The Permanent Portfolio Fund Investment U

Post on: 28 Июнь, 2015 No Comment

by Mark Skousen Monday, March 10, 2008 Wisdom of Wealth

By Dr. Mark Skousen. Advisory Panelist, Investment U

Monday, March 10, 2008: Issue #773

A permanent portfolio should let you watch the evening news or read investment publications in total serenity. No actual or threatened event should trouble you, because you’ll know that your portfolio is protected against it, whether it be inflation, deflation, recession, or war.

Harry Browne

If you had to choose between these two mutual funds, which one would you prefer?

Note the following:

Who are these financial creatures? The red fund is the Vanguard S&P 500 Index Fund (VFINX) and the black one is the Permanent Portfolio Fund (PRPFX).

Not surprisingly, the Vanguard Index Fund is much more popular than the Permanent Portfolio Fund. Even though both have been around for more than 25 years, Vanguard’s fund has $59.2 billion under management, while the Permanent Portfolio has only $1.7 billion in assets.

How the Permanent Portfolio Fund Works

The advisor who originally came up with the idea of the Permanent Portfolio Fund is the late Harry Browne, the libertarian financial writer.

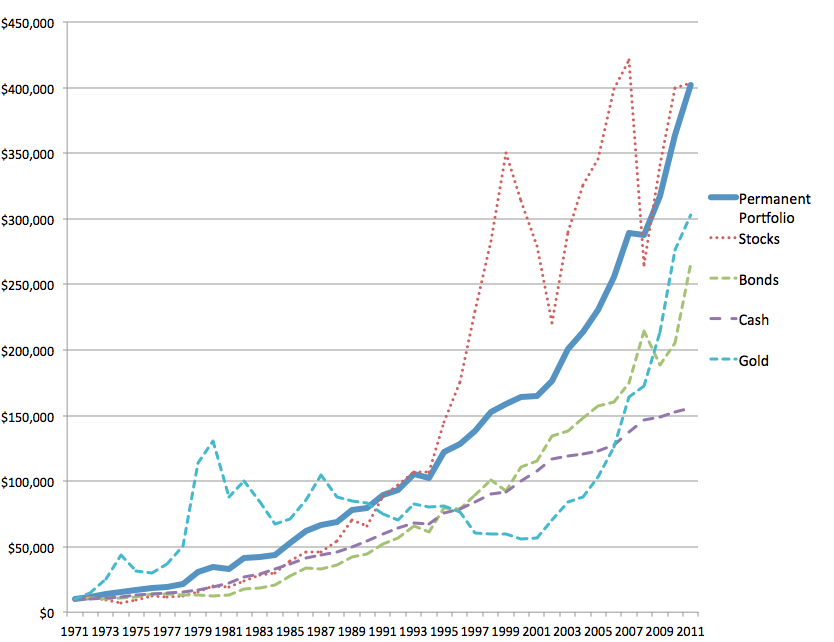

Harry Browne created the permanent portfolio concept in the late 1970s, arguing that a balanced portfolio of stocks, bonds, cash and gold would hold up well no matter what happened. Stocks, bonds, gold and cash combine to provide balance and safety, one that will do well in any economic environment, he wrote. In this latest Age of Turbulence, the title of Alan Greenspan’s memoirs, the Permanent Portfolio Fund is an ideal place for your hard-earned assets.

Harry Browne’s Permanent Portfolio Fund Investing Strategy

Harry Browne’s original strategy was to invest equally — 25% in each category — into four investments: growth stocks, bonds, precious metals and cash (T-bills or money market funds).

Today, the Permanent Portfolio Fund has a similar mix:

Clearly it is a strange mix, with much heavier emphasis on precious metals and natural resources compared to traditional managed accounts. This hard-money edge is great in times like the past seven years when the hard-money trinity of gold, silver and Swiss francs outperformed, but not so good when traditional investments like stocks and bonds shine.

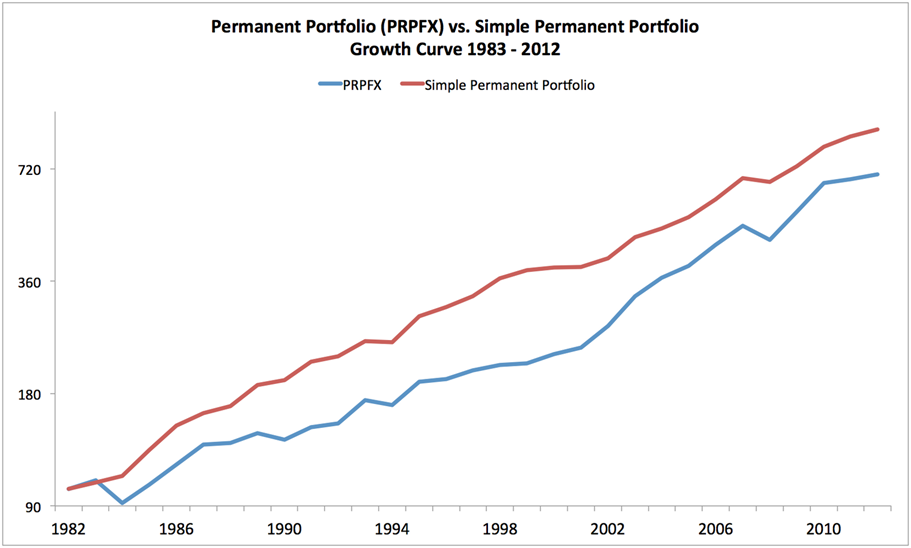

The Permanent Portfolio Fund began operating in 1982, not a particularly good time for hard assets, and the fund substantially under-performed the S&P 500 Index for many years. It lost money slightly in three years — 1984, 1990 and 1994. However, it has managed to keep ahead of the T-bill rate, and since 2002, when hard assets again showed strength, the Permanent Portfolio Fund has had a remarkable 13% annualized gain over the past five years.

The Permanent Portfolio Fund:A Low-Cost, No-Load Hedge Fund

Essentially, the Permanent Portfolio Fund is a low-cost, no-load hedge fund that requires little trading while offering non-correlated assets that avoids short-term volatility while enjoying long-term net gains. It also had the advantage of actually holding the metals themselves, not just mining stocks. During a stock market crash, mining stocks are likely to crash too, even though the metal itself rises (as was the case of the October 1987 crash).

If you want stability, reasonable growth and peace of mind, I recommend you add the Permanent Portfolio Fund to your brokerage account.

Good investing,

Mark

Today’s Investment U Crib Sheet

The idea behind the Permanent Portfolio Fund is a variation of efficient market indexing, only in Harry’s case, he originally recommended an equal 25% position in four areas (reset every year):

Harry Browne’s Permanent Portfolio may give too much weight to hard assets, and not enough in stocks and bonds. The theory of a permanent portfolio is sound, but you should adjust it to your own comfort level.