Too early to pass judgment on Modi

Post on: 20 Апрель, 2015 No Comment

Most Popular

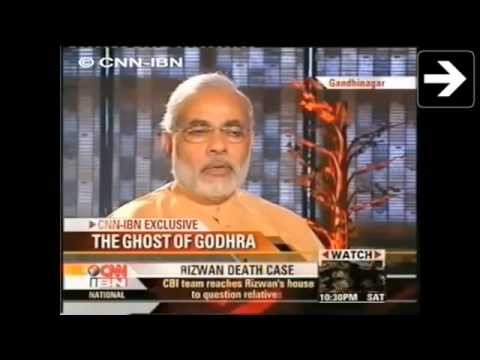

Are financial markets losing confidence in Indian Prime Minister Narendra Modi, whose overwhelming victory in the country’s parliamentary election in May was seen as providing a crucial impetus to much-needed economic reforms?

While it’s still early days, the enthusiasm among investors has begun to wane somewhat over the past three months.

The Modi-mania that fuelled India’s buoyant equity market in the run-up to the election is giving way to more cautious optimism about the prospects for meaningful reforms in India.

The big question is whether Modi can come up with a concrete plan to overhaul public finances

Having risen by a staggering 24 per cent this year, Indian equities are up just 1.5 per cent over the past month, compared with a rise of 3 per cent for both Latin American and emerging European stocks.

While the Indian rupee strengthened 7 per cent against the US dollar between the end of January and the end of May, it has weakened nearly 4 per cent since then — although partly as a result of recent financial jitters in emerging markets.

Doubts among investors began setting in when the Modi government’s maiden budget, on July 10, fell far short of expectations, with little in the way of specific proposals to revive growth, impose fiscal discipline or help curb India’s persistently high inflation rate, which reached nearly 8 per cent last month.

The government’s fiscal credibility was called into question by its decision to duck the politically sensitive issue of overhauling India’s mammoth US$43 billion state subsidy system yet stick to the outgoing government’s overly ambitious 2014 fiscal deficit target of 4.1 per cent of gross domestic product.

What’s more, in July Modi torpedoed a landmark World Trade Organisation deal to slash red tape at national borders due to concerns about food security.

Even in foreign policy, the area Modi has focused on the most since becoming prime minister, there have been setbacks.

On August 18, the government called off the first formal peace talks with Pakistan in two years because of the latter’s decision to meet with Kashmiri separatist groups before the start of talks.

As Modi nears the end of his first 100 days in office, the sense among investors is that the new government may have wasted its honeymoon period by failing to launch radical fiscal and structural reforms.

Yet the reality is that investor expectations about a Modi-led India were unrealistic to begin with. Modi is not a miracle worker.

The scale of the political, institutional and economic problems plaguing India require at least several years of bold and sustained reforms to produce meaningful results.

It would be wrong and unfair to pass judgment on Modi after just 12 weeks in office — especially after his inspirational Independence Day speech on August 15.

For the first time since becoming prime minister, Modi sounded like a radical and modernising reformer, pledging to provide banking services to all Indians and unleash a wave of investment in the country’s long-neglected manufacturing sector. He also promised to abolish India’s Soviet-style Planning Commission.

Just as importantly, Modi decried rapes and the mistreatment of women, condemned caste discrimination and insisted on toilets for all in one of the world’s least hygienic countries.

The big question now is whether Modi can come up with a concrete plan of action to overhaul India’s public finances and generate the high growth rates needed to modernise the economy.

Despite their concerns, investors still believe Modi — who has an exceptionally strong mandate following his Hindu nationalist Bharatiya Janata Party’s emphatic victory in May’s election — is the best thing that could happen to India.

India’s benchmark Sensex index of leading stocks rose to a record high on August 19 on renewed optimism about the government’s commitment to economic reform. And foreign investors have been increasing their holdings of Indian local currency bonds.

In a further sign of confidence, the Canada Pension Plan Investment Board, one of the world’s biggest pension funds, is increasing its exposure to India.

Modi-led India still retains its appeal among investors.

Nicholas Spiro is managing director of Spiro Sovereign Strategy