TIPS protect against inflation and deflation

Post on: 4 Июль, 2015 No Comment

Got a question about this topic? Just ask it in the comment box below and the editors will answer!

Perhaps no word is scarier to a fixed income investor than inflation. especially for those who depend on the yields from bond investments for their retirement income needs. For example, inflation can reduce the payout rate of bonds over the long-term, as the higher costs of living can often weaken the purchasing power of bonds return over time.

However, retirement investors can factor in the effects of inflation in their investment portfolios. You can also help protect your portfolio and your cash flow from inflation by adding Treasury inflation-protected securities (or TIPS) to the bond portion of a diversified investment portfolio. In these times, with talk of asset deflation TIPS are also a reliable choice as the principal is not reduced for deflation as it is increased for inflation as explained below.

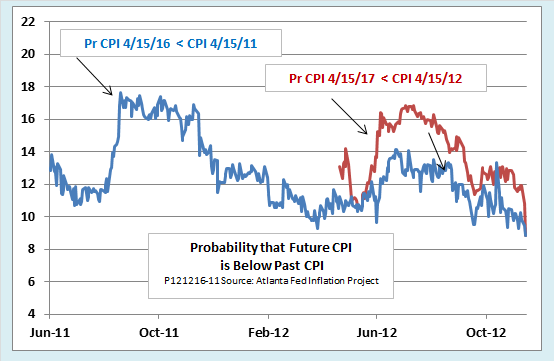

TIPS were introduced a few years ago by the U.S. Treasury to offer investors a means to protect assets from inflation. TIPS help to protect against inflation by adjusting the principal amount by a rate equal to the Consumer Price Index (CPI). the primary barometer of inflation on the consumer level. When the bond reaches maturity, the TIPS investor receives either the principal value of the bond adjusted for the CPI rate over the term of the bond or the bonds original par value, whichever is greater upon maturity (and thus protection from deflation). The TIPS investor also receives the interest amount on the bond. Because the principal amount of the TIPS bond rises over time, this helps to protect the purchasing power of the bond. Every 6 months when the investor receives interest, the interest is based on the inflation adjusted value of the bond so your income rises with time in an inflationary environment.

TIPS can also be a suitable choice for a diversified portfolio, because they have a low correlation with stocks and other bond securities. That means they often react differently than stocks and other bonds to market and interest rate risks and can potentially reduce the volatility of your overall portfolio. However, TIPS are not a risk-proof investment. To receive the full inflation-protection potential of a TIPS holding, it must be held for the term of the bond. Also, TIPS may under perform regular Treasury bonds, should inflation remain low. In a deflationary environment, TIPS could also lose value, although investors would be guaranteed to receive at least the par value of the security upon maturity. The key is to buy and hold to maturity.

TIPS may also provide you with some tax benefits. Like other Treasury notes and bonds, TIPS are exempt form state and local income taxes but interest payments are subject to federal income tax. However, gains from inflation adjustments to the value of the TIPS principal are taxable in the year they occur, even though you wont get the cash until maturity.

Should asset deflation occur, the value of stocks, real estate and other assets fall. But since your TIPS are protected form deflation when held to maturity, your maturing TIPS would buy more of the deflated assets.

Financial Advisors seeking to help retirees with fixed income investing ProspectMatch

Get Free Email Updates!

Signup now and receive our ebook Most Costly IRA Mistakes