The Pros and Cons of Target Retirement Funds

Post on: 23 Август, 2015 No Comment

You can opt-out at any time.

Growing investor demand for one-stop solutions has led to a proliferation of “target retirement funds” in recent years. These portfolios differ from traditional funds in that they focus on asset allocation, rather than individual security selection, and they change their allocations over time as the fund approaches a specific target date. Target-date funds can invest in individual securities, but they can also establish their allocations by using mutual funds or exchange-traded funds. (Until recently, the latter group was typically referred to using the term “funds of funds”).

Target retirement funds typically have names such as Life Strategy, Target Retirement, Asset Allocation, and Life Cycle, and most have a specific date that they target in order to help investors achieve specific goals. Target retirement funds are distinct from target maturity funds, which are described here .

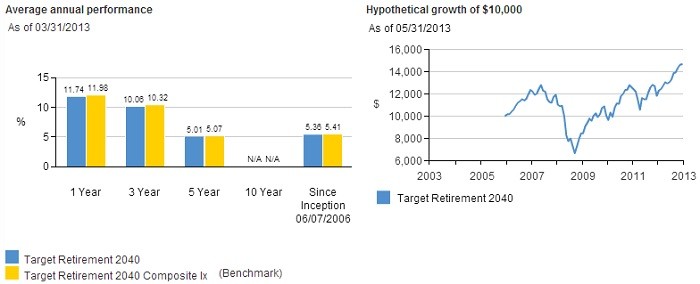

For instance, a Target 2040 fund is managed in such a way to fulfill the goals of investors who intend to use the money for a particular purpose on that date (usually retirement ). The funds usually employ a “glide path,” through which the managers gradually reduce risk in the portfolio over time. For instance, a fund with a 2040 target date may invest in a 90-10 mix of stock and bonds currently, move to a 50-50 mix by 2030, and be mostly invested in bonds closer to 2040. These funds have exploded in popularity in recent years, experiencing massive growth in terms of both the number of funds available and the total assets under management.

Target Date Funds: the Pros

The key benefit of such funds is that they provide an all-in-one solution for investors. By buying a single fund that invests across the full spectrum of the financial markets – and that changes its weightings as necessary – investors can avoid the need to 1) choose their own funds and 2) rebalance their portfolios as their time horizon changes.

In addition, these funds also provide one-stop diversification that helps obviate the need for novice investors to learn how to diversify appropriately. For this reason, target-retirement funds are a popular option in company retirement plans such as 401(k)s, where many investors know they need to save and invest – and know when they will need to begin withdrawing funds — but lack the inclination to take a fully self-directed approach. As of mid-2013, Forbes reports, more than 13% of all 401(k) assets was invested in such products.

Another potential benefit of such funds is that the automatic nature of the portfolio construction and rebalancing prevents investors from buying and selling at inopportune times, which – unfortunately – is what most individual investors typically do.

Target Date Funds: The Cons

The primary downside to funds that invest in other funds is that they have two layers of costs: the expense ratios on the underlying products, and the expense of the fund itself. This means that investors are essentially paying the fund company twice. As a result, it’s necessary to select such funds carefully to make sure they aren’t charging hefty expenses that will decrease investors’ return over time – a consideration that is especially important when it comes to funds that are designed to be held over long, 20- to 30-year time frames. Due to this added layer of fees, investors can save themselves money by choosing a self-directed approach. For some people, however, the extra fees may be a worthwhile expense if they lack the time, desire, or skill needed to learn the ins and outs of investing.

Another potential issue with these funds is that the underlying investments may be poor performers. While diversification and professional management are both positives, these benefits may be lost when the fund invests in a line-up of poor-performing funds from its own fund family. As a result, the ideal choice is low-cost options from established fund families with strong long-term track records.

Know What You Own

While there are countless target-date funds now available, all of the products are not created equal. Different fund companies employ different glide paths and invest in different types of products. One fund company, for example, may own riskier high yield bonds as part of its fixed-income allocation, while another may take a more conservative approach. Look at holdings and past returns to make sure that a fund billing itself as “conservative” or “aggressive” is in fact what it purports to be. Also, check its track record against other funds to make sure it doesn’t have a history of underperformance.

The Bottom Line

Target-date funds can serve an important purpose for novice investors. However, those with a basic level of knowledge will probably find that selecting a mix of funds on their own is the less expensive option – a critical consideration, since lower expenses are a key component of higher returns.