Three Kinds Of Bond ETFs That Can Battle Rising Interest Rates

Post on: 12 Июнь, 2015 No Comment

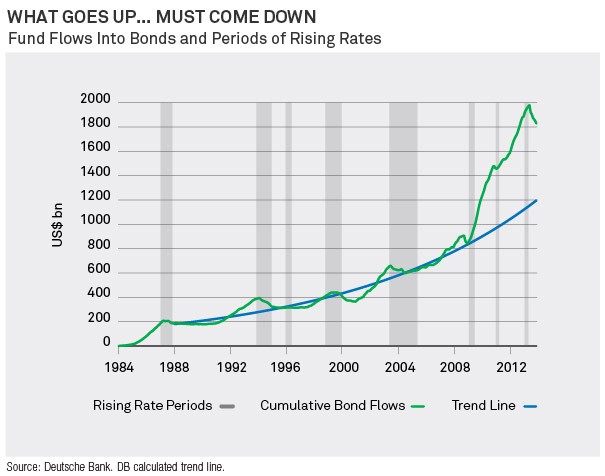

A U-turn in the bond markets, on worries about when the Federal Reserve will wean the economy off its stimulus drug, has unnerved fixed-income investors. They fled for the exits after interest rates marched to a fresh one-year high in May.

In the past week they pulled the second most amount of money out of bond funds since Lipper Inc. started tracking fund flows in 1992. Fixed-income mutual funds and ETFs bled a net of $9.1 billion in the week ended June 5, Lipper reported. Municipal bond funds lost $1.5 billion the largest weekly net outflow since January 2011.

Whether the Fed starts taking away the quantitative easing meds in two months or two years, investors will be hard-pressed to find respectable yield income without volatility or the risk of losing principal. Bond prices and yields move in opposite directions and the longer a bond’s duration the more sensitive it is to interest rate moves.

For every percentage point gain in yield. a 10-year bond would lose 10% in price. Prices for 30-year bonds would drop 30% a massive loss for a supposedly safe-haven investment.

IShares Barclays 20+ Year Treasury ETF (ARCA:TLT ), which has a 12-month yield of 2.75%, is 9% off its May high and down 5.6% year to date and 7.3% the past year.

Here’s a look at three kinds of ETFs with the best odds of protecting principal while earning dividend income.

• 1. Short-Term Bonds

Short-term bond are less sensitive to interest rates and will lose less when rates rise.

SPDR Barclays Short Term High Yield Bond Fund (ARCA:SJNK ) holds nearly 400 bonds from companies with junk credit ratings. The fund yields 6.19%.

Bonds in SJNK have an average duration of two years, and so its price swings less violently than its longer-term peer SPDR Barclays High Yield Bond ETF (ARCA:JNK ), which carries similar credit risks. JNK’s portfolio has a duration of 4-1/2 years and yields 6.49%.

SJNK is 2% off its May high but has returned 2.04% year to date and 10.45% the past 12 months, while JNK has returned 1.41% and 12.21% in those periods.

Pimco 0-5 Year High Yield Corporate Bond Index (ARCA:HYS ) yields 5.03% and its portfolio has an average a duration of two years. HYB is 2% off its May high but still up 2.10% year to date and up 10.88% the past year.

The major risk to high-yield bonds is that they’ll sell off like stocks in bear markets. High-yield bonds tracked by Morningstar Inc. dropped 32% in 2008. Since 1989, the sector has experienced 12 corrections greater than 5%.