There’s evidence that investors tend to pile in toward highs and sell on lows.

According to Morningstar, Inc. investors in one of the largest gold ETFs lagged the return of that ETF by more than an average of 3 percentage points annually since the end of 2004 (11.86% versus 8.66%), largely because of the timing of investor cash flows.

The reality of performance chasing calls into question the suitability of such a volatile asset in clients’ portfolios, suggests Philips.

Is gold really a hedge against inflation?

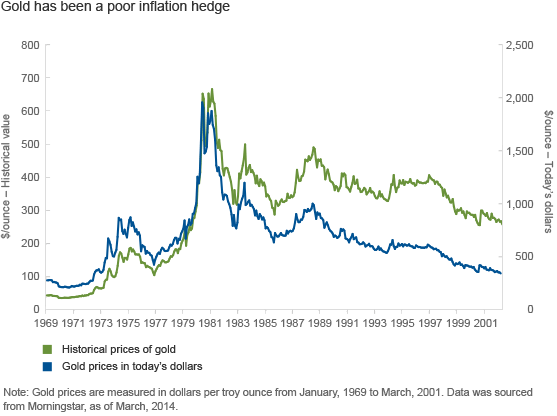

Despite many investors’ perception that gold is a good hedge against inflation, there’s little if any evidence to support it. The chart below plots historical gold prices against prices adjusted for today’s purchasing power. As the blue line indicates, the value of gold has not kept up with inflation.

The value of gold is subject to the whims of the marketplace, driven more by global supply and demand than inflation, explains Philips, making it much like other commodities.

Using gold to hedge inflation may or may not be effective. The price movement over the past decade makes that point. During a period when U.S. inflation was well contained, the price per troy ounce shot from $400 in 2005 to nearly $2,000 in 2012, and then plunged below $1,200 in 2013, bouncing back above $1,300 recently. 3

U.S. Treasuries, an enduring diversifier

Despite the rising interest rate environment, Treasuries remain among the best safe-haven assets.

For example, during the global financial crisis, gold prices spiked in volatility, falling nearly 30% from peak to trough in 2008. 4 Treasuries, on the other hand, were one of the few asset classes that provided downside protection through the uncertainty.

Correlations tend to increase among risky assets during periods of extreme market stress, and gold’s record as a safe haven has not been as consistent, points out Philips.

The high degree of certainty of cash flow and return of principal is what makes Treasuries a good safe-haven asset. That’s peace of mind that is worth something, especially during times of extreme market stress.

The flight to quality in January reinforces that point. As equities dropped, Treasury prices moved higher, offsetting stock losses and dampening portfolio volatility.

The role of high-quality bonds as a diversifier, especially during sharp equity market declines, remains intact regardless of yields and justifies their inclusion in balanced portfolios, says Philips. (High-quality bonds include U.S. Treasuries and other fixed income securities with a credit rating of Baa3 or higher by Moody’s or a credit rating of BBB- or higher by Standard & Poor’s or Fitch.)

The trade-offs inherent in gold

Bear markets and stock pullbacks can be triggered by any number of external shocks. Very few come with warnings. The prudent course is to maintain a diversified strategy of stocks and bonds allocated according to your clients’ unique situations, rather than making big moves in anticipation of a crisis.

Even as interest rates rise, what ultimately matters most for risk-averse clients is the return of their total portfolio. Over the long term, Vanguard expects bonds to continue to reduce the risk of loss for balanced investors. Accordingly, greater economic uncertainty argues for holding more bonds, not less.

By contrast, an investment in gold could result in big gains, but based on its volatile history, a bust isn’t out of the realm of possibility either. Clients who are comfortable with gold’s unique risks should view an investment in the context of a well-diversified portfolio, rather than as a concentrated position.

1. Vanguard calculations, using data from Thomson Reuters for gold prices and the performance of the Standard & Poor’s 500 Index.

2. World Gold Council, as of March 4, 2014.

3. World Gold Council, as of March 4, 2014.

4. World Gold Council. In 2008, the spot gold price peaked at $1,011 on March 17, and reached a trough of $730 on October 27.

Notes:

- All investments are subject to risk, including possible loss of principal.

- Diversification does not ensure a profit or protect against a loss.

- Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

- Investments in bonds are subject to interest rate, credit, and inflation risk.

- U.S. government backing of Treasury or agency securities applies only to the underlying securities and does not prevent share-price fluctuations. Unlike stocks and bonds, U.S. Treasury bills are guaranteed as to the timely payment of principal and interest.

- Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility.