TIPS in a Rising Interest Rate Environment

Post on: 16 Июль, 2015 No Comment

Source: Morningstar Direct, Data as of March 31, 2013

As retirement plan committees look at their investment menus, inflation-protected bonds stand out as an asset class with high duration and the potential for the greatest negative impact from rising interest rates. The table to the right shows the average duration for mutual funds in a variety of fixed income categories that are common within the retirement plan investment menus.

So as committees evaluate their investment menus, the question arises as to whether it makes sense to include inflation-protected bonds when they carry so much interest rate risk. Giving credence to this concern is a transition that Vanguard has recently made; transitioning the inflation-protected bond allocation within their target date fund series from a portfolio with duration of 8.45 years to a newly launched Short-Term Inflation-Protected Securities Index Fund with duration of 2.4 years.

Unfortunately, there is no simple black and white answer. As with most investment decisions, the choice is dependent on the specific objectives and the tolerance for different types of risks within a portfolio. Our objective in this paper is to outline the key concepts that should be understood in making this decision and to highlight the strengths and weaknesses of the asset class within a portfolio.

BACKGROUND ON TREASURY INFLATION-PROTECTED SECURITIES

Treasury Inflation-Protected Securities (TIPS) are bonds issued by the U.S. Treasury that provide inflation protection. These can be attractive for investors, as traditional Treasury bonds are subject to the risk that inflation will erode the value of the interest that these bonds pay. TIPS specifically protect against rises in the Consumer Price Index for Urban Households (CPI-U) which is calculated by the U.S. Bureau of Labor Statistics.

The principal value of a TIPS bond is adjusted based on changes in CPI-U. If inflation exists, the principal value of the bond is adjusted upward to account for the increases inflation. If deflation exists, the principal value is decreased to account for the decline in CPI-U. The principal value can never fall below the par value of the bond. At maturity investors are paid back the adjusted principal value. The interest rate for a bond is set at auction and the rate is fixed for the term of the bond. The fixed interest rate is multiplied by the adjusted principal value to determine the interest payment.

TIPS are generally considered low-risk investments because they combine the credit risk protection of U.S. Treasuries with inflation protection. Theoretically, because of the inflation protection insurance that TIPS provide, they should have slightly lower returns over the long-term when compared to similar nominal Treasuries that are subject to inflation risk.

TIPS were first issued in 1997 and there are currently 37 outstanding securities. TIPS are issued in 5-, 10-, and 30-year maturities by the U.S. Treasury. Since first launching in 1997, the TIPS market has matured with a wide variety of maturities for investors.

COMPONENTS OF A TIPS’ RETURN

TIPS are a relatively new asset class with the first issuance only 16 years ago. As a result, we only have observed TIPS performance for a very short window. The short window also coincides with modest inflation and declining interest rates making it very difficult for investors to fully grasp how their TIPS investment might perform during different market environments.

In order to better understand how TIPS might behave in different market environments, it is important to understand the drivers of TIPS returns. The return for TIPS can be broken down into three components: the inflation adjustment, the level of real yields, and changes in real yields.

Inflation Adjustment

Built directly into the TIPS structure is the inflation adjustment. The principal value the security is adjusted every 6 months based on the CPI-U rate. All TIPS bonds have the same inflation adjustment regardless of maturity, so a 5 year bond will have the same principal adjustment as a 30 year bond. The inflation adjustment provides the protection within the bonds against a spike in unexpected inflation.

Level of Real Yield

Real yield is the yield on a bond above the rate of inflation. All investing is focused on achieving real growth of wealth. Investors are willing to forego current consumption with the objective of investing to grown their purchasing power in the future. In order to determine wheter an investment has been successful, and investor needs to understand the real (inflation-adjusted) return that they have generated (or expect to generate).

For traditional Treasury bonds, the real yield is estimated based on the nominal yield minus the expected inflation. For TIPS, because of the inflation protection built into the security, the real yield is simply the yield on the bond.

The table below shows the historical real yield on 10-year Treasuries over the past decade. Through 2007 the average real yield on 10-year Treasuries was 2.06%. Since the credit crisis began in late 2008 real yields have declined, and since late 2011 the real yield has been negative. The negative real yield means that investors purchasing a 10-year Treasury note will earn less than the inflation rate over the term of the loan, therefore losing purchasing power with their investment.

Changes in Real Yields

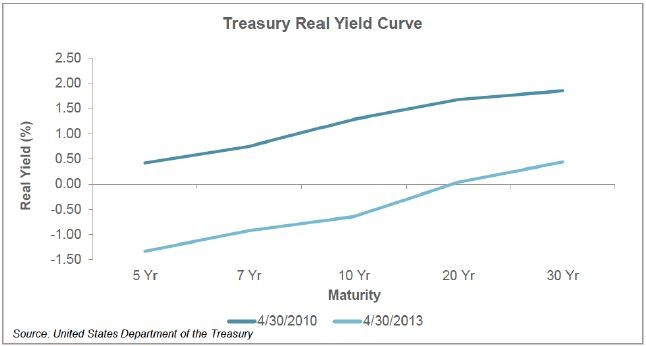

The final component of TIPS returns comes from changes in the level of real yield. Changes in real yields have the same directional relationship with bond prices as do changes in nominal yields. As real yields decline, bond prices go up, and as real yields increase, bond prices go down. Changes in real yield levels can substantially impact the total return for TIPS investors and the volatility of real yields leads to periods where TIPS’ total return differs substantially from inflation. The table below shows the real yield curve for Treasuries as of April 30, 2010 and April 30, 2013. Over the past 3 years real yields have declined substantially across all maturities, pushing up TIPS prices and providing a positive contribution to TIPS’ total return.

THE FEDERAL RESERVE’S IMPACT ON REAL YIELD

The decline in real yield on Treasuries coincides with the Federal Reserve’s (Fed) aggressive monetary stimulus program. The Fed is keeping the Fed Funds rate near zero to keep short-term rates low and is purchasing approximately $85 billion in longer-term bonds in an effort to keep long-term rates at low levels. The Fed’s actions are artificially suppressing real yields across all maturities in an effort to stimulate economic growth.

The Fed is able to keep their quantititive easing program in place because inflation continues to remain in check. When they will let up on their quantitivative easing is difficult to predict and has been repeatedly deferred with the failure of the economy to generate attractive growth rates. Last fall, the Fed indicated they would like to keep rates low until unemployment declines below 6.5%. With the national unemployment rate at 7.5% in April 2013 it could be some time before the Fed eases up on their stimulus.

IMPACT OF RISING RATES

In trying to determine how rising rates might impact an investment in TIPS, it is important to understand that not all rate increases are created the same. To illustrate, consider two examples. In the first case, rates rise because of an increase in inflation. If inflation increases, and is expected to be higher in the future, it is safe to assume that investors would demand an increase in yield to compensate for the higher level of inflation and to maintain the same real yield on their investment. Nominal rates should increase to compensate investors and nominal bond prices would decline. The increase in nominal yields would negatively impact traditional bonds but because the real yield does not change. TIPS should not experience the same price declines.

In the second scenario, assume that inflation stays the same, but the real yield curve shifts upward. In this environment both nominal bonds and TIPS should experience price declines as the inflation-protection in the TIPS does not protect against changes in the real yield. In this scenario, the real yields curve could shift upward either because the Fed unwinds their quantitative easing program, or because investor sentiment improves to the point that investors are no longer willing to accept negative real yields on their fixed-income investments.

The sensitivity of a bond portfolio to interest rates is measured by the duration of the portfolio. Duration is a linear estimation of the change in the portfolio’s value based on changes in interest rates. If a bond portfolio has a duration of 5 years, then a 1% increase in interest rates would cause an estimated 5% decline in asset value of the portfolio. When evaluating the duration of a portfolio there are a few important caveats. First, the duration is a linear estimation. As a result, it is most accurate for small changes in interest rate levels. For larger rate changes, an investor would also need to factor in the convexity of the portfolio as the relationship between bond prices and yields is not linear.

Another important caveat is that duration assumes the yield curve shifts in parallel. However, there have been many cases where this has not occurred. If you have ever heard anyone say the yield curve was steepening or flattening then they were describing the type of scenario where short term and long-term rates did not move together.

Finally, the biggest caveat with duration is that the measures for nominal bonds and TIPS are not apples-to-apples measures of interest rate sensitivity. Nominal bonds react to changes in nominal rates, while TIPS react to changes in real yields. The duration for a nominal bond portfolio measures its sensitivity to nominal interest rate movements, while the duration for a TIPS portfolio explains its sensitivity to real interest rate movements. As a result, investors should not compare the duration of nominal bonds and TIPS as if they were the same.

OPTIONS FOR INVESTORS

With a better understanding of the dynamics of the TIPS market, we can evaluate the alternative choices for retirement plan committees. The first question to ask is Should TIPS be included in the investment menu? With most maturities exhibiting negative real yields, and a need for investors to extend out to the 20 year maturity range to achieve a zero real yield, at first blush, most observers might think TIPS are a poor investment choice.

I believe that analysis is more accurately a commentary on the existing investment environment, rather than an indication of TIPS as an asset class. The Fed’s actions to maintain low rates has suppressed real yields on a wide range of asset classes, including the intermediate bond portfolios that are the core fixed income exposure of most retirement plan investment lineups. TIPS are not unique in this regard.

In deciding whether TIPS are an attractive asset class, it is important to remember the reason they were initially considered so attractive. They provide a clear and direct hedge against rising inflation; in particular, unanticipated increases in inflation. To look at TIPS yields differently, we can compare the yield of nominal Treasuries against the yield on TIPS to determine the breakeven inflation rate. The breakeven inflation rate is the rate of inflation where nominal Treasuries and TIPS provide the same outcomes. If inflation is higher than the breakeven rate, then it is better to be invested in TIPS. If inflation is less than the breakeven rate, nominal Treasuries will outperform. The chart below shows the historical and current breakeven inflation rate on 10-year Treasuries.

The chart above shows that the current breakeven inflation rate is 2.34%. If inflation runs higher than 2.34% annually for the next 10 years then the 10-year maturity TIP would provide a better total return than the 10-year Treasury bond. While I am not providing any specific inflation forecast, the historical record demonstrates that there is at least a reasonable likelihood that inflation could exceed that level over the next 10 years.

Assuming that there is some value to including TIPS within the investment menu because they do provide a hedge against unexpected rises in inflation, we are still left with the concern about interest rate risk that was discussed at the outset. As the first table highlighted, the average TIPS fund carries a higher duration than the average intermediate bond fund. One option for investors is to utilize a short-term TIPS portfolio rather than the traditional broad TIPS portfolios that carry a longer duration.

To evaluate whether short-term TIPS are a better choice for an investment menu, look at the three components of return that we discussed previously. The inflation-adjustment for all TIPS is the same regardless of maturity so there is no difference between short-term TIPS and the broader TIPS market. The difference comes with the second and third components of the return.

As the current real curve chart demonstrates, the current real yield curve is upward sloping, so investors willing to move farther out on the curve will achieve higher real yields on their investments. Based on current yield levels, 5-year maturity TIPS have an almost 2% real yield disadvantage compared to 30-year maturity TIPS.

While longer maturity TIPS currently provide a yield premium to short-term TIPS, they are more sensitive to changes in real interest rates. The increased sensitivity to changes in real interest rates increases the volatility of these securities compared to short-term TIPS, and exposes investors to greater declines in principal if interest rates should move higher.

Interestingly, short-term TIPS also have a higher correlation to inflation compared to longer maturity TIPS. Intuitively this makes sense, as both portfolios experience the same inflation adjustments but longer maturity TIPS have more interest rate risk. The increased interest rate risk translates to higher volatility for longer maturity TIPS. Inflation rates are relatively steady and the higher volatility of longer maturity TIPS decreases their correlation to inflation. We do not believe this means that short-term TIPS are necessarily a better inflation hedge, because viewing it solely based on the correlation ignores the cost of that hedge.

CONCLUSION

We do not believe that retirement plan committees should build their investment menu based on a short-term, tactical view of the market. Asset classes should be evaluated based on their suitability and appropriateness for the plan based long-term expectations. A focus on shorter-term expectations can lead to increased turnover within the investment menu that challenges participants to maintain a suitable portfolio and can challenge participants’ confidence in the retirement plan committee.

Over the long-term inflation expectations should be priced into the broader market. However, the direct inflation protection of TIPS can be beneficial to investors concerned about spikes in unexpected inflation eroding the purchasing power of their portfolio. The inflation protection can be viewed as insurance against these spikes. As with all types of insurance, there is a cost to this protection and it currently comes in the form of negative real yields on these securities. Because of the cost of inflation protection, TIPS should be viewed as a complementary, rather than core, asset class for investors’ portfolios.

If electing to include TIPS as an asset class within the investment menu, the retirement plan committee should have a fundamental understanding of the components of TIPS’ performance. Using this knowledge, a committee can make better decisions about the type of TIPS strategy that is appropriate for their investment menu. Short-term TIPS have lower short-term yields than longer maturity bonds but are less sensitive to changes in the level of real interest rates. On the other hand, broad market TIPS portfolios have higher current real yields but carry greater interest rate risk. The increased sensitivity to changes in real interest rates increases the volatility of these portfolios. We do not believe one is preferable over the other, and reasonable committees can make different choices based on their plan’s demographics as well as their tolerance and preference for risk within the investment menu

† Information contained herein is provided as is for general informational purposes only and is not intended to be completely comprehensive regarding the particular subject matter. While Multnomah Group takes pride in providing accurate and up to date information, we do not represent, guarantee, or provide any warranties (express or implied) regarding the completeness, accuracy, or currency of information or its suitability for any particular purpose. Receipt of information herein does not create an adviser-client relationship between Multnomah Group and you. Neither Multnomah Group nor any of our advisory affiliates provide tax or legal advice or opinions. You should consult with your own tax or legal adviser for advice about your specific situation.