The Unpleasant Fiscal Arithmetic of Eurozone QE with Risk of Sovereign Defaults

Post on: 6 Сентябрь, 2015 No Comment

- Home

- Uncategorized

- The Unpleasant Fiscal Arithmetic of Eurozone QE with Risk of Sovereign Defaults

Paul De Grauwe has written about potential fiscal effects from an anticipated ECB quantitative easing (QE) program:

The analysis is excellent to a point, but doesn’t go far enough. In fact, there are problems with the methodology and the conclusion.

The subject involves complex aspects of Eurozone monetary policy – multiple sovereigns, the prospect of Eurozone QE purchases of multiple sovereign bonds, fiscal sharing of ECB seigniorage, and the potential for sovereign defaults. The ECB has not yet announced the details of the anticipated program. In particular, it has not yet specified how the program might be implemented using the national central banks (NCBs) that make up the Eurosystem along with the ECB. De Grauwe’s analysis reads as if the ECB will acquire all the bonds for its own balance sheet, whereas the NCBs will most likely have important operational and balance sheet roles in QE. For consistency of comparison, I will not change that apparent framing of the balance sheet mechanics. The purpose of this post is to draw attention to more general points of principle regarding monetary and fiscal effects of defaults in a multi-sovereign system. The principles in question shouldn’t be affected by the mechanics of implementation, although different balance sheet arrangements may be accompanied by different intended fiscal effects depending on the design of the program.

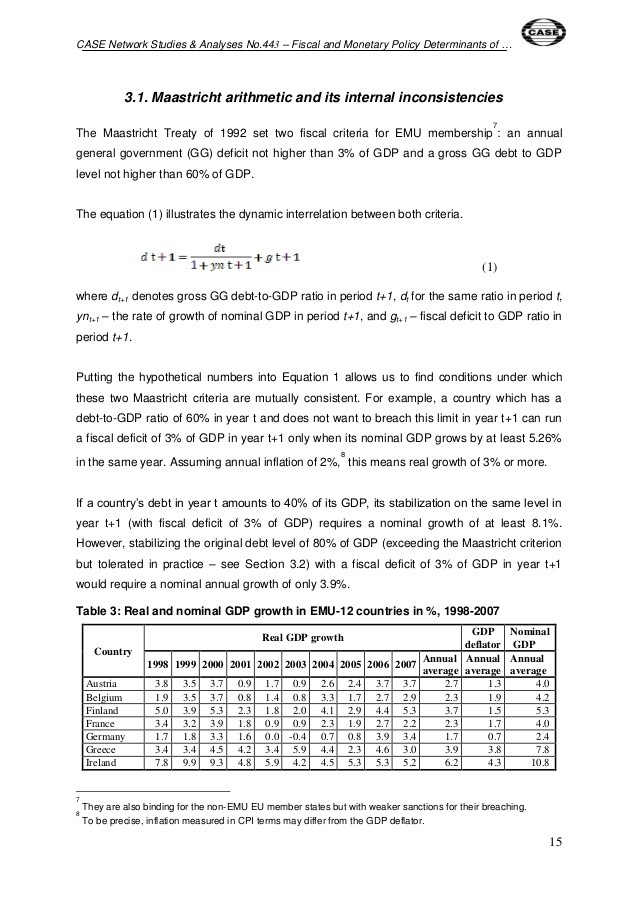

The intention of the anticipated ECB QE program is similar to that of the US central bank – buying government bonds and creating bank reserves or other forms of central bank liabilities as a result. The difference is that the ECB will be buying the bonds of multiple sovereigns. There are potential fiscal implications for multiple European governments. De Grauwe uses the example of Italian government bonds to illustrate the potential effects. I will use the same example, with additional simplification in order to cut to the core issues.

If the ECB buys Italian bonds for example (along with other sovereign bonds), the immediate effect will be to expand the ECB balance sheet. The acquisition of bonds will create new bank reserves in the first instance. Those bank reserves may be converted into related forms of ECB deposit liabilities according to subsequent ECB reserve management operations. The overall balance sheet expansion will create a source of incremental central bank profit (or “seigniorage’) over time. This is because the yield on bonds will normally be higher than the interest expense of the ECB liabilities that are created as a result. This will usually be the case even if some ECB liabilities are at negative interest rates for a time, although spreads may be compressed until policy shifts back toward generally higher positive interest rates. The fiscal consequence will be comparable to what has been experienced in the case of the US Fed, where quantitative easing has resulted in increases in the Fed’s profit remittances to the US Treasury. In the case of the Eurozone, each country holds a share of ECB capital. So ECB profit gets distributed in that proportion to the various EZ countries. Those issuer/recipients include Italy of course.

The fiscal effect of the generic QE operation includes the conversion of Treasury bond interest expenses to central bank reserve or deposit liability expenses. This is because the Treasury pays interest on the bonds to the central bank while the central bank pays back this interest to Treasury as part of its profit calculation. That said, this return of interest only occurs at the top line of the central bank’s profit calculation. Operating expenses and any new interest expenses that the central bank incurs must be subtracted in order to arrive at the actual net profit that is remitted to the Treasury function.

In the case of Eurozone QE, the ECB will be buying the bonds of multiple countries and then remitting profits back those countries. Those profits include the effect of the interest revenue that the ECB receives on bonds that are issued by multiple Eurozone Treasury functions, netted by any operating and interest expenses. The country distribution of bond acquisitions and the interest rates on those bonds determines aggregate interest income, whereas the distribution of profit back to the various sovereigns is made according to a relatively fixed capital share formula (this is covered in detail in De Grauwe’s article).

One can conceive of a QE purchase pattern that might be considered “sovereign neutral” according to the source of bond interest inflow and the destination of profit distribution outflow. That would occur in the hypothetical and stylized case in which the ECB bought the bonds of all Eurozone countries in proportion to their ECB capital shares, and where bonds of different countries yielded the same interest rate at the time of bond acquisition. In reality, there will be a departure from such a perfectly “hedged” fiscal situation due to differences between the mix of sovereign bonds and the distribution of profit, and because bonds of different countries will inevitably have different yields. To the degree that this is the case, and other things equal, it will be seen that there will be net fiscal transfers within the Eurozone as a result of a QE operation, unless something is done to make the formula for profit distribution sensitive to such variations. De Grauwe works through some of these possibilities and offers solutions in which the formula for distribution can be adjusted in order to ameliorate these effects and reduce fiscal distortions that might otherwise result from QE. This preliminary analysis seems fine as far as it goes, so long as there are no bond defaults. Bonds are alive and well and paying interest in this phase.

For example, the interest that the Italian Treasury pays to the ECB on Italian bonds acquired by the ECB under QE becomes part of the profit calculation that ends up being recycled back to the various Eurozone Treasuries. The same holds for all other sovereign bonds held by the ECB. The gross fiscal cost incurred by multiple sovereigns paying interest on QE bonds held by the ECB gets recycled back to the affected fiscal authorities in proportion to their capital participation. But any country distribution of bonds acquired that is different than the formula for capital shares will tend to diminish a potential equalization of proportionate net fiscal effect by country. And different sovereigns will pay different rates of interest on their bonds, which has a redistributive effect of its own. For example, if Italian bonds yield more than German bonds, the extra interest that Italy pays will not come back entirely to Italy in the profit distribution. It will be blended into the distribution across all capital holders. Italy would incur a relative cost and Germany would receive a relative benefit through the ECB profit distribution. The reader can refer to De Grauwe’s piece for a more detailed analysis of such possibilities for profit share distortions and how he proposes to neutralize them by adjustment to the profit distribution formula. Thus, he deals effectively with the problem of potential fiscal transfer disruptions to this point, which includes the assumption that all bonds are alive and well and paying interest.

But there are problems with the analysis beyond this point, as it gets into the core issue of potential sovereign defaults. The author’s treatment of defaulted bonds still held by the ECB prior to full QE exit seems incomplete, omitting important considerations about future interest rate risk. And the treatment of defaulted bonds upon full QE exit overlooks certain sovereign fiscal interests.

The first problem is that De Grauwe associates ECB profit distribution only with bond interest revenue, at least implicitly, without accounting for the netting impact of operating costs and actual and/or potential ECB interest expenses. Most importantly, he effectively assumes away the potential for positive interest rates on reserves. The interest expense on ECB liabilities is ignored, and thus by implication is assumed to be zero forever. (In fact, the ECB currently pays a small negative rate of interest on deposits.) That is questionable as a long term forecast and misleading as an assumption, particularly given the normal central bank strategy for eventual QE exit and an associated expectation for the emergence of unambiguously positive interest rates during and/or after QE exit.

This factor becomes especially important in analyzing the fiscal consequences of a default on sovereign bonds held by the ECB. There is definitely a potential net fiscal effect that De Grauwe has overlooked and one that really can’t be recovered by the kinds of adjustments he suggests. Such recovery would require not only his suggestion of a hold back of normal profit distribution from the defaulting sovereign treasury (Italy in the example), but a proportionate charge for any future interest expenses on those ECB liabilities that were created as the result of QE purchases of bonds that have now defaulted. This is relevant considering the real possibility that the world may return to more positive interest rates at some future point (notwithstanding current depressed interest rate conditions). In that case, under De Grauwe’s proposed treatment, any Eurozone country that has defaulted on bonds will have escaped its respective share of ECB liability costs for which it has been responsible by direct QE association. Such a country will have obtained perpetual free funding courtesy of the ECB and its remaining capital holders. That is an unambiguous fiscal transfer that De Grauwe has either not recognized or assumed away.

The standard central bank strategy for QE includes the assumption that it is temporary – that there will be an exit sometime down the road, anticipating the prospect that central banks will be returning policy interest rates to more normal positive levels. Given that goal and expectation, QE related excess reserves (and related liability forms) will have to pay a positive rate of interest in order to support a policy rate structure above the zero bound – until the completion of QE exit. QE related liabilities must pay a positive interest rate as floor support if the central bank’s policy rate is set sufficiently above zero (I do not consider currency to be a QE related liability). So, for a period of time at least, there would be an interest cost on QE originated ECB liabilities under this assumption. This is a cost that will have been avoided by any Eurozone issuer who has defaulted on bonds and not been full charged for it from a Eurosystem perspective, under De Grauwe’s interpretation. And while this may not be much of an issue when central banking is near the zero bound, it is an aspect that cannot be overlooked in a long run analysis of potential fiscal implications for Eurozone QE through the full cycle of implementation and eventual exit. This potential fiscal effect should not be hidden by the assumption of zero interest rates.

Consider the generic case. Suppose that interest rates start to turn meaningfully positive starting 3 years from now. That means that the central bank liability structure, apart from currency, must be capable of supporting such a positive interest rate structure. And to the degree that QE liabilities are still outstanding, those liabilities must pay a supporting positive interest rate if the central bank policy rate is positive. This is true whether the eventual reserve control system after QE exit is a floor system, a symmetric channel system, or an asymmetric channel system. This caveat applies to the US Fed and the ECB and other major central banks.

De Grauwe goes on to say that because bonds held by the ECB –defaulted or otherwise – are “eliminated” on consolidation, it doesn’t matter what they were valued at on the ECB balance sheet in the first place. They may as well have been valued at zero – because they have effectively been eliminated and replaced by ECB liabilities (assumed by implication to be permanently interest free). This approach exceeds the logic of simple balance sheet consolidation. He then leverages the disappearing bond interpretation by claiming that that when the time comes to exit QE and sell bonds back into the market, it won’t matter that the Italian bonds have no value. Taking this exit assumption into account, his trump card for dealing with the issue of default is the expectation that currency issued by the ECB will have grown over the full cycle of QE implementation and exit. And that means according to De Grauwe that not all bonds bought under QE will need to be sold back into the market into order to achieve balance sheet normalization. Indeed, this assumption is almost certainly true. (The same idea applies to the US Federal Reserve. QE exit will no doubt take years to complete and the currency part of the Feds balance sheet will have grown and have replaced some of the excess reserves now outstanding (banks pay for new currency with reserves)). Because of this, some quantity of bonds bought under QE will still remain on the balance sheet by the time that the excess reserves created by QE have been eliminated according to exit intention. De Grauwe takes advantage of this prospect in dealing with defaulted bonds in case of the ECB. He suggests that the ECB in effect forgive the existence of worthless assets on its balance sheet, using the rationale that they don’t need to be sold back to the market in order to exit QE. This is very questionable. From an economic standpoint, the fact that worthless assets are not a hindrance to QE exit is no justification for keeping worthless assets on the balance sheet. From an accounting standpoint, the loss should be recognized appropriately and the balance sheet recapitalized with newly issued bonds. That is the correct way to recognize and crystalize a loss on the ECB balance sheet. De Grauwe instead treats an actual loss as if it were a forgivable opportunity cost that can simply be swept under the rug of future seigniorage. The proposed treatment plays fast and loose with regular accounting, committing errors of economic analysis in the process.

Thus, the balance sheet implication of De Grauwe’s treatment is that some portion of future currency issued by the ECB will be “backed” on its own balance sheet by an asset of zero value – the defaulted Italian bond. The problem is that this currency would have been issued in any event according to the demand that will arise naturally from the growth of the European economy over time (notwithstanding current depressed conditions). And so ECB seigniorage will have been reduced from what it would have been had it included the effect of good interest on Italian bonds. That reduction in seigniorage due to default is a real fiscal cost, because it reduces the profit remittance of the ECB from what it would have been in the non-default counterfactual. And the fact that the reduced seigniorage gets distributed to the residual capital holders means that there has been a fiscal transfer to the defaulting sovereign from the remaining capital holders. So De Grauwe is simply wrong on this point.

Consolidated balance sheet accounting changes nothing in the analysis of such fiscal effects unless specific fiscal sharing arrangements have been modified. De Grauwe assumes no such changes in the case of the treatment of defaults, at least not in a transparently intentional way.

A consolidated treasury and central bank balance sheet includes bank reserves, currency, and government debt. It would typically be mismatched with an excess of liabilities over assets. The net debt position might be offset by a notional asset entry representing the contingent taxing power of the state – a sort of Ricardian balance sheet. The idea of central bank capital would disappear, as the consolidated government balance sheet has a constant contingent source of new equity in the form of this taxing power. The most important feature is the liability mix, which includes reserves, currency, and Treasury bills and bonds (except for those bills and bonds held by the central bank as it currently exists in balance sheet form). That requires accounting and accountability for the mix of bond and non-bond funding at the consolidated level. The implementation of QE would be reflected on the consolidated balance sheet by a shift in liability mix – fewer bonds and more reserves (or other central bank type liabilities). QE would still mean buying bonds and issuing reserves. QE exit would mean reissuing these bonds or selling new ones. None of this changes the proper treatment of the fiscal effects of ECB liability interest rates and aggregate seigniorage benefits.

Balance sheet consolidation changes nothing material in the economics of sovereign default under QE. It does not constitute a rationalization for subsidized fiscal effects that lurk in stealth beneath the surface. The impact of liability mix must still be taken into account for the effect on the distribution of funding costs back to the sovereigns. Distinct sovereign entities still have distinct accountabilities. A default on Italian bonds held by the ECB is equivalent to a default on interest payable on the corresponding amount of reserves created in the original acquisition of those bonds. It is equivalent to Italy not paying that portion of liability costs. That equivalence holds in both the deconsolidated and consolidated views of joint fiscal and monetary operations. Contrariwise, the impact of default under De Grauwe’s proposed treatment would be as if the consolidated entity had implemented a strategy of shifting from bond funding to reserve funding (and similar short term liabilities) but was willing to forgive Italy’s share of that short term liability cost.

Without more fundamental fiscal consolidation, the distribution of bond default costs according to multiple sovereign accountabilities still has to be considered. De Grauwes analysis only covers the case of defaults on bonds issued by multiple sovereigns. It does not include cases for a consolidated sovereign Europe or a European Treasury function that issues Eurobonds.

In conclusion, the effect of bond defaults on fiscal costs shouldn’t be obscured by assuming that central bank liabilities will never again pay a positive rate of interest. A return to more normal positive interest rates is the standard assumption underlying a QE strategy. A positive rate of interest will be paid on excess reserves in those circumstances, at least until QE exit is complete, depending on the eventual reserve control regime. And following QE exit, the fiscal effect shouldn’t be obscured by assuming that the cost of default can be buried under an aggregate currency seigniorage benefit that in any event is owed equitably to the remaining fiscal authorities who still participate in the currency union.