The Impact of Inflation on Bonds

Post on: 1 Июнь, 2015 No Comment

Colin Anderson / Getty Images

Inflation and the Bond Market

Inflation, or rising price levels for goods and services, can have two negative impacts for bond investors. One is obvious, while the other is more subtle – and therefore much more insidious.

The Impact of Inflation on Federal Reserve Policy

The first effect is that rising inflation can cause the U.S. Federal Reserve – or any country’s central bank for that matter – to raise short-term interest rates in order to reduce the demand for credit and help prevent the economy from overheating. When the Fed raises short-term rates – or when it is expected to in the future – intermediate and longer-term rates also tend to go up. Since bond prices and yields move in opposite directions. rising yields mean falling prices – and a lower principal value for your fixed-income investment .

The Difference Between Nominal Returns and Real Returns

The second impact of inflation is less obvious, but it can take a major bite out of your portfolio returns over time. This important effect is the difference between the “nominal” return – or the return a bond or bond fund provides on paper – and the “real ,” or inflation-adjusted, return.

To understand this concept, consider a shopping cart of food that a person buys at the supermarket. If the items in the cart cost $100 this year, inflation of 3% means that the same group of items cost $103 a year later. That same person has a short-term bond fund with a yield of 1%. Over the course of the year, the value of a $100 investment rises to only $101 before taxes. On paper, the investor made 1%. But in real world money, he or she actually lost $2 worth of purchasing power. The “real” return was therefore -2%.

The average rate of inflation in the United States since 1913 has been 3.2%. While this is skewed somewhat by the high-inflation periods of World War I, World War II, and the 1970s, it still means that investors needed to earn an average annual return of 3.2% just to stay even with inflation.

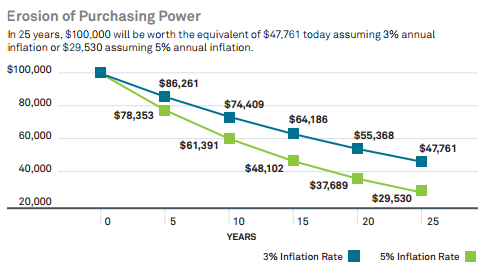

Keep in mind that inflation compounds annually just like investment returns. except with inflation the result is negative. From 1982 through the present, inflation has risen nearly 100% on a cumulative basis due to this compounding effect. Consequently, an investor would have needed to see the value of their investments double during that time just to keep up with inflation.

Naturally, in some cases investors are willing to trade a negative real return in exchange for safety. For instance, in August 2013 the average return for a one-year certificate of deposit (CD) was 0.70%. This represents a return below inflation, but in some cases the preservation of principal is an investor’s most important concern.

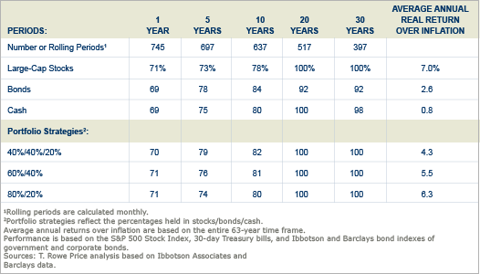

If safety isn’t your top priority, be mindful of the impact of inflation. If your goal is to build a nest egg for the future, a bond or bond fund that pays 2% isn’t going to cut it. Instead, consider a diversified approach incorporating medium- to higher-risk investments such as investment-grade corporate bonds. high-yield bonds. and equities. In addition, many mutual fund companies currently offer “real return” funds specifically designed to stay ahead of inflation over time.

The Bottom Line

Inflation will always be a silent thief eating away at the value of your investments, but with some awareness and good planning, you will be able to maintain the purchasing power of your savings.