Time To Sell HYG JNK And LQD

Post on: 12 Июнь, 2015 No Comment

Yesterday’s divergence/convergence in HYG/HY17 was another example of the interplay between various instruments in the credit market space and how they can be traded profitably. Taking a step up from the trees to the forest, unlike Mr. Fink’s earlier comments on the cheapness of equities relative to any and every other asset class, we note that in fact — were you to have a bullish perspective on the world — then HY spreads are far cheaper (i.e. priced for much more of an Armageddon-like scenario) than equities and offer more upside if things work out. However, the bond ETFs have their own set of technical flows and idiosyncratic risks and Peter Tchir, of TF Market Advisors. sees growing concerns in this increasingly active area of the market.

These ETF’s have performed well and are attracting assets at a good pace. That is all good news, and think these are still a great way to time the market, and I remain convinced that as the ETF’s evolve they can replace some of the much maligned (but incredibly liquid) CDX Indices. In the meantime, I think these are all due for a bit of a correction .

[For interest, a story we have been focused on is the growth in creation units for HYG and the chart below shows that we have see only one drop in shares outstanding in the last 59 days and the growth and scale is very similar to the Q4 2008 period — once again we worry that creation units and momentum are helping pros transfer illiquid HY debt to liquid HY ETFs and into retail pockets]

CYH is the biggest warning sign. They brought a new deal at par yesterday. It is trading as low as 98.5 today. That is a very weak break on the open for a benchmark name. CYH isn’t particularly scary, but it is often paired with HCA. HCA remains huge, and if the weakness in CYH leaks into HCA, we can quickly see a move lower in the market. HCA is just so big and is used as an index proxy by many hedge funds, so weakness there typically leads to additional selling pressure as no hedge fund has much risk tolerance right now.

3 of the top 10 holdings for HYG are HCA and CYH. JNK isn’t as exposed to those two names (in part because it is a lower quality portfolio in my opinion), so it wouldn’t be immune. Both HYG and JNK are trading at a slight premium to NAV. If the underlying High Yield market shifts to trading to the bid side, rather than the offer side, we would likely see a 1% or more move in NAV coupled with a shift from premium to slight discount — again, indicating to me a down 2% move as being quite likely.

With indicated yields of 7.22% and 7.53%, avoiding a 2% loss is worth more than 3 months of carry.

The yields may also see some pressure from Italian and Spanish yields. Italian 10 year bonds are yielding almost 7% and are trading at a price of 85. The low price and fact that it is not callable means that it can offer better risk/reward than the high yield market with all their premium bonds and callable issues. It is clearly a different bet, to buy Italian bonds than to buy HYG, but I suspect some people will look at the trade and see the appeal of buying a bond that potentially has ECB. Anyone who got bullish Italy a couple of weeks ago has lost on that bet, but is about even on their high yield positions. If the losses are forcing them to cut risk, some will choose to cut high yield so they can keep their high beta Italy positions. I don’t necessarily agree with that trade, or want the FX risk, but I think it is something many managers will do. It is harder to admit you were wrong in Italy and cut that, than it is to sell some high yield to raise cash or reduce exposure and cling to the losing bet (that you are sure will come back).

I think the combination of HYG/JNK having outperformed HY17, trading at a premium, weakness in the new CYH bond, and possible cannibalization from Italy and Spain, will put some short term pressure on the market.

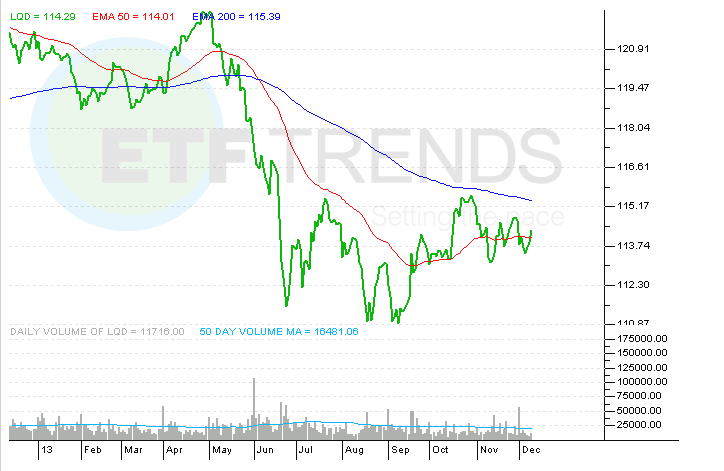

LQD may face pressure from a couple of sources as well. With French bond yields reaching new highs relative to bunds and hitting outright yields of 3.66% in 10 years, you could see a shift out of corporate bonds. LQD only yields 4.26% and has a duration longer than the French 10 year risk. So you pick up diversified exposure and no FX risk, but the duration is longer and the yield pick-up isn’t that much. Furthermore, half of the top 10 holdings in LQD are financials. The financials often account for about 20% of LQD (which is in line with their representation in the indices), so a large portion of the yield is driven by financials. Would you rather own financials than France? I find this trade less compelling as LQD still has the perception of safety and will move with treasuries so could continue to outperform France, but it is worth watching. I think an all corporate index (LQD ex Fins) would be more interesting. The good balance sheet story applies to corporations far more than to banks.