The Legal Form of a Hedge Fund South African Hedge Fund Guide

Post on: 16 Март, 2015 No Comment

When launching a new fund the choice of legal structure which will house the fund is an important consideration to the manager. In South Africa there are a few different structures available to the fund manager and they include:

- Limited Liability Partnerships,

- A Debenture structure,

- Trusts,

- Segregated portfolios,

- Promissory notes.

Out of these the Limited Liability Partnership and the Debenture structure are the most popular representing 42.7% and 31.8% of local funds respectively according to the South African Hedge Fund 2011 Survey (2011:23). These structures enjoy this popularity largely due to the way in which they limit the investors’ liability exposure.

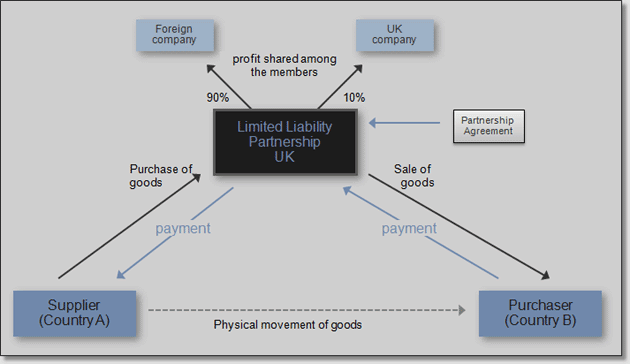

Limited Liability Partnership

A Limited Liability Partnership, also called an En Commandite partnership, is a legal structure which has between 2 and 20 participants (Gibson, Visser, Pretorius, Sharrock & Van Jaarsveld 2003:239). When forming an En Commandite partnership it is expressly agreed upon in the partnership agreement that that the business will be carried in the name of only one partner. This general partner does not necessarily have to make a monetary contribution to the partnership but he then has to contribute knowledge or skills, which in a hedge fund would mean his management expertise. The remaining partners then contribute an agreed upon sum of money to the partnership in exchange for the right to share in the profits and losses. The losses that a sleeping partner can incur are limited to the specific principle contribution of each partner and they will not be held liable for any excess third party debt that the partnership may have incurred (Gibson et al 2003:252).

This makes it an ideal form of legal entity for small hedge funds to operate within since investors receive peace of mind that their potential losses are limited only to the amount they contributed and the rest of their net worth is safe from creditors (Limited Partnership [Sa]). It is important to note that the sleeping partners’ identity has to remain undisclosed to the public for the partner to maintain his limited liability protection (Gibson et al 2003:252).

A partnership does not exist as a continuous legal entity in the way that a company does. Each time a partner exits the partnership or a new one enters, the partnership agreement has to be redrafted for all partners. This new agreement will include all the new contribution and profit sharing ratio of the partners as well as any new terms agreed upon. As one can imagine this is an extra incentive for the fund manager to retain investors for extended periods of time and it would thus not be suitable to hedge funds that intend to have a high turnover rate of investors. The limit on the maximum amount of investors in the partnership makes this form of structure a good choice for a fund that aims to target a small number of high net-worth investors.

In establishing a Limited Liability Partnership a fund manager will generally compose a document called a partnership prospectus. This document contains all the details pertaining to the management of the hedge fund, from the investment mandate through to a sample partnership agreement. The prospectus is intended to be used as a marketing tool to investors and acts as one of the first forms of communication from the fund manager.

A debenture structure

Hedge funds that employ a variable debenture structure usually do so by creating a private company that sells debentures to investors. The private company would then transfer the proceeds from the sale of the debenture to an underlying trust that houses the hedge fund and where the portfolio is managed. Under this structure the investors are not equity holders in the company, as is the case with an en commandite partnership, but rather debt holders. Due to their status as debt holders, they would also enjoy limited liability and could seek reimbursement for their original capital contribution should the hedge fund be liquidated (Loubser & Smit 2009).

Profits are distributed to the debt holders in the form of interest payments that are variable depending on the success of the fund during the period. These structures are very popular with fund-of-funds because they don’t place a limit on the maximum number of investors in the same way an en commandite partnership does. With this in mind a hedge fund could pursue a business model that aims to generate a large pool of investors with relatively small investments in the fund (Loubser & Smit 2009).

They also have the added advantage that they do not require to be reconstituted each time an investor decides to enter or exit out of a position. This added liquidity provides additional peace of mind to the investor and it is one of the reasons for this structure’s enormous growth in popularity (Loubser & Smit 2009).

As stated before some hedge funds employ alternative legal structures such as; trusts, segregated portfolios or promissory notes. These structures, however, are not commonly used and are generally employed by fund managers trying to create a niche structure for their clients. The limited liability partnership and the debenture structure are generally the most efficient and convenient structures to use when creating a hedge fund.

Source list:

Gibson, JTR, Visser, CJ, Pretorius, JT, Sharrock, R & Van Jaarsveld, M. 2003. South African Mercantile and Company Law. Pretoria: Juta.

legal-dictionary.thefreedictionary.com/Societe+en+Commandite Accessed 24 April 2012.

Loubser, J & Smit, N. 2009. On the right path. Hedge Fund Manager Week 8-9.