The New York School of Bonds & Fixed Income Instruments

Post on: 16 Март, 2015 No Comment

Course Instructor

Course Description

The course gives an essential overview of the fixed income capital markets. Very good course leader, excellent techniques

Analyst, Banco Bradesco BBI

The course is intended for professionals seeking to enhance their skills and market knowledge in today’s challenging fixed income environment.

Bond School is a 4-day intermediate training program on the key structures and applications of bonds and fixed income instruments

- Gain an overview of bond & fixed income markets and the current trends in global issuance

- Determine a methodology to structure, price and position bond and fixed income instruments to maximize investment, financing and risk management activities

- Develop an understanding of the syndicated loan process and how to create facilities to match client needs

- Examine how bond & fixed income instruments are rated and the implications of the rating

- Analyze yield curves and the implications for future interest rate movements

- Understand the differences between yield and return conventions in the fixed income market

- Calculate and use duration and convexity to measure risk and actively manage fixed income portfolios

- Customize complex interest rate swaps to meet client objectives

- Structure and price equity linked securities, structured debt products and other complex fixed income derivatives

- Construct interest rate caps and collars to manage financial risk

- Define and analyze financing and arbitrage vehicles

- Determine the impact of a securitization transaction on a company’s performance measurements tools

Teaching Methods

The program will combine lectures with hands-on practical exercises as well as computer simulation exercises to apply the topics presented and interpret the results. The program focuses on practical implementation issues necessary to establish a sound understanding of how to bond and fixed income instruments.

Assumed Knowledge

This intermediate level course assumes participants possess a basic knowledge of finance and derivative products. Knowledge of basic financial mathematics and excel skills are also suggested.

Who Should Attend?

- Fixed Income Sales & Trading

- Fixed Income Research & Analysis

- Fixed Income Origination

- Corporate Finance/Corporate Treasury

- Capital Markets

- Audit/Product Control/Risk Management/ALM

- Investment Management

- Securitization/Syndication/ Structured Finance

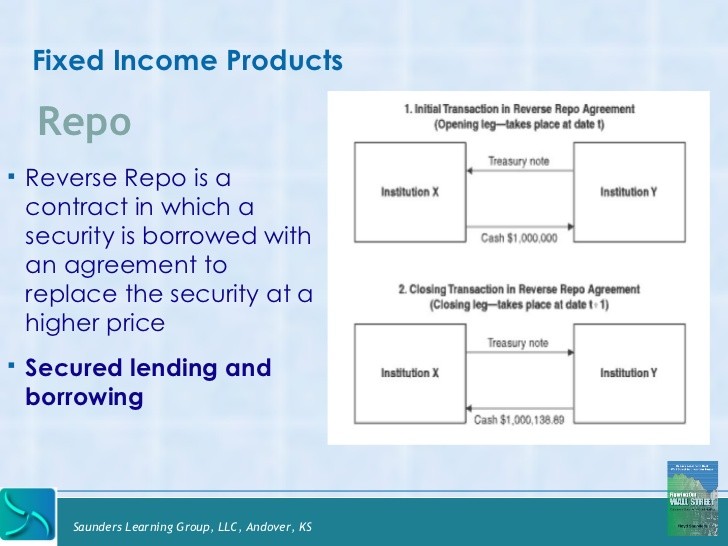

- Money Markets/Repo

- Systems Programming

- Funding

- Government/Agency Funding & Investment

- Regulation/Compliance/ Documentation