The Value of Rebalancing

Post on: 2 Июль, 2016 No Comment

Follow Comments Following Comments Unfollow Comments

The first quarter of 2012 was marked by rising equity markets and declining volatility. Yet this trend shifted rather abruptly in the second quarter. The month of May was a particularly rocky one for stocks, commodities and other risky assets. Particularly during times like this, investors should redouble efforts to adhere to investment disciplines—such as portfolio rebalancing.

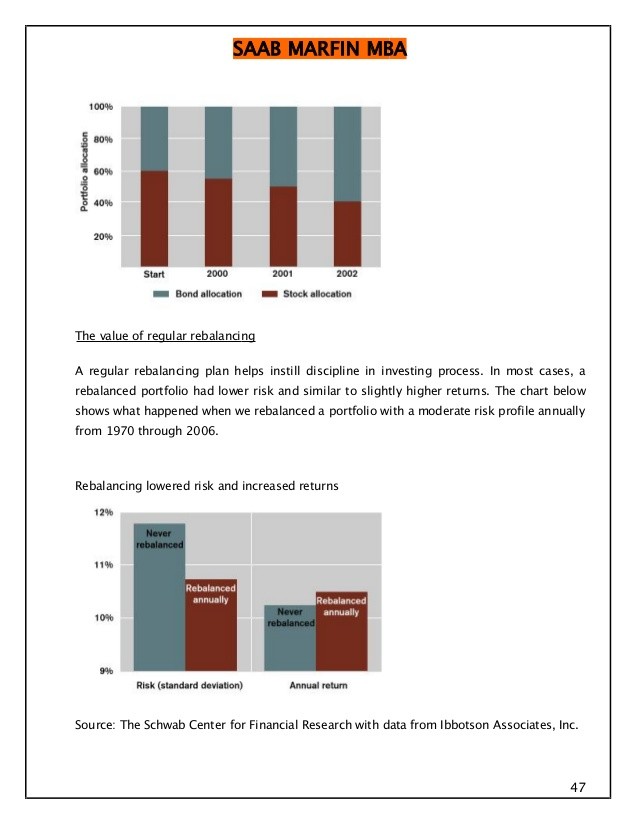

You can look at rebalancing as a form of portfolio risk management. Let’s say you’ve set strategic asset allocations of 60% stocks, 30% bonds and 10% commodities as part of an investment policy statement. This reflects your desired exposure to systematic risk factors and reflects the risk and return goals of your portfolio. If you allow allocations to drift as asset prices fluctuate over time, however, the more volatile assets classes tend to take over and increase portfolio risk; hence the need for periodic rebalancing.

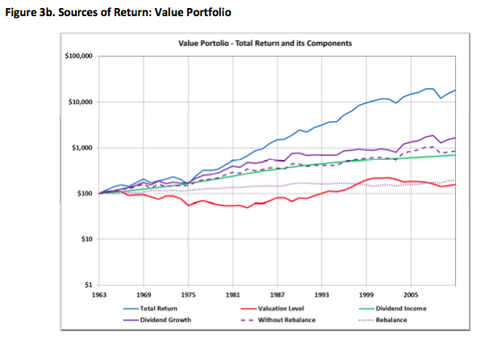

Discipline’s Reward

Implemented over extended time periods, systematic rebalancing tends to improve a portfolio’s risk-adjusted returns quite substantially. For example, we looked at two portfolios comprised of 60% stocks, 30% bonds and 10% commodities from January 1, 1992 to May 31, 2012.* We rebalanced the first portfolio quarterly and never rebalanced the second one. Result: the rebalanced one returned 7.66% annualized, compared to 7.19% for the second one. Due to the power of compounding, a $100,000 investment in the rebalanced portfolio grew to $451,000, compared to only $413,000 in the case of no rebalancing, a 12% greater profit. Rebalancing reduced portfolio volatility quite dramatically, from 10.79% to 9.47%. Overall, rebalancing resulted in a 21% improvement in the portfolio’s reward/risk ratio.

There are of course different methods and philosophies of rebalancing. For instance, calendar rebalancing calls for returning allocations to target weights on a periodic basis, such as quarterly or semi-annually. This is a fairly simple process since it doesn’t require continuous monitoring of a portfolio, but the downside is that the calendar rebalancing is unrelated to market behavior that may have moved allocations way out of whack.

Setting Rules

Many investors follow a form of percentage-of-portfolio rebalancing. Here, thresholds or trigger points for rebalancing are established. For instance, take the simple example of a 60/40 strategic allocation with a five percentage-point rule. This results in a tolerance band or corridor of 55%-65% for stocks and 35%-45% for bonds. If stocks or bonds move out of those ranges, that would be the trigger to rebalance the entire portfolio. Another common technique is percentage of asset class; for instance, a 10% movement (say, from 40% to 36% or 44%) as the threshold to rebalance.

Regardless of what method you use, there are some basic guidelines to bear in mind. First, since there are transaction costs involved each time you rebalance to strategic asset allocations, you must determine if the trade-off (rebalancing vs. not rebalancing) is worth it. All things equal, it is better to set wider corridors for illiquid investments with high transaction costs, such as real estate or private equity. If the portfolio is in a taxable account, you’ll probably want to set wider bands than in a tax-deferred account.

Second, the higher an asset class’ volatility, the narrower should be the corridors. For example, commodities will typically have a tighter band than high-quality fixed income. And the higher an asset class’ correlation with the rest of the portfolio, the wider is the optimal corridor. I should also note that for investors who seek exposure to certain risk factors within an asset class—for instance, small cap vs. large cap, value vs. growth or international vs. domestic within equities—it makes sense to drill down and set some rules for rebalancing risk-factor exposures (with the caveat that such changes should be justified by the related transaction costs).

Finally, don’t forget to rebalance portfolios in your defined-contribution retirement plan (such as a 401K). For some reason investors seem particularly prone to what is called status quo bias in managing their own DC accounts. In other words, perhaps out of sheer inertia people simply let their retirement portfolios drift until allocations and risk levels are way out of kilter. As one extreme example, just consider the cost of riding equities (and tech stocks in particular) all the way up until the market bubble burst in March 2000.

Investors can exercise risk management in their portfolios through disciplined rebalancing back to targeted strategic asset allocations. Over time, rebalancing can potentially increase portfolio returns and reduce risk— an enhancement over which the investor can exercise control.

*60% S&P 500, 30% 5-year Treasuries, 10% Dow Jones-UBS Commodity Index

To read more articles from Gregg S. Fisher go to: www.gersteinfisher.com .

You should follow GersteinFisher on Twitter here .

IMPORTANT DISCLOSURE INFORMATION

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Gerstein Fisher), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. A copy of the Gerstein Fisher’s current written disclosure statement discussing our advisory services and fees is available for review upon request.