The Pitfalls and Accuracy of Capital Asset Pricing

Post on: 28 Июль, 2015 No Comment

The Capital Asset Pricing Model (CAPM) was the work of William Sharpe (1964) and John Lintner (1965) (Fama & French, 2004). It is used to find the cost of capital for firms and evaluate the performance of portfolios. It helps in measuring the risk, and finding the expected return on the portfolio. Two types of risk are involved in the investment portfolios: systematic risk and non-systematic risk. Non-systematic risk is specific to individual stocks, and it can be diversified by increasing the number of stocks in one’s portfolio. Systematic risk, however, cannot be diversified, because it includes the market risks, like change in interest rates, wars, etc. The CAPM is used to measure this systematic risk, and its effect on the expected rate of return.

In the capital asset pricing model, the risk associated with an asset is measured in relationship to the risk of the market as a whole. This is expressed as the stock’s a (beta), or correlation to the market average. The returns of an asset will, on average, move equally with the returns of the overall market. Assets with β < I will display average movements in return less extreme than the overall market, while those with a > I will show return fluctuations greater than the overall market (Cooper, Encyclopedia of Business, 2nd edition).

Ks = Krf + B (Km — Krf) (McCracken, 2009)

Ks = The Required Rate of Return, (or just the rate of return).

Krf = The Risk Free Rate (the rate of return on a risk free investment, like U.S. Government Treasury Bonds)

B = Beta

Km = The expected return on the overall stock market.

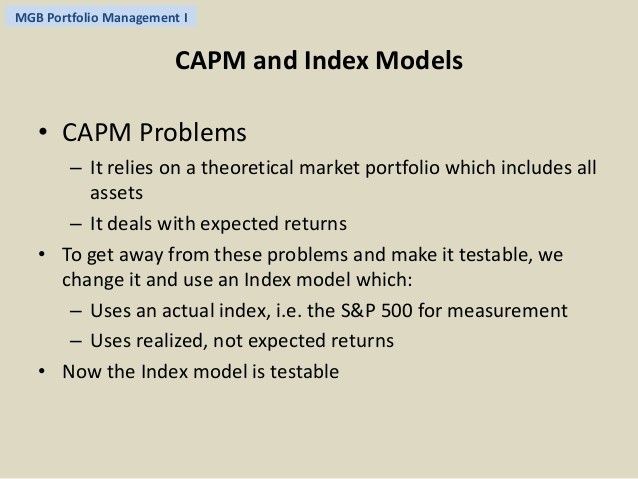

Pitfalls of CAPM

The CAPM has been criticized for its unrealistic assumptions. Firstly, it assumes that a perfect capital market exists, meaning that the capital market is in perfect equilibrium and the demand for securities from the risk-averse investors matches the available supply. This, however, is not the case in reality because in the real world the investment decisions are made by companies and individuals. By assuming that the markets are perfect, this model ignores the effects of taxes, inflation, transaction costs, and short selling on the capital markets.

This model also assumes that perfect information is freely available to all investors, as a result of which they all have same expectations (homogenous expectations) about asset returns- that they agree about mean and variance as the only system of market assessment. This may not be true, because in the real market not all the information is available to the investors; also, not all the investors have the same expectations about risk and return. Even though, according to the CAPM, the investors might prefer lower risk to higher risk at a specified return, and a higher return to lower return at a specific level of risk, there could be those who accept lower returns at a high level of risk (McCracken, 2009). The model does not take the third type into consideration.

The CAPM model assumes that there is a positive linear relationship between the return on portfolio and the beta of the portfolio; and the difference in assets’ expected returns is only because their betas are different. However, studies carried out by some professors (Eugene Fama and Kenneth French) suggest that between 1963 and 1990 there were times when the stock performance could not be explained by the differences in betas (McClure, 2006). Also, there were periods when there was no linear relationship between the beta and the individual stock returns. These findings suggest the poor construction of the CAPM model.

CAPM could only be applied to those portfolios that have been diversified because it assumes that the investors hold diversified portfolios. This means that the CAPM only provides the required return for the systematic risk of the investors’ portfolios. Hence CAPM cannot be applied to the portfolios that are not diversified.

Another serious problem is that this model assumes that lending and borrowing can take place at risk-free rates (for which the yield on short-term Government debt is taken as a proxy). In reality this is not possible, because the risk associated with individual investors is much higher than that associated with the Government, so the investors cannot borrow at the risk-free rate. This means that the slope of the security market line (SML) is shallower in practice than in theory. SML shows the relationship between the return and the risk. Another problem associated with using yield on short-term Government debt as the risk-free rate of return is that this yield keeps changing on a daily basis depending on the economic situation. Same is the case with the beta values that change with time and do not remain constant. This gives rise to uncertainty in the value of the expected return. Since the CAPM considers beta to be the most important factor for the change in the expected returns of the assets, frequent changes in the beta might lead to inaccurate results.

Problems could also arise when the CAPM is used to calculate a project-specific discount rate. This problem is specially seen in the proxy companies that undertake more than one business activity. It is difficult to find one suitable proxy beta for such a company. Proxy beta is used when the company is not listed in the market and thus has no beta of its own. It is taken from a comparable listed company and adjusted as necessary for relative financial gearing levels, hence proxy discount rates (London South East, lse.co.uk).

Problem with this proxy beta for a certain investment project is that it must be separated from the company’s equity beta. For this the market value of the proxy company should be viewed, and the betas of the several different areas of the proxy company should be averaged to obtain the equity beta. This, however, may lead to inaccurate results as the information about relative shares of the proxy company market value may be quite difficult to obtain. Also, the companies having complicated capital structures find it difficult to get information to get their betas. The CAPM assumes a standard holding period to compare the returns on different securities. Therefore, a security getting a return over six months cannot be compared with the security getting a return over 12 months. Keeping all this in mind, a problem in using the CAPM in investment appraisal is that the above mentioned case involves multi-period investment appraisal, whereas CAPM assumes a single-period time horizon.

How the CAPM was Considered to be Accurate

The CAPM was considered better and accurate than other methods of calculating required return due to the following reasons:

It is simple and sensible since it is based on the modern portfolio theory according to which the investors should diversify to eliminate non-systematic risk, they should hold only the risk-free asset and the market portfolio, and an asset’s systematic risk is measured by contribution to the risk of the market portfolio. Also, it provides a simple pricing model, and is relatively easy to implement.

It considers systematic risk only, and in reality most of the investors have diversified portfolios and have eliminated non-systematic risk from their portfolios. Also, it is considered to be better than other models, like the Dividend Growth Model (DGM) for the calculation of the cost of equity, and Weighted Average Cost of Capital (WACC) for calculating the discount rates.

Graphically, return-beta relationship through the security market line or the SML can be represented as shown in the graph below.

economics.fundamentalfinance.com/capm.php

In equilibrium, all assets will lie on the SML because they will have an appropriate return-beta relationship. However, if we depart from equilibrium some assets will not be correctly priced. If an asset is overpriced it will lie below the SML since it will provide an expected return less than what is determined by the SML given its risk (beta). If an asset is underpriced it will lie above the SML since its return will be greater than what the SML determines (Taylor, 2005). This will help the investors in making decisions of whether they should hold low-beta or high-beta stocks. For example, if the market falls, the investors will prefer holding low-beta stocks. They can also customize their portfolio to their specific risk-return requirements. So when the market is rising, they will hold securities having a beta greater than one; when the market falls, they will hold securities with a beta less than one.

The message conveyed by the CAPM, that by taking a higher risk the investors will earn a higher return, resulted in the rise in the use of indexing – assembling a portfolio of shares to mimic a particular market – by risk-averse investors (McClure, 2006).

The CAPM not as Accurate as Claimed

Fama and French, in the tests that they carried out, found that the CAPM does not give an accurate value of the required returns. Reasons were the assumptions of the model, most of which, as already discussed, were unrealistic and did not exist in the real-world conditions. They found that while the CAPM’s measure of systematic risk was unreliable, firm size and book-to-market ratios were more dependable (Taylor, 2005).

According to Roll (1977), the CAPM is inaccurate because it has never been tested, and the market portfolio on which this model is based is theoretically and empirically unclear (Fama & French, 2004). It is not theoretically clear which assets can rightfully be excluded from the market portfolio, and those assets that are included, data about them is not sufficient. So the CAPM is tested using the proxies for the market portfolio and not the true market portfolio, and the proxies are often inadequate, and this may give rise to a bias in estimating the firm’s cost of equity.

A major problem for the CAPM is that portfolios that are formed by sorting stocks on price ratios produce different average returns which are not positively related to the market betas (Fama & French, 2004). Also, according to Fama and French, the CAPM results in a very high cost of capital for high-beta stocks (when compared with the historical average returns), and it provides very low costs of capital for the low-beta stocks.

There are likely to be errors in determining a most-correlated asset. CAPM, because of the errors in the definition of the optimal portfolio and errors in beta, would likely give an incorrect price. Even if the most correlated asset is correctly identified, it is important to estimate the needed statistics- the means, co variances, and variances- called for in the corresponding pricing formula.

Conclusion

The CAPM is used to find the cost of capital of the portfolios, and to evaluate their performance. It is based on the modern market portfolio, which makes it simple and easy to be implemented; it is considered better than the Dividend Growth Model and the WACC; it clearly identifies the relationship between the returns and the beta, which is positively linear, which helps the investors make decisions about what kind of stocks should they invest in, high-beta or low-beta. Despite of its usefulness, this model is not considered as accurate by many of the researchers, because its assumptions are considered to be unrealistic. It assumes that a perfect capital market exists, and that it is in equilibrium; according to this model, lending and borrowing can take place at the risk-free rates, which is not realistic; perfect information is freely available to all the investors due to which they have homogenous expectations about the asset returns. Some studies that were carried out negate the positive linear relationship between the returns and risk. Problems also arise when the CAPM is used for investment appraisal. It was also found out that the CAPM gives unrealistic values of the required returns, which are higher than the historical average returns for the high- beta stocks, and lower for the low-beta stocks. Hence, looking at the above findings, we can conclude that even though the CAPM is widely used nowadays, it is not an accurate model.