Time Value of Money Terminology

Post on: 22 Июль, 2015 No Comment

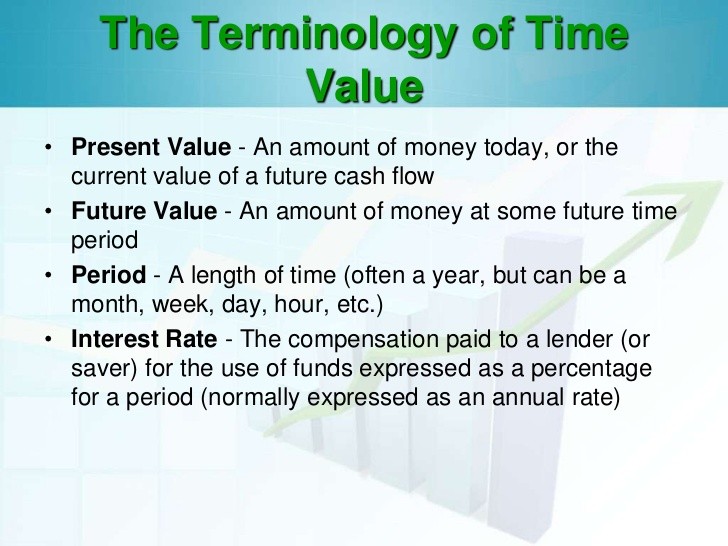

Terminology (AKA jargon) can be a major impediment to understanding the concepts of finance. Fortunately, the vocabulary of time value of money concepts is pretty straightforward. Here are the basic definitions that you will need to understand to get started (calculator key abbreviations are in parentheses where appropriate):

Banker’s Year A banker’s year is 12 months, each of which contains 30 days. Therefore, there are 360 (not 365) days in a banker’s year. This is a convention that goes back to the days when calculator and computer were job descriptions instead of electronic devices. Using 360 days for a year made calculations easier to do. This convention is still used today in some calculations such as the Bank Discount Rate that is used for discount (money market) securities. Compound Interest This refers to the situation where, in future periods, interest is earned not only on the original principal amount, but also on the previously earned interest. This is a very powerful concept that means money can grow at an exponential rate. Compounding Frequency This refers to how often interest is credited to the account. Once interest is credited it becomes, in effect, principal. Note that the compounding frequency and the frequency of cash flows are not always the same. In that case, the interest rate is typically adjusted to an effective rate that is of the same periodicity as the cash flows. For example, if we have quarterly cash flows with monthly compounding, we would typically convert the monthly rate into an effective quarterly rate to solve the problem. Discount Rate This is the interest rate that is used to convert between future values and present values. Note that the process of calculating present values is often referred to as discounting because present values are generally less than future values. Frequency of Cash Flows When using the cash flow functions, many financial calculators prompt you for both the cash flow (CFx) and then the frequency (Fx or #Times). The frequency is simple a shortcut to save both time and memory. If a cash flow occurs more than one time in a row, then you would enter the number of times that it occurs (in most cases, you will leave it at 1). The next cash flow that is entered will be the next different cash flow. Future Value This term refers to the value of a cash flow (or series of them) at some specific future time. Any cash flow that is scheduled to occur sometime later than today is referred to as a future value. Literally translated, future value means what will it be worth at some future point in time? For example, if an investment promises to pay $100 one year from now, then the $100 is the future value of the investment because that investment will be worth $100 at that point in time. Internal Rate of Return The compound average annual rate of return that is expected to be earned on an investment, assuming that the investment is held for its entire life and that the cash flows are reinvested at the same rate as the IRR. Investments that have an IRR that is greater than or equal to the cost of funds (WACC) should be accepted. Modified Internal Rate of Return The compound average annual rate of return that is expected to be earned on an investment, assuming that the investment is held for its entire life and that the cash flows are reinvested at a rate that is different from the IRR. Typically, the reinvestment rate is assumed to be the WACC. Investments that have an MIRR that is greater than or equal to the cost of funds (WACC) should be accepted. Note that the difference between MIRR and IRR is in the assumed reinvestment rate. Net Present Value The present value of the future cash flows less the cost of the investment. The NPV is a direct measure of cost versus benefit. It represents the economic profit to be earned by making an investment. Rational investors will take all investment opportunities that have an expected NPV greater than or equal to zero. If you use Excel (or any other spreadsheet program) you should read my post about the misleading nature of the NPV function. Number of Periods The total number of periods is a key variable in all time value of money problems. It is important to distinguish between the number of periods and the number of years. For example, we may refer to a 30-year mortgage. However, unless the payments are made annually, the number of periods is not 30. Instead, the number of periods would be 360 (= 30 years x 12 months per year). Similarly, we may say that this bond has 10 years to maturity. In this case, the number of periods would be 20 (= 10 years x 2 semiannual periods per year) because bonds typically pay interest semiannually. Payment The payment is the amount of a cash flow. Typically, payment refers to the amount of the cash flow in an annuity. This is especially true when using financial calculators or spreadsheet functions. Period A period is simply a unit of time. Note that, depending on the problem under consideration, the relevant definition of a period can vary. The length of a period is most often defined by the amount of time that passes between cash flows. Most commonly, a period will be a day, a week, a month, a quarter (three months), six months, or a year. In a problem that involves mortgage payments, a period would typically be one month since payments are usually made monthly. However, a problem that involves the valuation of a bond will usually have a period of six months since bond interest payments are typically made every six months (semiannually). Present Value This term refers to the current (todays) value of a series of future cash flows. In other words, it is the amount that you would be willing to pay today in order to receive a cash flow (or a series of them) in the future. Literally translated, present value means what is it worth right now? Required Return The required return is simply the return that an investor believes he/she needs to earn in order to make an investment in a particular security. It is based on the perceived riskiness of the security, the rate of return available on alternative investments, and the investor’s degree of risk aversion. It is likely that two investors looking at the same investment will have different required returns because of their differing risk tolerance. The required return, along with the size and timing of the expected cash flows, determines the value of the investment to the investor. Note that the required return is different from the yield (or promised rate of return), which is a function of the cost of the investment and the cash flows, and not of investor preferences. TVM A common abbreviation for time value of money. This concept is most succinctly described by saying that a dollar today is worth more than a dollar tomorrow. The concept underlies much of financial mathematics and is the main purpose of this site. But you knew that already, didn’t you? If you are interested in learning more about TVM math, please take a look at my introduction to time value of money math.