The Risks of Investing in Bonds

Post on: 8 Июль, 2015 No Comment

Bonds are often considered a safe investment. Many people talk about adding bonds to a portfolio in order to reduce risk. There are special risks to the bond investor, however, that the invest must understand.

The Basic of Bonds First the basics. A company, a city, or another entity issues bonds when it wishes to borrow money to pay for something. A bond is a loan made to a company or another entity which pays typically a fixed interest rate for a period of time. Bonds to companies are called corporate bonds, while those to a city are call municipal bonds. Most bonds are listed by the interest rate that is paid to the initial buyers of the bond, called the coupon, and an expiration date, called the maturity date. For example, if AT&T issued a bond that matures in 2020 that pays an initial rate of 9%, it would be called an AT&T 2020 9% bond. At&t may have a whole host of bonds of different maturity dates and interest rates.

On issue a bond normally sells for $1000 per bond. The coupon is set at whatever rate is expected to be needed to sell all of the bonds. Just as a consumer who has a high FICO score can often get a better rate on loans, a company that has a very good credit rating will be able to issue bonds with a lower coupon. Companies that have sterling credit are said to issue investment grade bonds, while those with poor credit are said to issue junk bonds. The higher interest rate paid by the junk bonds makes up for the greater risk of default.

Once the bond is issued, investors can trade the bonds on the open market. It is very rare for an individual to hold a bond all of the way from first issuance to maturity. Because the bond pays a fixed amount of money each year for example our AT&T 9% bond would pay $90 per bond each year if the price of the bond declines the interest rate that the new investor will get increases. Likewise, if the bond goes up in price the interest rate that the new investor receives will decrease. Because the investor holding the bond when it matures will receive the par value normally $1000 per bond a person who buys a bond below the par value will receive an additional amount of income if he/she holds the bond to maturity. Likewise, if one buys a bond above par value the effective yield is less. The yield taking into account this price differential is called the yield to maturity.

Risks for bonds

Default: Obviously the primary risk with a bond is that the company that issues the bond will be unable to pay and default on the bond. When this occurs, sometimes the company will issue shares fo stock to repay part of the loan, sometimes the company will repay the loan but at a later date, and sometimes the company will just default and not pay. In general when a company defaults on a bond the investor should expect to get little or nothing back.

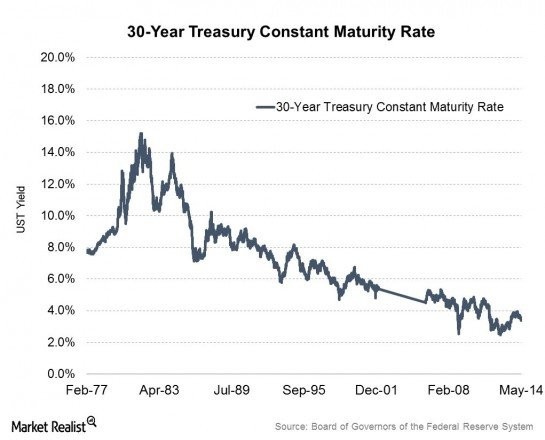

Interest Rate Rises: Because bonds are primarily bought for the interest they pay they are very sensitive to changes in interest rates. For example, if banks start paying higher interest rates, because a bank account is less risky than a bond, many investors will sell their bonds and invest their money in the bank. Because of this, the price of bonds will decrease, causing their interest rates they pay to increase (remember that bond interest rates go int eh opposite direction as the price of the bond). b]Buying bonds at periods like the present time, where interest rates are rock bottom and only likely to go up, therefore is especially risky. On-the-other hand, buying bonds when interest rates are very high and most likely to go down is a sound strategy. As interest rates decrease the price of the bond will go up. This will provide income in addition to the relative high interest rate that will be locked in when buying the bond.

Early Call: If interest rates are sufficiently low many bonds will trade above their par value. This is because investors will go to bonds in order to increase the amount of interest they make when bank accounts are paying nothing. Many companies have call provisions that allow then to repay the bonds early. If interest rates are very low they may well call the bonds, paying the par value, and then issue new bonds at a lower rate. this is much like a person refinancing their home. When this happens, if youve bought at above par value you will lose the difference.

To ask a question, email vtsioriginal@yahoo.com or leave the question in a comment for this blog.

Disclaimer: This blog is not meant to give financial planning advice, it gives information on a specific investment strategy and general information on picking stocks, handling money, and growing wealthy. It is not a solicitation to buy or sell stocks or any security. In addition the writer of this blog is not an accountant and writings should not be taken as tax advice which should be left to a CPA. Financial planning advice should be sought from a certified financial planner, which the author is not. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing