Tips For Mixing Passive And Active ETFs And Mutual Funds

Post on: 16 Март, 2015 No Comment

ETFs are great vehicles for traders, but they’re also well suited for long-term investors. Most investors probably take care of their long-term investing though their employer-provided 401(k) plans, which tend to use low-cost institutional shares of actively managed and index tracking mutual funds.

But for investors in IRA and other self-directed investing plans, ETFs have a clear cost advantage.

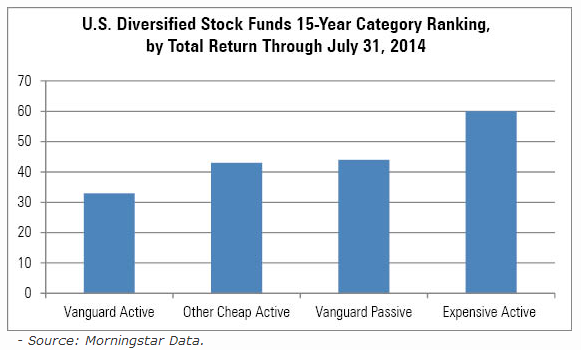

Long-term investing plans are geared to get the highest return available for the amount of risk taken. Most of the work in building such a portfolio can be done with ETFs that track broad market and sector indexes. And ETFs are a lot cheaper than using actively managed funds.

They’re better in very efficient markets, where active managers have a difficult time adding value, said Will Braman, chief investment officer of Ballentine Partners, a Waltham, Mass. wealth management firm catering to high-net-worth families and entrepreneurs.

Antaeus Wealth Advisors’ chief investment officer, Evan Welch, likes Vanguard for its low costs and low tracking errors.

Going Deep

What’s the best way to build a diversified ETF portfolio to meet your long-term goals?

Start with an investment game plan. Use software provided by your brokerage, mutual fund or financial planner to help determine your goals, time horizon and risk tolerance. The plan will lay out how much of your portfolio to place in U.S. and foreign stocks, bonds and perhaps such alternative assets as real estate and commodities. With a plan in hand, you can go about selecting ETFs that track those asset classes and market segments.

For example, the foundation for a core portfolio for a typical 50-year-old investing with Antaeus Wealth Advisors in Boxborough, Mass. consists of these Vanguard ETFs: 30% in Dividend Appreciation (ARCA:VIG ); 20% in Short-Term Corporate Bond (NASDAQ:VCSH ); 15% in Small-Cap (ARCA:VB ); 10% each in REIT (ARCA:VNQ ), Total International Bond (NASDAQ:BNDX ) and FTSE Emerging Markets (ARCA:VWO ); and 5% in Short-Term Inflation Protected Securities .

Also, active managers often do better with hedge-fund strategies. There are too many security selection decisions, and the markets change too much, for passive management, Braman said.

So for the fund portion of your portfolio, fill the bulk with passive ETFs, Braman adds. Use actively run funds to fine-tune your asset allocation decisions.

If you find mutual funds as well as ETFs that target a particular space with comparable success, remember that index-tracking ETFs will usually cost less than their actively managed siblings or mutual funds.