The MustHave Mobile App Metrics Your Business Cannot Do Without

Post on: 16 Март, 2015 No Comment

This article is a summary of the AppInTop mobile app marketing podcast in which AppInTop talked with CTO and co-founder of the mobile analytics company Adjust.com. Paul Müller, and senior account strategist at Google, Stanislav Vidyaev. This summary covers some key facts about mobile analytics.

The way people interact with an app is different from the way they use websites. Mobile app analytics is about converting ad budgets to installs, and installs to repeated app usage and in-app purchases. Ultimately, the objective of a mobile app developer is to evaluate user lifetime value, retention, and the frequency of usage.

First, A Recap on the Importance of Mobile

Getting Your Foothold in an App Store

Running a mobile app as a business is essentially about balancing the cost of user acquisition with the user lifetime value, which is how much money the user will spend on the app throughout the time he or she uses it.

As user acquisition costs grow rapidly, optimizing that cost is as important as improving the user lifetime value. Getting the app up into the top ranks of the app stores becomes the name of the game for most of the major app publishers, because that is where the free, organic users find the app.

What gets an app into the top ranks varies slightly between the App Store and Google Play, but the most important factors are:

- The number of installs in the first 72 hours of the app’s launch (and thereafter)

- The number and quality of reviews and ratings

- User retention (Google Play)

The beginning of an app’s life in the app stores will determine where it will rank in the long run. So, use services such as App Annie to track your key app store statistics.

Tracking Installs

Daily installs and their sources are the basic metrics a developer needs to track. No installs means no users, and no users means no revenue.

Understanding the sources of these installs is equally important. This is how marketers evaluate the effectiveness of their advertising channels.

Working with an independent tracker is essential in order to eliminate a conflict of interest that comes, for example, with using a tracking solution from an ad network. A tracker offered by an ad network, whose sole interest is to sell you as many installs as possible, may leave you wondering if your reported installs reflect the actual picture.

Which tracker to use?

Tracking services from companies independent from ad networks would not have a conflict of interest. Look at AppsFlyer. MAT by HasOffers. Adjust.com. or Google Mobile App Analytics .

Retention and Usage

The retention metric is based on the frequency of app sessions. Many mobile analytics platforms routinely record the number of sessions, without giving too much thought to what a session actually is. They define a “session” the same way iOS rules do, which is the act of a user opening the app.

This is not a good definition, as a user may be distracted from the app by push notifications, messages, and phone calls. Google Analytics counts only sessions that have 30 minutes between them, which is a more acceptable definition.

The “retention” metric is calculated by dividing the number of users who return to the app daily by the total number of users from the group monitored.

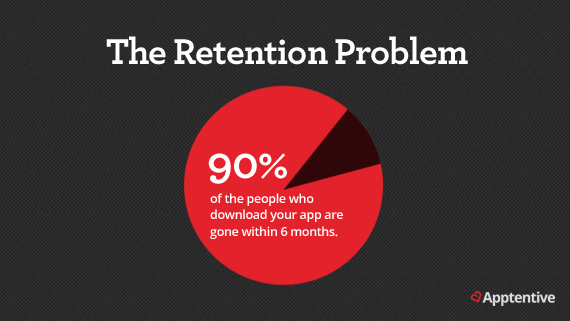

The “churn rate” is the opposite of retention. It is the percentage of users who do not return to the app.

The retention metric is important to evaluate the user lifetime, which in turn, is used to calculate the lifetime value of the user.

The “user lifetime” (LT) is the average number of days a user from the original group spent in total interacting with the app. This metric helps evaluate how many users the app should acquire daily in order to maintain or grow revenue.

The other usage metrics serve to help app developers identify the popularity of different sections within the app and improve the user experience. This set of metrics is essential to understand what is actually happening in the app.

Break-even Metrics

The app, the main purpose of which is to generate revenue, will need to be measured based on the user lifetime value.

The “user lifetime value” (LTV) is calculated based on the revenue the user generates over their lifetime. This is purely a marketing metric to calculate return on investment in marketing and advertising.

The “average revenue per user” (ARPU) is calculated by dividing the total revenue per user by the user lifetime.

The “virality” metric or K-factor is essential because it helps lower the cost of user acquisition. If your user tells another user about your app, then your cost is no longer $2 per user, but $1 per user or even less. It is a complex metric that can be calculated in a number of ways and takes into account the number of users who came from viral channels as well as the number of daily active users (DAU), user lifetime (LT), and new users.

If an app asks users to share links on social media, those links and the new users who come from those links can be tracked to calculate the virality metric.

“Cost of user acquisition” is required to build a business case for an app. This is the cost of all marketing efforts divided by the total number of installations over a fixed period of time. If the cost of user acquisition is less than the LTV, the app will be profitable.

Cohort Analysis

The purpose of cohort analysis is to tell you which channel works best: Facebook, InMobi native ads. Aarki interactive ads. Unity video ads. or any other ad sources you are using. For example, in launching Wooga’s game Jelly Splash, the company used 23 ad networks to get it in the top charts of the key markets, according to Wooga’s head of marketing, Eric Seufert.

Cohort analysis is all about grouping users into segments and analyzing the metrics of those groups. Cohorts are based on traffic source, country, and device.

Identifying more profitable cohorts helps better target users with ads to increase user lifetime value and app revenue. The key metric is the total revenue generated by the cohort divided by the number of users in that cohort.

Measuring the Effectiveness of TV Ads

Measuring the impact of TV ads on mobile app installs has not yet been openly offered by mobile analytics companies, although Adjust.com is running a closed beta TV ad tracking service. The results of the early tests have shown that there is indeed a correlation between a number of organic installs and the TV ad.

This metric is calculated by comparing the number of organic installs received 5 minutes before the TV ad is shown with the number of installs during and a short time after the TV ad is shown. The number of installs that came from the TV ad is the difference between those two measurements.

Custom Metrics

App developers may have very specific requirements about which metrics to track for increasing retention rate, optimizing user experience, or improving monetization.

Analytics services may not be able to offer ready-to-use metrics in their dashboard, but there is always an option to set up custom variables for creating custom reports. Using those custom reports (for example, Google Mobile App Analytics ) enables app developers to tag the paying user in an app, segment the paying users, and then analyze them separately.

The challenge of collecting and analyzing the app metrics is the technical implementation that requires a developer to work alongside the marketer. One solution is to implement the SDK of an existing analytics company that has an extensive list of predefined metrics. A detailed analysis of various analytics services will be the topic of a future article.

The Future of Mobile App Analytics

For businesses where both mobile and web presence are equally important (for example, ecommerce), division between mobile and web may not be as strong as in, say, mobile-first businesses that track a completely different set of metrics. Google’s introduction of Universal Analytics aims to help such businesses analyze their users, regardless of whether they interact with the company’s brand online or on a mobile device.

There is a trend to move from a fragmented analytics service landscape to a single source of app data. The industry is likely to adopt a platform model, where a single source for data will be used by various specialized providers, but that single platform will provide a bigger picture to app developers about what is happening with the app and in the app.