The link between Money Supply and Inflation

Post on: 3 Май, 2015 No Comment

Readers Question: When would an increase in the money supply not result in an increase in inflation?

The basic answer is that it depends on factors such as the velocity of circulation (number of times money changes hands), the state of the economy and the growth in productive capacity (the Long Run Aggregate Supply LRAS).

1. Growth of Real Output. Suppose the money supply increased by 4%. In a simplified model, this would lead to an increase in Aggregate Demand (AD) of 4%. If AS (productive capacity) stayed static there would be no increase in Real Output, only inflation.

However, if the increase in AD of 4% was matched by an increase in AS of 4%, there would be no inflation, but, just an increase in real output.

In other words the money supply can grow at the same rate as real output to maintain same price level.

However, if ceteris paribus, money supply grows faster than the rate of real output, it will cause inflation.

But, in the real world there are other reasons why an increase in the money supply does not lead to an increase in inflation.

2. Hard to Measure Money Supply. Sometimes the money supply is hard to calculate and is constantly changing. Large increases in the money supply are often just due to changes in the way people hold money, such as increase in credit card use may cause an increase in Broad money M4.

3. Velocity of Circulation

MV=PY

The quantity theory of money equation assumes that an increase in M causes an increase in P. However, this assumes that V is constant and Y is constant.

V (velocity of circulation)

However, in practices it is not as simple as this equation assumes. In practice there are variations in velocity of circulation e.t.c.

4. Keynesian view Liquidity Trap

In a recession, there may be much spare capacity in the economy. Therefore, an increase in the money supply, merely helps to get unemployed resources used in the general economy. Therefore, in the case of a recession, increased money supply is unlikely to cause inflation.

In a liquidity trap, interest rates fall to zero but this doesnt prevent people saving. In this situation there is a fall in the velocity of circulation and this can cause deflation. In this situation, increasing the money supply will not necessarily cause inflation.

Summary of Link Between Money Supply and Inflation

- In normal economic circumstances, if the money supply grows faster than real output it will cause inflation.

- In a depressed economy (liquidity trap) this correlation breaks down because of a fall in the velocity of circulation. This is why in a depressed economy Central Banks can increase the money supply without causing inflation. This occured in US between 2008-11. Large increase in money supply no inflation.

- However, when the economy recovers and velocity of circulation rises, increased money supply is likely to cause inflation.

- Why Increasing Money supply in US didnt cause inflation

- Why Increasing the money supply can cause inflation (theoretical)

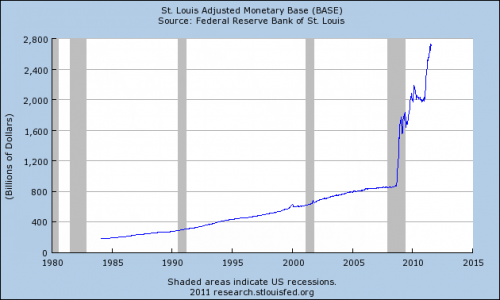

Quantitative Easing and Inflation

Quantitative easing led to a big increase in the monetary base

The Federal Reserve created money to buy bonds from commercial banks. Banks saw a rise in their reserves.

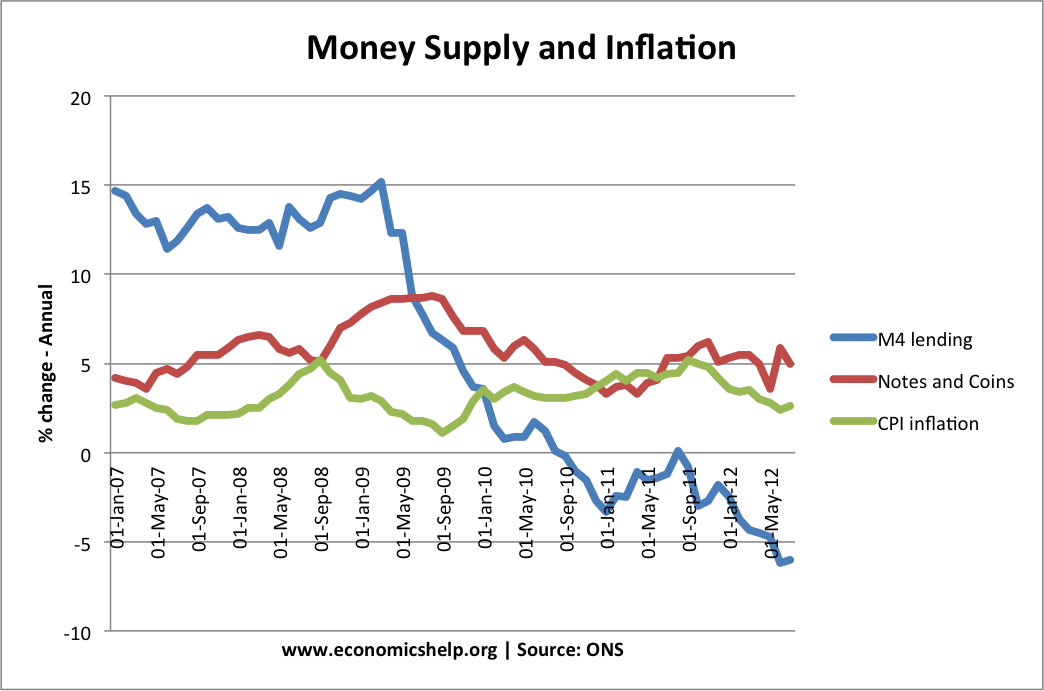

However, commercial banks didnt really lend this money out. Therefore the growth of the broader money supply didnt change much

What happened is that commercial banks merely oversaw a rise in their reserves

The US inflation rate was largely unaffected by this increase in the monetary base. Stripping out volatile cost push factors (food and fuel), core inflation remained below 2% inflation target

Further Reading