The pros and cons of using lifestyle investment strategies for pension funds

Post on: 23 Август, 2015 No Comment

Related images

Lifestyle strategies are the investment style of choice for most employers with defined contribution (DC) pension schemes, but although they are a huge improvement on the passive equity funds and cash funds often used for default options in the past, they have drawbacks.

IF YOU READ NOTHING ELSE, READ THIS…

- Lifestyle strategies progressively switch pension scheme members into bonds as they approach retirement.

- Although lifestyle options have done well over the past decade, this has been a consequence of rising bond markets.

- Providers have been devising diversified funds that are actively and tactically managed so members can stay invested in growth assets into their retirement years.

Members in lifestyle strategies are generally invested in ‘growth assets’ such as equities in the early and middle part of their careers, and are progressively switched into less volatile fixed-interest investments, such as bonds and cash, as they approach retirement. The aim is to lock in any gains made, and consolidate the member’s pension pot at a time when any losses incurred would be hard to make up.

The timing of switching is often based on the retirement age members select when they join the plan in their 20s or 30s, when they may have unrealistic ideas about when they will be able to retire. People are now generally retiring later, often because they need the money, they are staying fitter, and because the abolition of the default retirement age allows them to work for longer.

If the lifestyling strategy starts switching someone out of equities at the age of 45, because decades ago they thought they would retire at 55, this will have a major impact on the investment fund because, at this juncture, the fund will be at its largest and every percentage point of return will make a significant difference.

Engaging members

Employers have tried to remedy this by asking members 10 years before the typical retirement age to reconfirm what their plans are. But plans change and engaging members is a battle, even when they are approaching retirement.

Also, switching into bonds in preparation for buying an annuity assumes that buying an annuity is the best thing to do, but that may not be the case, even for most members with average-sized pots. Annuity rates are poor and people are living longer, which makes a strong case for members to keep their pension pots invested in growth assets well into retirement and instead take income via drawdown.

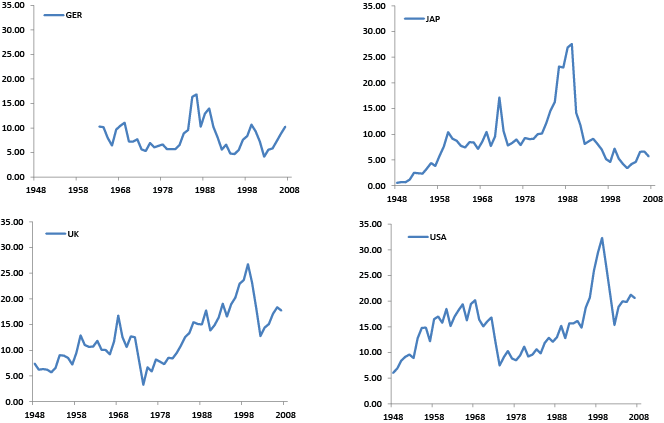

Another critical issue is that, after a 30-year bull market in bonds, bond prices have finally begun to fall. This trend is likely to continue because interest rates have been low and will inevitably edge up at some stage in the future, which will put more pressure on bond prices.

Lifestyle funds have done well in the past decade on the back of these conducive market conditions, but Will Allport, UK vice-president of DC at investment firm Pimco, warns: “If interest rates do normalise, it will lead to some catastrophic consequences. If someone is 75% exposed to bonds and then interest rates climb, that will have a materially negative impact on the account balance.”

Room to manoeuvre

There may be some room to manoeuvre because there are many types of bond, including high-yield bonds and index-linked gilts, for which institutional demand is likely to remain high. But there is a growing awareness that the economic climate and changing patterns around retirement expose the weaknesses of the lifestyling system.

Most alternative solutions use diversified funds invested across a range of asset classes, including non-mainstream assets, such as property and hedge funds, that should behave differently at various points in the economic cycle, with some rising when others fall. A common practice is to add a tactical overlay, making short- to medium-term bets to take advantage of the macro-economic picture.

Lorna Blyth, investment marketing manager at Scottish Life, says: “We maintain a diversified asset mix in the last five years and target a mix of 75% index-linked gilts and 25% cash at retirement. There is a tactical overlay, so although someone may be moving into cash and gilts, the multi-asset portfolio may be underweight gilts.”

Rather than switching the member’s pot on the glide-path to retirement, some products are structured as a series of funds, each focused on a target retirement year, so the whole fund will be managed holistically and, over time, will move towards an appropriate risk level for the investor’s retirement year. This differs from the lifestyle approach, which mechanically switches a pot by increments out of a growth fund and into a bond fund.

Ineffective management

Tim Banks, head of DC client relations at AllianceBernstein, which provides target date funds, says: “The difficulty with lifestyle funds is they have overly precise assumptions and are not managed proactively. And if they perform poorly, they are difficult to change in law.”

Recently, there has been much talk about providing funds with partial guarantees, an approach favoured by pensions minister Steve Webb. The idea is to allow a member to maintain exposure to the upside potential of a risky asset while providing a capital guarantee against downside risk via a swap or ‘swaption’, arranged with a large investment bank.

Some asset managers are developing variance optimisation tools to help reduce volatility. Esther Hawley, an actuary at Barnett Waddingham, says: “These allow you to keep more in a growth-style structure for longer. But in the DC environment, you need to keep fees down and advice simple; these challenges can shoot down even the best solution.”

Case study: Telent communicates a different fund approach to reduce volatility

Telent, the telecoms organisation formed in 2006 from the UK and German services businesses of Marconi, set up a group flexible retirement plan in April 2010 after closing its final salary scheme to existing members. The scheme is provided by Standard Life and currently has 764 members.

Peter Harris, director of pensions at Telent, says: “We originally chose our default fund on the basis that we did not expect our membership to be financially sophisticated, and therefore a lifestyle profile with a diversified growth fund in the early stages, switching to annuity matching in the later phases provided a good ‘vanilla option’. Three years on, we have decided to change the default to a risk-based fund, with the same lifestyle profile but with a fund approach aiming to reduce volatility by widening the opportunities to diversify.”

An investment committee was formed, comprising Harris, the HR director, the chief information officer for the legacy defined benefit (DB) plan and a member-nominated representative.

Harris says Telent has spent a lot of time talking to staff. “While for many of them a move from DB to defined contribution (DC) was unwelcome, the general perception is that the DC offering is a good-quality product,” he says. “However, one of the things that keeps me awake at night is whether staff have a sufficient understanding of their pension arrangements, so any value judgement by members must be considered with this in mind.”

Viewpoint: Mark Baker, legal director, Pinsent Masons

An employer holds a heavy responsibility when it chooses its default investment option.

For most employers, it is conventional to use lifestyle strategies or target date funds. For younger workers, the money is held in equities, then, over time, it is switched into bonds and cash. Often, the member can nominate a planned retirement date and the lifestyling switches are geared towards that date; a recognition that one size does not fit all.

The question remains whether to spend time and money on employee engagement. Traditionally, the answer would have been yes. But there is a growing sense that, for most employers, it is unrealistic to expect employees to engage fully with investment choices.

So the design of the default fund takes on a new importance. We are seeing a gradual shift towards structures that do more of the work behind the scenes, using the sophisticated variations on lifestyle funds that are now becoming available.

All the same, few employers can step away from engagement entirely. The bottom line is that there is one big decision that all employees need to engage with: how much to pay in.

There is a tangled relationship between this decision and the default fund design. Longer term, we will see greater focus on default funds that protect staff from risk using some of the more sophisticated structures.

But the immediate challenge is drawn out by the National Employment Savings Trust’s (Nest) decision to use a low-risk, low-return investment approach in the early years of membership. Danger lies in an investment strategy that is overly cautious, but Nest’s decision recognises that many of its members will simply stop paying contributions if they see their money falling in value.

Arguably, some employers’ own schemes are not that different. They need to weigh this up carefully. They must respect the fundamental link between communication of risk and members’ confidence.