Trading in The Currency Market versus Stock Market

Post on: 16 Март, 2015 No Comment

Understanding Forex VS Stocks

There are advantages and disadvantages to both markets. That being said, the forex market offers traders a number of opportunities and advantages that stocks just can’t compete with, and over the past several decades, large numbers of stock traders have drifted over to currencies.

A major difference is informational. Currency values are almost exclusively effected by two different types of events: developments of importance to entire macroeconomies and geopolitical events. Stocks are effected by these things as well, of course, but a whole other slew of factors determine the fate of individual companies. Details as minute as which consultant is hired to negotiate with a union can drive a stock up or down.

This difference in required information is of huge importance. With stocks, it gives a huge advantage to large trading firms who can afford to hire researchers to track the happenings at various companies. It can be a great advantage if you are the one with the information, but more often than not, it’s just a group of Wall Street insiders and no one else who knows about such things in a timely fashion.

Since most of the information that moves forex markets is of a more public nature–often published by governments or major events that everyone has to follow through the media–the forex market does not offer the same institutional disadvantages to individual traders as does the stock market.

That being said, if you’ve spent your life in a particular industry, you won’t have the same sort of advantage that you would if you traded stocks in just that industry. Even in that scenario, though, you’ll still face an uphill battle against large investment firms.

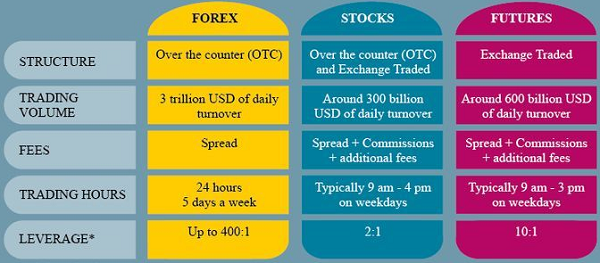

Another difference is volatility. Obviously, the stock market itself – which is to say nothing of individual stocks – is far more volatile than the world’s major currencies. You can always increase your effective volatility by increasing how much your investment is leveraged. However, you can’t reduce the volatility of the stock market. Quite often, that is a problem which requires to you to diversify more than you would have to in the forex market in order to avoid excessive risk, thus further complicating your task as an investor.

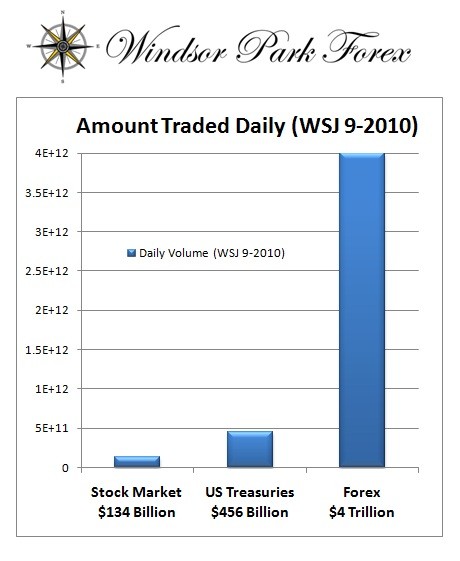

The mention of leverage brings up another good point. The liquidity of currencies – money being the most liquid thing in the world – is a huge advantage of the forex market. It makes trading on the margin cheaper, and it allows you to get in and out of the market much more easily than with many stocks and bonds.

A funny quirk of the forex market: it is a 24 hour market. Most traders think of this as a significant advantage of the forex market. You can place straddle orders or any other type of order and then go to bed; Thus you’re playing the market even while you’re sleeping.

If all this information is taken together, it is hard to make the case that most individual traders should specialize in stocks over currencies, unless they have already developed some expertise in a particular industry that puts them at a massive advantage over the other traders. Even then, though, the forex market is a good place to retreat to during times of excessive market volatility.