The Risks of TIPS and TIPS ETFs

Post on: 5 Октябрь, 2015 No Comment

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Treasury Inflation Protected Securities, or TIPS, are a way for investors to help manage the risks of inflation. TIPS’ principal adjusts upward along with consumer price inflation, or CPI, which provides investors with a guaranteed “real return ” (or return after inflation).

Individual TIPS bonds can be an important portfolio component for investors who want to maintain the purchasing power of their savings. But TIPS, despite being issued by the U.S. government, are not free of risk – particularly if you choose to access the asset class through mutual funds or exchange-traded funds (ETFs).

The Risks of Investing in Individual TIPS

Since TIPS are backed by the full faith and credit of the United States government, they are seen as being free of credit risk – in other words, investors are guaranteed to receive all of the interest and principal that’s coming to them.

While the price of a TIPS bond will fluctuate between the time when it is issued and the date at which it matures. a person who holds until maturity isn’t affected by these price movements. However, this moderate level of volatility does have the potential to become an issue if a person sells a bond prior to its maturity date. In this case, he or she isn’t guaranteed to receive the bond’s par value since its market price could be more or less than par at the time of the sale.

Another potential risk of TIPS is that the official CPI fails to track actual inflation or the rising prices of the products or services the investor needs. In this case, there is the chance that the element of inflation protection in the bonds will be insufficient to protect that investor’s true purchasing power.

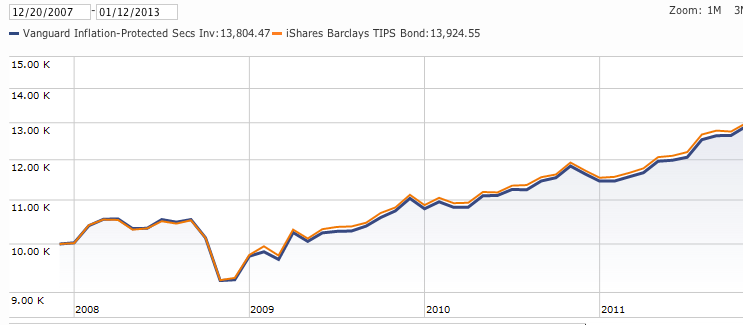

A third risk is the rare chance of de flation, or falling prices. In this case, investors would likely sell TIPS – driving prices down – since there would be no need for inflation protection. This indeed occurred during the depths of the financial crisis of 2008, when fears of a worldwide financial meltdown raised the possibility of deflation and led to a sharp decline in the prices of TIPS in the autumn of that year. Deflation a long-shot possibility, but one that merits consideration.

The Risks of TIPS Mutual Funds and ETFs

While TIPS will work as intended for investors who buy individual bonds and hold them to maturity, those who hold TIPS via mutual funds or ETFs face an entirely different set of risks.

Funds do provide an element of inflation protection in the sense that the principal value of the bonds held by the funds will indeed adjust upward with inflation. However, unlike individual securities, bond funds have no maturity date. This means that investors are not guaranteed to see a full return of principal. And since TIPS are highly sensitive to interest rate movements, the value of a TIPS mutual fund or ETF can fluctuate widely in a very short period.

A prime example of this danger occurred in November-December of 2010. In that two-month period, bond yields spiked higher as prices fell, driving the yield on the 10-year U.S. Treasury note from 2.61% to 3.31%. In that same time period, the largest TIPS ETF, iShares Barclays TIPS Bond Fund (ticker:TIP) returned -3.2%. The fund was also hammered for a loss of 7.8% in May-June 2013 amid a smiliar spike in Treasury yields

These losses are meaningful, since inflation typically has run in the 1-3% range in recent years. As a result, it doesn’t take much of a loss to offset the protection feature in the funds’ TIPS holdings.

TIPS Funds Lack True Inflation Protection

TIPS funds face another headwind: higher inflation generally leads to higher rates, which equates to falling share prices for TIPS mutual funds and ETFs. Any hint that inflation is rising would almost certainly lead to a decline in Treasury prices (keep in mind, prices and yields move in opposite directions ), which in turn would weigh heavily on the prices of TIPS and the funds that invest in them.

In this sense, TIPS funds actually provide the opposite of what many investors may be expecting: rather protecting against inflation, they will in fact be hurt by it. For short-dated TIPS funds, the impact would be less severe.

Keep in mind, this is only a problem if rates rise. But with yields already at extremely low levels. investors in TIPS funds are taking a chance that their investment won’t live up to expectations.

Learn More About TIPS