Time horizon

Post on: 16 Март, 2015 No Comment

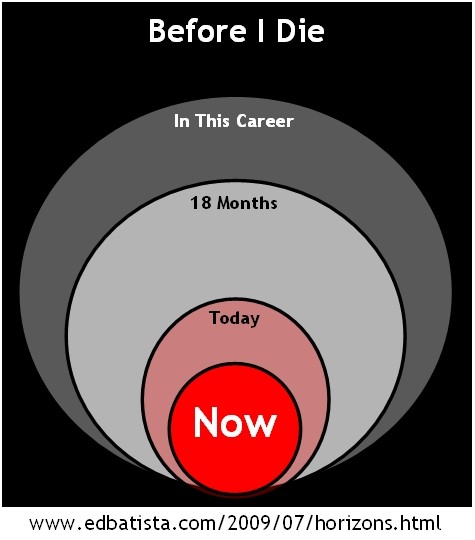

Your time horizon is the length of time you expect to hold an investment. The time horizon you choose and the risk of an investment are related.

Risk and time horizon

Investments like cash and short-term bonds carry little risk for an investor whose time horizon is short, for example, a person saving for a vacation in 2 years. However, they can be risky for an investor whose investment horizon is long, for example, a person saving for retirement. The low return on short-term investments may not keep pace with inflation, or be enough to meet the long-term goal. Learn how not taking enough risk can affect your ability to achieve your goals.

In comparison, stocks are very risky for the short-term investor since their value may change frequently. People saving for a short-term goal could end up with less money than they originally invested. Stocks have a higher potential return than cash and bonds over the long term, and are better for investors saving for long-term goals.

Use this chart to see how the average annual return and risk of loss on a diversified portfolio of Canadian Equities changed historically in relation to time horizon.

Longer-term investors are in a position to allocate a larger portion of their portfolio to higher-risk investments like stocks than shorter-term investors because a longer time horizon is associated with lower volatility. This doesn’t mean that stocks are not risky over the long-term, but for long-term investors, stocks are more likely to provide higher returns.

Factors that can affect time horizon

Human capital

Your investment portfolio is only one part of your wealth. Investors also have human capital, which is their ability to generate income from work. Human capital affects the amount of risk you can take when investing. If your human capital is high, you can afford to take more risk. If your portfolio loses money in the short-term, you have time to recover your losses and the ability to generate more income. If your human capital is low, you won’t be able to rely on employment income to compensate for potential losses. You can’t afford to take unnecessary risk.

Your human capital depends on a combination of factors that include your age, health, skill set and employment status.

Horizon Risk

Horizon risk is the risk that your investment horizon may be unexpectedly shortened. For example, you lose your job or the roof of your house needs immediate replacement. This may force you to sell some investments, including those that you had hoped to hold for the long term. If you are forced to sell investments at a time when the markets are down, you are likely to lose money.

To guard against horizon risk, you can include some short-term investments in your portfolio. This emergency fund could be cash in a high-interest savings account or short-term bonds. If you find yourself in a situation where you are forced to sell, these investments will limit your losses.

Generally, you should reduce your allocation of longer-term investments as you come closer to the end of your investment time horizon. This will help you avoid the risk of having to sell most or all of your investments at a time when the markets are down. Learn more about rebalancing your portfolio as you age .

John. Giovanni and Julia. and Juan all have different time horizons – from 3 years to 30. See how they take their time horizon into consideration when choosing investments.