TradingMarkets ETF Basics

Post on: 6 Июнь, 2015 No Comment

October 30, 2009 By David Penn

Exchange-traded funds (ETFs) are an excellent way to trade markets in the short term or invest in them for the long term. ETFs are so versatile that a growing number of people from professional traders to the average investor are learning about how to trade and invest in exchange-traded funds.

ETFs can be bought and sold as easily as stocks. And like mutual funds, ETFs can provide exposure to whole markets like the S&P 500, individual sectors like technology or oil company stocks, even the stock markets of entire countries like China or Brazil. Commodity and currency ETFs make it possible for ETF traders to trade and invest in markets once available only to forex or futures traders.

Because ETFs can be traded like stocks, ETF trading is an increasingly popular way for traders to take advantage of a wide variety of markets as they pull back to new lows or breakout to new highs, providing potential opportunities for traders of all kinds. In our upcoming book, High Probability ETF Trading Strategies, we will share with you some of our best strategies for identifying high probability ETF trading opportunities in the market every day.

But before you wade into the ETF waters, be sure you know what ETFs are all about: what they are made of, how they work and, as you will learn in, High Probability ETF Trading Strategies, how to trade them.

Here are some frequently asked questions to help get your introduction (or refresher course!) to ETFs started.

What are ETFs?

Exchange-traded funds are investment products that allow investors and traders to buy or sell whole indexes, sectors, international stock markets, as well as a wide and growing variety of securities from currencies to commodities. Because ETFs behave much like stocks and are traded on the same exchanges as stocks, exchange-traded funds have become an increasingly popular way for institutional and retail investors and traders to gain diversified exposure to far more markets less expensively than might be the case if the same exposure was sought using mutual funds, stocks, options or even futures contracts.

The very first exchange-traded fund (ETF) was the ^SPY^, which were first created in 1993 as the Standard and Poors Depositary Receipts. The SPY is now the most widely traded ETF in the world.

What types of securites are in ETFs?

Most exchange-traded funds consist of stocks. However innovation in exchange-traded funds has led to ETFs that are composed of not just stocks but bonds, preferred securities, even commodities and currencies.

The term exchange-traded fund usually is reserved for those ETFs that consist of stocks. Similar products that consist of securities other than equities such as commodities or currencies are often referred to as exchange-traded notes (ETNs). This ETN category also includes exchange-traded products that are based on indexes like the CBOE Volatility Index that have no specific underlying security.

How and where are ETFs traded? Can I trade ETFs from a regular stock brokerage account?

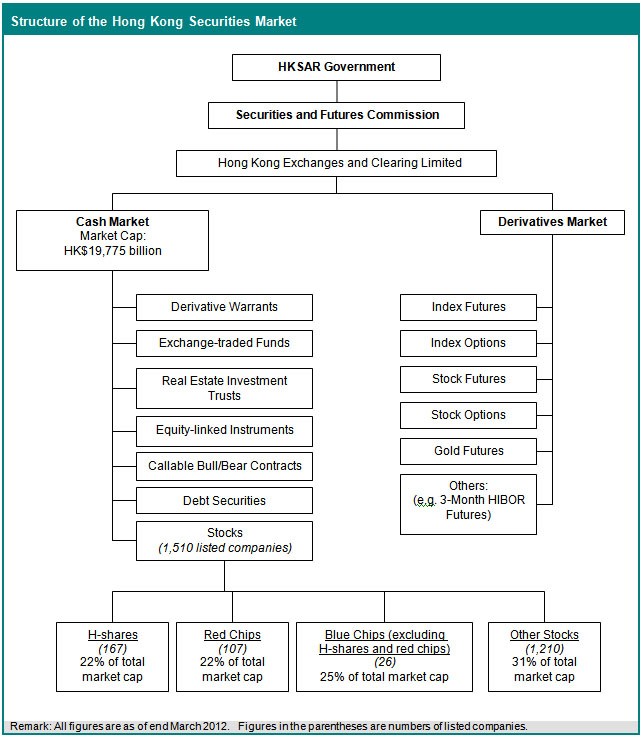

Exchange-traded funds are traded on the major exchanges such as the NYSE and the Nasdaq. The fact that ETFs are traded on the major exchanges along side stocks means that traders and investors can buy and sell exchange-traded funds using their regular stock or options brokerage accounts.

Exchange-traded funds allow traders and investors to take advantage of opportunities in sectors, as well as entire stock markets. ETFs such as the ^XLE^, which includes among its holdings many of the largest oil companies, such as ^XOM^ and ^CVX^.

What are some of the most widely traded ETFs?

Among the more widely traded exchange-traded funds are the ^SPY^, the ^XLF^ the ^QQQQ^, the ^UYG^, and the ^IWM^.

Are ETFs for trading, investing, hedging or all of the above?

Exchange-traded funds are popular securities used by everyone from long term investors and short term traders. Many ETFs, such as the S&P 500 SPDRS, are used by long term investors, many of whom prefer their low cost to similar products like no-load index mutual funds. On the other hand, leveraged exchange-traded funds such as those offered by ProShares, Rydex and Direxion are better suited for short-term traders who are better positioned to take full advantage of the 2x or 3x daily returns sought by leveraged ETFs.

What are some of the benefits of using ETFs compared to stocks?

One of the biggest benefits of investing and trading in ETFs is that exchange-traded funds help investors and traders avoid single stock risk. Single stock risk refers to the potential for any one stock to create a disproportionate effect on a given stock portfolio. While a trader or investor who buys a stock runs the risk that the stock could actually go to zero (not an unrealistic possibility in the age of Bear Stearns and Lehman Brothers), a trader or investor who owns the XLF or the UYG both exchange-traded funds that include a variety of stocks is far less affected should one or even two of the stocks that are in their ETF collapse or, worse, fall to zero.

Exchange-traded funds also give stock and ETF traders easy access and diversification in stocks and stock markets from around the world. One popular vehicle for trading and investing in Chinese equities is the ^FXI^.

What are some of the benefits of using ETFs compared to mutual funds?

Low cost, transparency and flexibility are among some of the reasons why more and more investors and traders are turning to exchange-traded funds and, in some cases, leaving their mutual funds behind. Transaction costs for ETFs are typically much lower than those for mutual funds. Those who own ETFs can also learn with a few mouse clicks exactly what their ETFs consist of and in what proportion something that is often not the case with many mutual funds.

What are leveraged ETFs?

Leveraged exchange-traded funds offered by a number of ETF underwriters seek to produce twice or even three times the daily return of their underlying benchmark. Because the leverage in leveraged ETFs is based on daily returns, leveraged ETFs are especially popular among short-term traders, but tend not to produce the same 2x or 3x returns over longer periods of time.

Developed by the ProShares family of exchange-traded funds, the ^UYG^, provides short term traders with two-to-one leveraged exposure to the most widely traded financial stocks in the market such as ^JPM^, ^WFC^, and ^GS^.

What are inverse or short ETFs?

Inverse or short exchange-traded funds seek to produce the opposite of their underlying benchmark. Consider, for example, a short ETF that tracks the inverse of the Nasdaq 100. If the Nasdaq 100 moves lower by 1%, then a short ETF based on the Nasdaq 100 would move up by 1%. Inverse ETFs are popular products not only for short term traders looking to take advantage of markets moving lower, but also for traders and investors who are looking to hedge long trades or investments.

ETF traders and investors can take use short or inverse ETFs for both hedging long stock or ETF positions as well as for taking advantage of overbought markets that may be vulnerable to reversal. One such short ETF is the ^PSQ^, which tracks the inverse of the Nasdaq 100.

How do I find out what securities are in an ETF?

Lisa Dallmer, Senior Vice President for ETFs and Index Services for NYSE Euronext, told TradingMarkets.com in an interview that one of the best places for ETF traders and investors to find out more about their ETFs is simply by reading the prospectus and visiting the website of the company sponsoring the fund. Said Dallmer, if youre at a restaurant and want to order something off the menu and youre allergic to peanuts, you ask: Does this have peanuts in it? ETF traders and investors should have the same attitude when it comes to knowing what is in the exchange-traded products they are considering for purchase.

Are there options on ETFs? Are they widely traded?

Yes, there are options on a growing number of exchange-traded funds and ETF traders and investors should consult with their brokers to find out whether the exchange-traded fund they are interested in is optionable.

David Penn is Editor in Chief at TradingMarkets.com.