Top Foreign Holders of

Post on: 19 Апрель, 2015 No Comment

Foreigners and the Fed hold large percentages of US. Treasury Bonds. What happens when foreigners reduce their need for U.S. dollars and the Fed ends QE?

Updated February 18, 2015

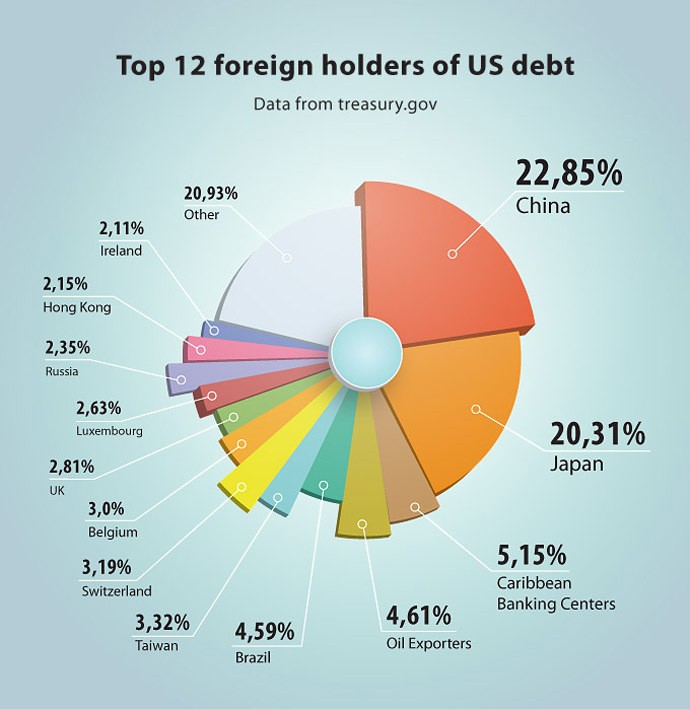

Here is a list of the largest foreign holders of U.S. Treasuries as of December 2014 (click on the chart to enlarge ):

Russia dumped nearly $22 billion in U.S. Treasuries from November to December.

Why Foreign Nations Hold U.S. Treasuries

The United States dollar became the worlds reserve currency in 1944 towards the end of World War II. Because the U.S. dollar is the worlds reserve currency, demand for dollars remains strong as countries hold dollars in reserve to buy oil, settle international trades and to hold as their nations savings. These dollar reserves are held in the form of U.S. Treasury bonds (T Bonds).

The United States is able to incur massive deficits funded in part by foreign purchases of U.S. debt and more recently and increasingly through the Federal Reserves (the Fed) purchases of T Bonds as part of their multi-year/multi trillion dollar quantitative easing (QE) program whereby they print dollars out of thin air to buy them.

As a result of QE more than a few nations, notably Iran, Russia. China and Brazil have become increasingly concerned that the value of their T Bond holdings are being diluted by the Feds massive money printing campaign and have made efforts to reduce their need to hold dollars for settling their trade accounts. Last October, China called for the world to de-Americanize because the destinies of others are in the hands of a hypocritical nation that have to be terminated”.

Such calls to de-dollarize have increased and been joined by Russia as the west battles Russias designs on Crimea and Ukraine with economic sanctions. Most recently, Russia and China signed a 30 year gas deal that supposedly does not involve dollars for payment.

For a short history of the Bretton Woods Agreement of 1944 that established the gold standard that would back the dollar as the worlds reserve currency and the subsequent removal of the gold standard in 1971 and the creation of the petro dollar that maintained the dollars world reserve currency status, click here .

Chinas U.S. Treasury Holdings

For the past ten years or so as Chinese exports to the United States have boomed, China has steadily increased its U.S. Treasury holdings to become the largest U.S. holder surpassing Japan. Chinas willingness to purchase U.S. Treasuries for their reserves has allowed the United States to increase its deficits and to fund its liabilities.

In the past two years, China has been talking about reducing the pace of its purchases of T-Bonds and eventually reducing their holdings. As of October 2014, China held $1.252 billion of T bonds, about $20 billion less than it held a year ago (see chart above).

China, however, has been diversifying its reserves and notably increasing their gold reserves. (see gold charts below)

Russias U.S. Treasury Holdings

Russia has historically held T-Bonds, but in small amounts ($153 billion as of March 2013). Russia had publically threatened to dump its T-bonds in retailiation for sanctions imposed on it by the U.S. and it appears to have begun to do so. As of October 2014, Russia held just $108 billion worth of T-Bonds.

Russia, like China has been increasing its gold reserves steadily. (see gold charts below)

Belgiums U.S Treasury Holdings

Belgium is now the third largest foreign holder of U.S. Treasuries

Other than Russias reduction of its T-Bond holdings, the only other significant change in foreign holdings of U.S Treasuries is the dramatic increase in Belgiums holdings in recent months. Belgium held $188 billion of T Bonds in March 2013, $200 billion in November 2013, $257 billion in December of 2013 and $348 billion by October of 2014.

There has been much speculation as to why Belgium has emerged as the third largest holder of U.S. Treasuries. Belgiums massive increase has coincided with the Feds tapering of QE in December 2013 and with Russias selling of its T-Bonds.

Belgiums purchases of about $200 billion worth of T-Bonds since October 2013 dont square for a country with a trade deficit and GDP of around just $400 billion, leading some commentators to question where is Belgium getting the money to make the purchases. We have suggested that the U.S. has requested that Europe, perhaps through Belgium, purchase additional U.S. Treasuries in exchange for continued NATO military support as a form of Marshall Plan in reverse .

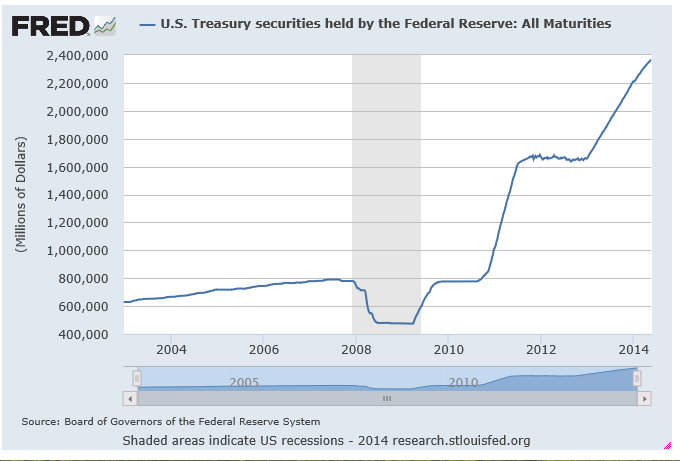

The Federal Reserves Holdings of U.S. Treasuries

In the past few years the Fed has been purchasing between 60 and 90% of the newly issued treasuries as part of their QE program. The Fed buys U.S. Treasuries by printing the dollars needed to purchase them. Listen here to Ben Bernanke in 2009 explaining the rationale behind the dollar printing process and when it will stop.

The Fed now holds nearly $2.4 trillion T-Bonds, or about two times as many as China. Since the Fed has essentially become the T-Bond market over the past few years via QE, the question remains, who will buy T-Bonds that the Fed will not buy as it ends QE in the amounts necessary to keep interest rates low? As incredulous as it may seem, it appears that tiny Belgium has taken up that monumental task.

The Federal Reserve now holds nearly $2.4 trillion in U.S. Treasuries

Foreigners Diversifying and Moving Their Reserves from U.S. Treasuries To Gold

The movement away from the dollar appears to have begun. As recently as May 2013, the percentage of foreign exchange transactions conducted in dollars was 80% and the percentage of overseas reserves held in dollars was 60%. As countries sign more non dollar deals among themselves and diversify their reserves, these percentages will certainly fall.

Set forth below are charts that show how China has been satisfying its thirst for gold.

Russias Gold Reserves

Russia has been increasing its gold reserves steadily as it diversifies away from the dollar.

China and Russia (but not Belgium) are now in top twenty gold holding countries:

Russia and China Have Increased Their Gold Reserves And Are Now In The Top 10.

The Federal Reserves Gold Holdings

According to the Fed itself, it holds no gold on its own behalf, but acts as custodian for other countries gold. Recently there has been some speculation that the Fed does not have the gold it claims to hold on behalf of other countries. For example, in January 2013, Germany requested the repatriation of a portion of its gold held by the Fed and their request was meet with an initial denial and a promise to return only some of the requested amount over seven years. Slowly, Germanys gold appears to be making it back.

The United States Treasury supposedly holds most of the worlds gold, a good portion of it at Fort Knox, although an audit of that gold has not been held since the 1950s. Former Congressman Ron Pauls 2011 request to audit Fort Knox remains unanswered.

The United States has enjoyed a high standard of living partially because it can fund its deficit spending via the sale of T-Bonds to foreigners or through the printing of money via the Federal Reserves QE programs. If the demand for dollars is reduced as the Fed tapers and ends QE and countries use currencies other than the dollar in international trade and reduce their dollar reserves, the value of the dollar will decline making imports to the U.S. more expensive and causing price inflation in the United States.

Updated: December 15, 2014

Russia and China reduced their holdings from October to November.