The War of Words Over Muni Bonds Deal Journal

Post on: 16 Март, 2015 No Comment

Here’s a quick word game. Whats your quick-trigger reaction when you hear “municipal bonds.”

Boring? Staid? Wonky?

That would have been true –- until recently. But lately muni bonds have become a flash point of investor fury so extreme the cat fights over QE2 seem like a polite tea party by comparison.

Bloomberg News Meredith Whitney

And as usual when there’s controversy, financial analyst Meredith Whitney is the white hot center of the muni wars. Her bearish call on municipal debt –- outlined in a “60 Minutes” interview last month lays out expectations of “50 to 100 sizeable defaults” among municipalities, amounting to hundreds of billions of dollars worth of soured debt.

The interview sparked a boomlet in panicky calls from municipal bond investors to their brokers, and today Whitney took again to the airwaves on CNBC to defend herself.

When you have the first group of defaults you will see indiscriminate selling that would be a buying opportunity for some, she said, according to CNBC. Because there has been such complacency in the market and muni investors have been talked down to for so long—Theres nothing to worry about, theres nothing to worry about—theyll just fly.

Whitney isnt the only bear. Speaking about municipal defaults on Tuesday, J.P. Morgan Chase CEO Jamie Dimon said there have been a handful of defaults so far, and there may be more, the company confirmed Wednesday. Dimon also said that investors in municipal debt have to be very careful, J.P. Morgan said. And investor Wilbur Ross told Reuters that some U.S. states may barely avert debt default, creating investment opportunities if spooked investors run for the exits.

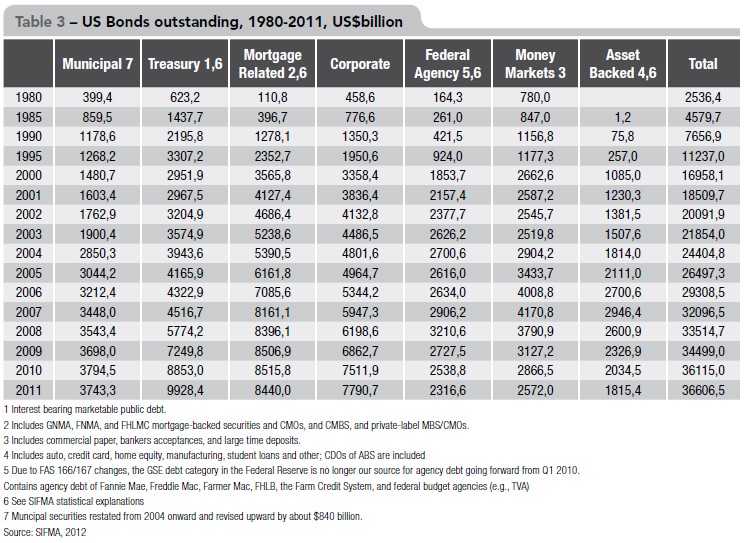

The thing is, few people disagree with Whitney (and we suppose, Jamie) about the problems facing cash-strapped states and cities. Many investors believe a day of reckoning is coming for the $2.9 trillion market for municipal debt, which states, cities and local governments use to finance projects such as highways, stadiums and schools.

Where they disagree is over the scope of the problems. So far, though, the default rate remains tiny. Through Dec. 1, there was $4.25 billion of municipal debt in default in 2010, or about 0.15% of the total market. according to Bank of America Merrill Lynch.

That means the anti-muni backlash is starting. Pimco’s Bill Gross –- who of course has a vested interest in calming nervous bond investors –- said recently on CNBC that investors should buy municipal bonds (except for those of Illinois ). Bloomberg News columnist Joe Mysak recently wrote that there are plenty of reasons to worry about municipal debt, but he doubted the scale and scope of Whitney’s expectations of hundreds of billions of dollars in muni defaults.

Today, a municipal bond firm called FMSbonds even took out a full page advertisement in The Wall Street Journal lamenting the “steady drumbeat…predicting a muni market meltdown.”

WSJ, 1/12/11, page C5

The big worry is that cities, counties or states will simply throw in the towel, fail to pay off their debts and perhaps file for bankruptcy protection. In 2010, there were five municipal bankruptcy filings, half the level of 2009, according to the recent report from Bank of America Merrill Lynch.

The belief has been that municipalities always pay back what they’ve borrowed. Of course, that was the conventional wisdom about home loans, too. Until people stopped paying their mortgages and dropped their house keys off at the bank.

The high-profile tug of war over munis is leaving some industry veterans wishing for the boring old days.

Jimmy Klotz, president FMSbonds, said he has had to soothe a stream of spooked investors in recent weeks. In the past, Klotz said buying municipal bonds was “like watching your car rust,” causing him to lament the lack of media attention on his chosen field. “I used to [complain] about it,” he said. “Now I long for it again.”

No matter what happens in the municipal market, one thing is crystal clear. Muni doesn’t mean dull anymore.

Jeannette Neumann contributed to this post

ITT Breakup: How Much Are the Three Businesses Worth? Next