The Risks of Corporate Bonds

Post on: 13 Май, 2015 No Comment

You can opt-out at any time.

Please refer to our privacy policy for contact information.

While most investors are undoubtedly aware that corporate bonds typically offer attractive yields, there is also the matter of risk. But what are the risks of corporate bonds in reality?

Corporate bonds are affected by both credit risk. or the risk of default among the underlying issuers, as well as interest rate risk, or the impact of prevailing rates.

Default risk is relativley limited in corporate bonds, particularly among higher-rated issues. According to a study conducted by the fixed income investment manager Asset Dedication LLC, the risks of corporate bonds are worth the added yield for diversified, long-term investors. In the 40 years ended with 2009, a full 98.96% of all Aaa- and Aa-rated corporate bonds had delivered all of the expected interest and principal payments to investors. Aaa and Aa are the two highest credit ratings. Higher-quality bonds tend to perform better than lower-quality securities even during times of economic distress, since the underlying issuers have sufficient financial strength to keep making their payments even under adverse conditions.

However, the same cannot be said for lower-rated issuers. Below is a table showing the percentage of issues that defaulted (again, meaning a failure to make an interest or principal payment) by issuers within each credit tier over the first ten years after issuance, in the period from 1970-2009. Aaa, Aaa, and A are considered investment grade, while the remaining tiers are below investment grade, or high yield. Keep in mind, a defaulted bond does not necessarily go to zero – investors can typically expect some degree of recovery.

Looking back even further, this table shows the same measure, but for the period from 1920 through 2009:

The takeaway from this data is that an investor in individual bonds can significantly reduce the probability of default through a focus on individual security selection. In its study, Asset Dedication notes with regard to higher rated issues, “The only investments with lower expected default rates are Treasuries, CDs and (agency securities), which also offer investors lower yields.”

Keep in mind, also, that shifting economic conditions create an additional set of risks. Corporate bonds tend to lag when the economy slows, since investors grow more concerned about that the issuers’ underlying businesses will remain strong enough to allow them to make all of their interest and principal payments.

Finally, it’s important to keep in mind that investors in corporate bond funds have less default risk. In this case, the risk of actual default is even less of a consideration, since most portfolios tend to be diversified among hundreds of individual securities. As a result, a single default has only minimal impact.

Interest Rate Risk

Even without actual defaults, broader factors can come into play. The two main risks that can pressure the performance of corporate bonds irrespective of individual issuer strength are:

Bond funds are particularly sensitive to interest rate risk since, unlike individual bonds, they don’t have a maturity date. In this way, funds can lose value and investors don’t have the certainty of receiving all of their principal back at some point in the future.

How Much Can You Lose?

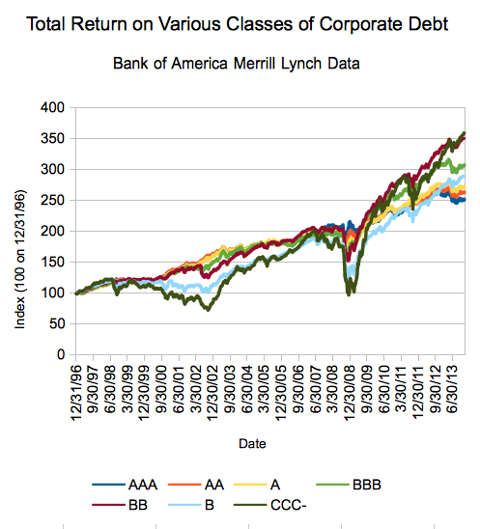

Since funds are portfolios of numerous individual securities whose prices fluctuate based on prevailing market conditions, their values can experience significant volatility. In 2008, the largest investment-grade corporate bond ETF – the iShares iBoxx $ InvesTop Investment Grade Corporate Bond ETF (ticker:LQD) – fell 15% in a matter of weeks during the height of the financial crisis. This the most extreme example from recent history, but it indicates that there can indeed be meaningful downside in corporate bonds.

The Bottom Line

The risk that any corporate bond with a high credit rating will default is negligible, though of course anyone putting cash into an individual corporate issue needs to do extensive research. While it is useful to know the default data discussed above, don’t forget that bond funds and ETFs nonetheless offer risks unrelated to issuer defaults.