The TReport High Yield Bonds vs Leveraged Loans

Post on: 12 Апрель, 2015 No Comment

Which is Better, Leveraged Loans or High Yield Bonds?

This is a question that really comes down to your view of the economy. Each product has its advantages and disadvantages, yet I think we have seen the markets become dislocated enough that high yield bonds now look to offer better risk/reward than leveraged loans under most circumstances.

So in spite of several positives I am switching my stance back to bearish risk here.

HY and Leverage Loan ETF Shares Outstanding

You can see that since August 1 st of last year, BKLN, a leveraged loan fund has attracted assets at a rapid pace. It grew from about $500 million back then to almost $4.5 billion now. We were early in spotting this particular ETF and recommended it, in spite of its small size in a nice WSJ article early last year.

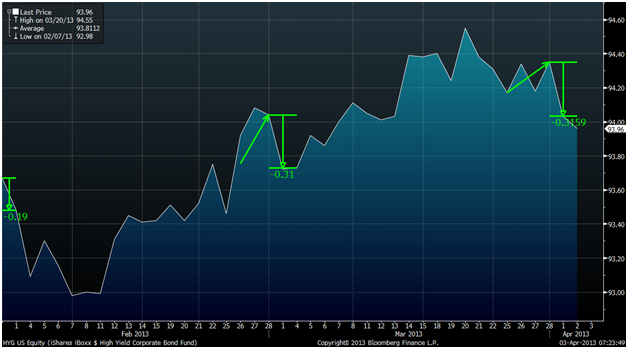

At the same time, the much larger HY bond ETFs (HYG is still over $14 billion) first eked out some additional growth, but since early this year have seen a steady decline in shares outstanding which accelerated during the recent sell-off. They have started attracting some new money.

While flows into mutual funds and managed accounts might differ than the flows we see in the ETF space, I think they are consistent enough for our purposes to see that investors have been dumping high yield to buy leveraged loans and that move accelerated once the Fed taper talk started.

Rate Fears More Than Credit Fears

This move has been more of a function of interest rates fears than credit fears. We think the market has gone too far on those fears.

For now we will ignore whether treasury rates are too high or not. We think they are too high in a world of low inflation and Fed buying and a decreasing deficit, but that is not critical to our argument here, it would just be the icing on the cake.

For every HCA 6.5% bond due 2020 which had a lot of interest and that we highlighted back on May 4 th as being extremely risky at a 3.5% yield in an eventful day in treasuries there are FDC 12.625% that have minimal interest rate risk and probably still deserve to be negatively correlated with interest rates.

HCA 6.5% Bond Yield

Even with somewhat dubious data quality on the pricing of this bond, the story is pretty clear. They moved from 4.25% to 3.5% in the last ridiculous chase for yield. That was the time where nothing would ever go down again. It did, but is back to a level where you are getting a decent yield for holding these bonds. Not great, but reasonable.

FDC 12.625% Bond Price

The FDC bonds also got caught up in the rally and the sell-off and this credit is far too risky to easily assess whether it is rich or cheap but it actually seemed to hold in better than the HCA bonds (and never did quite as well on the way up).

We think that is because the market became too focused on yield and spread and QE and was mispriced across the board. Much, if not all of that mispricing has been fixed.

High Yield Bonds Have Less Rate Risk than is Being Priced In

Investors are currently over emphasizing the importance of treasury yields on the high yield market.

For all of 2012 there was actually a negative correlation between the treasury market and the high yield market. When treasuries sold off, it was because data was strong, and high yield would rally as spreads could offset that. The best hedge for being long high yield bonds had been to be long treasuries. Pause for a moment and consider that, because it has been the normal condition for this market for years.

That correlation became positive this year as every trade was focused on QE and everything was moving in the same direction. We think the relationship will normalize again (be slightly negatively correlated) now that we blew off some of the froth in this market.

Leveraged Loans do NOT Benefit from Rising Rates

This might be the most confusing element of the move into leveraged loans. We agree that leveraged loans are unlikely to be hurt by rising rates (more on that later) but we do NOT see them benefitting from rising rates. That is a misconception that is out there, particularly at the retail level and is one reason this market is overbought.

- Rising treasury yields do absolutely nothing for leveraged loans as they are priced on LIBOR, in fact as the curve between LIBOR and treasuries steepen, leveraged loans look less attractive. This curve is the steepest it has been at any time since the start of 2012.

5 Year Treasury Spread over 3 month LIBOR

- You need LIBOR to increase to get a coupon increase on the leveraged loan you hold and there is absolutely no indication that the Fed is in any rush to raise LIBOR. Only 4 Fed members forecast an increase to Fed Funds by the end of 2014 (and Fed Funds drives LIBOR). Even those calling for a rate hike in the next 18 months were calling for modest rate hikes. So while new high yield bonds are coming with higher coupons again after the re-pricing, leveraged loans will not see a coupon increase for a long time

So this view of leveraged loans benefitting from increased rates is just wrong. There is no upside on the price, and even the coupon is unlikely to change in the next 2 years. On the other hand, if you think of leveraged loans as the low fixed coupon callable debt instrument they are, then they have exposure to yields rising (while the Fed keeps the front end at zero) as they simply look less attractive to other investments. We have rarely if ever been in a situation where long term rates are rising and there is little chance that front end rates will be increased.

It is counterintuitive to have the long end of the curve experience rising rates with little fear that the Fed will raise the overnight rate. It is bizarre and we have lived through the longest period of negative real rates in history, but that mentality is real and that manipulation is what is causing things that make sense in a normal world not to make sense in the current reality.

But Loans Are Senior in the Capital Structure

Yes, that is true. Loans are senior in the capital structure. But if you are an investor that is currently scared of interest rates because you think the economy is doing better, why would you care about being senior?

The seniority is a bear market trade. We shift into leveraged loans when we are scared of credit risk, not the other way around.

If you think the economy is doing well, you want credit spread duration. You want bonds not leveraged loans to benefit from the improving economy.

And now it is time to get a bit cynical. Leveraged loans are less secure than they once were.

You want leveraged loans when the only people making them are distressed investors and a few brave banks where the CEO of the company has pulled enough strings to force the bank to lend. You want bankers getting covenants on what the company can serve in the cafeteria. That is when you want leveraged loans.

You dont want leveraged loans when CLOs and BDCs are competing for assets. Where it is all about fee generation for managers and banks. That is when covenants get set aside. Things that would have been sacrilege during times of stress are given away like yesterdays donuts in the good times. When it is more important to ramp up a deal and get as much positive carry as possible to the equity holder, then standards start slipping.

It isnt done on purpose and it isnt done by all managers, but there is a tendency to get pulled down by the weakest. Once some less disciplined manager breaks down, and investors only focus on the current income, everyone gets forced to play the game. You can pass on every deal and feel good about your decision and lament not getting new mandates, or you can participate in where the market currently is.

So in no way do I mean disrespect to any loan manager, but there has been a steady deterioration in covenants, meaning that loans are less secured than they were and may offer far less protection above bonds than you think if push comes to shove and you actually need that protection.

The M&A Wild Card

If we ever get M&A activity, which we think is unlikely as equities just arent cheap, it helps high yield bonds.

High yield bonds almost always benefit from M&A or LBO activity as they tighten massively because they are getting acquired by a better company, or management has to call them out at a premium, or you can exercise the change of control put.

Investment grade bonds get hurt in general by LBOs and can increase the supply of high yield bonds if they get downgraded, but that tends to be far less of a supply increase than the leveraged loan market sees when LBO activity picks up.

It is the loan market that has to digest the Dell bridge for example. Supply tends to hit loans if we get increased M&A or LBO activity which puts pricing pressure on the existing market while in general high yield bonds benefit from M&A and LBO activity.

Our base case is more negative and we dont see an increase in M&A, but if you are bulled up on the prospect of that occurring, than bonds are for you, not loans.

The CLO Wild Card

While it is one thing to like bonds, it is often hard to find a reason for loans to sell off. The leverage loan market has been great. A certain fund manager, still on our distribution, told me in 1995 that leveraged loans were consistently the most mispriced and misrated asset class out there. That you could get paid very well for the risk as the senior secured nature was not properly accounted for.

In general we agree, but we have seen that break down before and think it could break down again.

Think of leveraged loans, with this current fed policy, as extremely low coupon fixed rate bonds and they instantly look less attractive. Throw in weaker covenants and callability and they look less interesting than ever.

But the real wild card is the CLO.

In its most basic form the CLO buys a bunch of loans paying L+X (where L is LIBOR and X is a spread). They issue liabilities that cost L+Y, and if X is bigger than Y, the equity gets nice current income.

That is the basic format of a CLO.

What has changed is that the arb has two legs currently. X is greater than Y, but the two Ls arent actually the same. The asset side has the LIBOR floors. The liability side doesnt.

So if LIBOR starts to increase, the arb becomes less attractive. The asset side will not see increased coupons but the liability side will. Returns to the equity will drop if LIBOR increases.

The first threat of a rate hike, which we view as unlikely, might actually be bad for leveraged loans. While that seems strange, the CLO arb is why it could be true, and in this market we have seen no shortage of things that seem strange actually coming true.

So the Question is Answered

High Yield bonds are more attractive than leveraged loans here.

We like the upside of bonds and dont see upside in loans here with some chance that the peculiar nature of current Fed policy may actually be hurtful to loans as it turns them into low coupon fixed rate loans rather than the floating rate product they are supposed to be.

If you want pure floating rate, then something like FLOT can work well. It is an ETF that has grown to $2 billion that invests in floating rate debt issued predominantly by financial institutions. It is a direct comparison to investment grade bonds and think many of the issues we highlight here that impact the relationship between high yield bonds and leveraged loans do not hold up when looking at investment grade bonds versus their floating rate bond equivalents, but that is for another day.

This writing discusses general market activity, industry or sector trends or other broad-based economic, market or political conditions and is provided for general information purposes, education purposes and entertainment purposes only. Nothing contained herein should be relied upon for any other purpose, including making investment decisions. It is not, and is not intended to be, a research report, a recommendation or investment advice, as it does not constitute a substantive research or analysis, nor an offer to sell or the solicitation of offers to buy any product or service in any jurisdiction. It does not take into the account the particular investment objectives, restrictions, tax and financial situations or other needs of any specific client or potential client. In addition, the information is not intended to provide a sufficient basis on which to make an investment decision. Any investment decision about buying securities or other assets should only be made after consulting appropriate tax, legal, financial and any other relevant advisors. This writing is for institutional investors only and is not for retail investors. The information and opinions herein are current only as of the date appearing on the cover or on the date upon which the writing was originally sent or posted on the website. Economic, financial and market assumptions and forecasts are subject to high levels of uncertainty that may affect actual performance and may change instantaneously and materially as market, financial, economic, political, regulatory or other conditions change. Any past performance is not indicative of future performance or results which may vary significantly. The value of any investment can decrease in price as well as go up in price and future returns are, in no way, guaranteed nor assumed. All information herein, including statements of fact, opinion and forecasts, do not provide any assurance or guarantee as to returns that may be realized from investment in any securities or other assets. This writing is the opinion of the author and TF Market Advisors, LLC, and does not provide or purport to contain all of the information that an interested party may desire and provides only a limited view of a particular market. TF Market Advisors, LLC, depends upon third parties such as Bloomberg LP to provide data and information which we believe to be reliable. TF Market Advisors, LLC, is not a broker-dealer nor investment advisor and does not sell securities nor advise individual clients based on specialized needs. TF Market Advisors, LLC, does not advise on the suitability of any trade or investment and provides no legal, tax or other type of advice.