The TimeValue of Money

Post on: 3 Октябрь, 2015 No Comment

What is a million dollars worth? If I were to offer a million dollars today of course the value would be a million, but what if I gave $500,000 today and $500,000 in ten years time? Still the same? What if I gave you a note promising that I, and my descendants would give you, and your descendants one dollar a year for a million years? Obviously inflation, the amount you could get if you invested the money today, and a myriad of other factors mean that the value of money has a time-factor, it is better to have money now rather than later.

Any financial text book will give the formulae that apply here, but it is the ignorance of the time value of money that leads many people to make poor investment decisions, especially when the question of paying off the mortgage or investing in something else comes up.

A very common piece of advice given on how to save money on your mortgage is to make more payments, pay more now and save all that interest later. The bank simulator shows that by tailoring your home loan, which usually means giving the bank more money and sooner, you are able to save many tens of thousands of dollars.

Yes, it is tempting to want to give the bank that money, because $20,000 is certainly a lot of money. today. What will it be worth in 20 years?

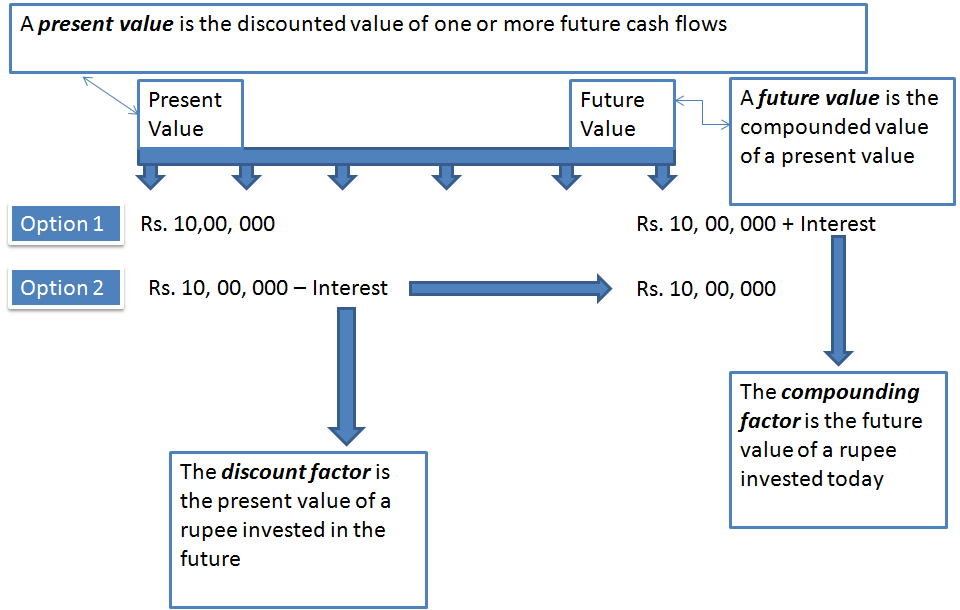

A simple calculation can be made, straight out of a text book. Just say the annual interest rate is 8%, compounding interval is monthly, over 20 years. The formula for the present value (PV) is

PV = FV * (1 + i/m)^-mt

where PV = present value = ?

FV = future value = $20,000

i = nominal interest rate = 8%

m = number of compound periods in a nominal period = 12

t = number of nominal periods = 20

PV = 20,000 * (1 + 0.08/12)^-(12*20)

which equals $4059.43.

If you gave me $4100 today, you should expect at least $20,000 back in 20 years as an absolute minimum, but most people would be overjoyed at such a return on their investment. Do this calculation with the tens of thousands of dollars you will save on your mortgage with your tailored home loan and then you will see just how unimpressive this really is. A $20,000 debt due in 20 years at that interest rate really is worth only $4059.43, and if you wanted to sell an IOU to a bond investor with these terms, $4059.43 is all he would give you for it. If inflation rose to double digits, as it has done many times this century, the capital value of such an annuity would fall dramatically. The real return, that is the after inflation return would be negative. If you invest in bonds with an interest rate lower than inflation you lose money.

This figure isn’t just some theoretical number crunch unworthy of any attention in the real world, just think of what a house was worth in the 1950s, in today’s money this isn’t really very much. That is inflation for you, the amount of money you dream of one day earning will be starvation wages in 50 years.

And here is another calculation. An annuity is a cash flow producing instrument, like a bond.

How much is $500 paid annually over 10 years worth, if the interest rate is 8% per annum, compounded monthly? On face value this is worth $5000, but the future value of this annuity is

FV = F[(((1+r)^n)-1))/r]

where FV = future value = ?

F = annuity per compound period = $500

i = nominal interest rate = 8%

r = i/m = 0.08/12

n = number of nominal periods = 10

Future value = $5152.69. This annuity will produce $5000 cashflow, but this is equivalent to a single payment of $5152.69 in ten years.

This gets more interesting when you look at the present value (PV)

PV = F[1-((1+r)^-n))/r]

so we plug those values in and find that this annuity is worth only $4821.45 today.

So now we look at something directly applicable to mortgages and the idea of paying them off sooner. An equivalent income stream calculation shows the equivalent cashflow of an annuity running for different periods of time.

A home loan runs over a period of 30 years. Repayments are $800 a month. What is the equivalent income stream such that the mortgage is paid off over 20 years instead? To calculate this we work out the PV of the 30 year mortgage and solve for the payments of the 20 year mortgage. Payments are monthly, interest 8%, compounded monthly.

PV = F[1-((1+r)^-n))/r]

F = $800

r = 0.08/12

n = 360 (=30 years x 12 months)

PV = $109,026.80

Now using this PV we solve for the new F, where n = 20

You pay $218,697.60 over the course of 20 years, as opposed to $288,000 over 30 years.

I will stress that these two series of cash flows are financially equivalent. They have the same present value, and the interest rate is the same. The argument that you are saving $70,000 in this case is false, and preys on people’s ignorance of the time value of money. The bank wants you to pay back more quickly because they make a large chunk of their money through fees, if you pay back early they can lend the money out again and charge the fees. Secondly as far as they are concerned, the less time they need to know you the less time they are exposed to your credit risk and the less expenses they have.