To Protect Yourself from Inflation Think About Purchasing Power Not Dollars

Post on: 4 Октябрь, 2015 No Comment

It’s What You Can Do With Your Money That Counts

Inflation means that each dollar buys less stuff over time — less apples, candles, cars, sweaters, or books. As an investor, you need to factor this into your financial plan. Victoria Blackie / Photographer’s Choice / Getty Images

Quick! You buy a piece of real estate for $100,000 and sell it for $200,000. What was your profit?

A new investor might say you made $100,000 or 100% on your money. In one sense, that is correct. Unfortunately, that kind of thinking is misleading and dangerous to your pocketbook. What really counts is how much more purchasing power you have as a result of your investment.

Why? Think of about it this way. If you bought the land in a few weeks in a stable economy with a strong currency, you probably did double your money before taxes. What if, instead, you held the property for ten years? During that time, the currency your home country uses for trade — let’s say the United States dollar — has lost around 4% of its value each year. By the end of 10 years, to buy the same amount of milk, cheese, coffee, gas, shirts, pens, furniture, carpets, silverware, perfume, and firewood would cost $148,000. That means your real profit was only $52,000 before taxes but after adjusting for the inflation rate. If you paid 25% on your total nominal gain, or $15,000, that figure drops to $37,000 after taxes and inflation.

Put more starkly, far from making 100% on your money, you only increased your purchasing power by 37% over a decade. On a compounded basis, that is a pathetic 3.2% annually net of inflation and taxes. (To learn how to calculate the compound annual growth rate, or CAGR, on your own, read Evaluating Investment Performance .)

Low Returns Aren’t Always Low Returns

There is one exception to the pathetic return part, though. It is entirely possibly that such a low rate of return on your money could still be tremendously valuable to your family if you somehow enjoyed utility out of the investment during the time you held it.

By way of example, imagine the money were invested in a lakefront summer home that you used every year, creating a home-away-from-home for your children and parents. Everyone packed up the car, went on adventures, spent time in nature, and loved it. While you enjoyed this boon your quality of life, you were also getting richer. In such a case, a 3.2% real return compounded annually would be a success. The same is true of sculpture or paintings for art collectors who love looking at a work every morning when they wake up, or for municipal bond investors who like knowing that their savings are helping build local hospitals and schools.

The Reason Investors Don’t Think About Inflation Properly Is The Money Illusion

The biggest reason many new investors don’t think this way is that they fall for what famed economist Irvin Fisher called the money illusion. I see it all the time, even in my own hometown. I talked about this in an article called The Rate of Inflation Matters to Your Portfolio but too many people insist on focusing on dollars, not purchasing power.

That is stupid. There is no other way to say it. All you should care about is how many cheeseburgers or diamond rings, televisions or pickup trucks you can buy (or, if you are more altruistic, how much you can give in tangible goods and services). I’ll keep repeating it over and over until you know it instinctively: Purchasing power counts more than dollars. Dollars are nothing more than a metric to attempt to measure purchasing power. Don’t confuse the ends with the means. It can be costly to your financial dreams.

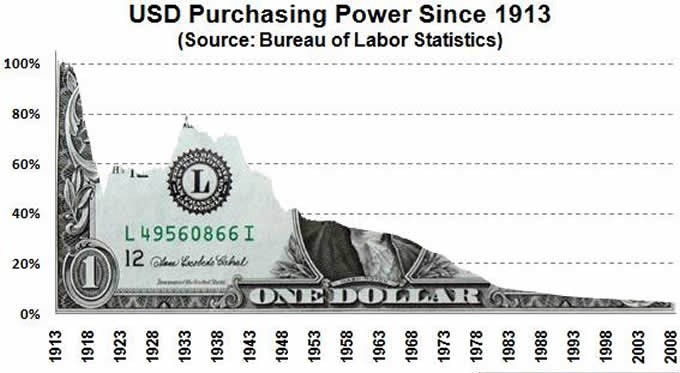

A $1.00 bill in 1971 has the purchasing power of only 18 today. A 1 bill in Great Britain has the purchasing power of only 0.09. That is, if you put money in a coffee can in 1971 and buried it in the back yard, you’ve lost 82% of your purchasing power in the United States and 91% in Great Britain. Don’t you love our governments printing money?

Right now, you are seeing the consequences of this foolishness in the bond market. I’ve written that we are living in the midst of one of the biggest bond bubbles in history. There is no conceivable way I would put a major portion of my net worth in long-term bonds at current interest rates because I expect the inflation rate will exceed the yield sooner rather than later. Even knowing this, older retirees that I know personally continue to line up, hand over their money to bond issuers, and effectively go long the United States dollar, which is what happens when you buy an instrument that promises to pay you a fixed amount of dollars in the future.