Total Income Real Estate Fund

Post on: 31 Август, 2015 No Comment

The Bluerock Total Income+ Real Estate Fund (the “Fund”) is a public fund utilizing a multi-manager, multi-strategy, and multi-sector approach. The Fund allows individuals to invest in private, institutional real estate securities alongside some of the nation’s largest endowment and pension plans.

Potential Investment Benefits

LEARN MORE

Data Source

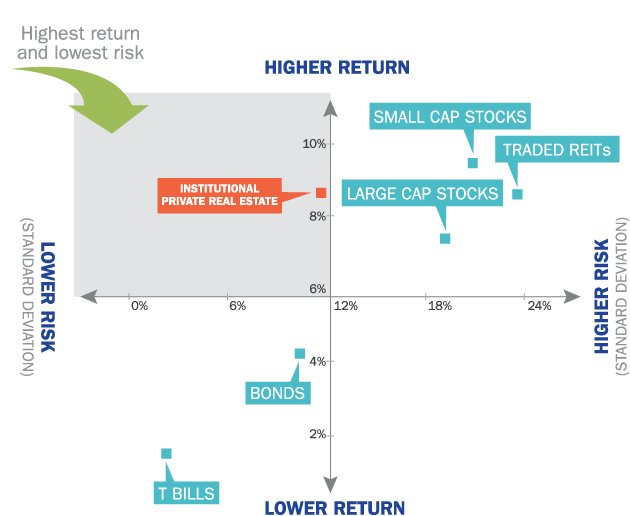

S&P 500 (Large Cap Stocks): An unmanaged composite of 500 large-capitalization companies, chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. Risks include the dynamic fluctuations of the market and possible loss of principal. You cannot invest directly in an index and unmanaged indices do not reflect fees, expenses or sales charges.

NCREIF NPI Total Return (Institutional Private Real Estate): The NCREIF Property Index (NPI) data is based on institutional investments and presented exclusive of leverage and fees. The NPI is based on the unleveraged returns from a large pool of individual, investment grade commercial real estate properties across retail, office, industrial, and apartment sectors. The market values of the properties in the NPI are determined by appraisals and not by market — based prices of the programs. Risks include declining property values, supply & demand factors, economic health of the country and/or regions and strength of industries that rent properties.

NAREIT All Equity Return (Traded REITs): The FTSE NAREIT US Real Estate Index Series is designed to present investors with a comprehensive family of REIT performance indexes that span the commercial real estate space across the US economy, offering exposure to all investment and property sectors. The FTSE NAREIT All Equity REITs index contains all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property that also meet minimum size and liquidity criteria.

Bonds: Federal Reserve of St. Louis 10-year yields, represents medium term fixed income yields.

T Bills: 3-month treasury bill yield, represents short term fixed income yields. The 10-year and 3 — month government bonds are considered low risk investments backed, but not guaranteed, by the U.S. Government.

Russell 2000 (Small Cap Stocks): The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.Average returns represent compounded annual returns. Specific real estate offerings may differ materially compared to the direct real estate transactions that make up the Indexes. The NPI is based on the unleveraged returns from a large pool of individual, investment grade commercial real estate properties across retail, office, industrial, and apartment sectors. The market values of the properties in the NPI are determined by appraisals and not by market-based prices of the programs. The NPI data is based on institutional investments and is presented exclusive of leverage and fees. The NCREIF ODCE Index is based on the returns from several large private real estate funds and the performance of these fund components may vary substantially from the Fund. The FTSE/ NAREIT Index component represents the FTSE/NAREIT All Equity REIT Index designed to track the performance of publicly traded Equity REITs that span the commercial real estate space across the US economy, offering exposure to all property sectors. The Indexes are not a measure of our Fund performance, but our management feels the Indexes are appropriate and accepted indexes for the purpose of evaluating the potential risks and returns of real estate as compared to other investments. The Fund differs from the Indexes in several material aspects including: the Fund can invest in debt securities; the Fund may incur leverage; the Fund requires the payment of up-front and other fees that typically exceed those of institutional programs, as well as expenses related to being a public company. All of the indexes show gross returns at the property level and do not reflect the impact of management and other investment entity fees and expenses as well as those associated with raising capital, which lowers returns. It is not expected that investments in the Fund will reflect any of the index returns.