The Global Instability Premium

Post on: 3 Июль, 2015 No Comment

By Eric Petroff, CFA, FRM, CAIA

The global instability premium is not a term you’re likely to find in any textbook, but it should be — because political and social instability can slow GDP growth rates, and wars can destroy economies, even for the victors.

So, why are we bringing this concept up now? Because when we looked at forecasted returns for the next decade and current implied returns for equities, we saw what appears to be a significant return premium between U.S. and global opportunities. Not only do these return premiums seem attractive on the surface, but they also grew noticeably throughout 2014, along with the rise of burgeoning military issues — all of which potentially implies that growth in return premiums is the result of global instability, since investors seem to be discounting these factors into capital market valuations.

This is why we need to see whether a global instability premium really exists and whether the apparent return premiums for global equities represent a compelling strategic or long-term investment opportunity.

Forecasted and Implied Returns for U.S. and Global Equities

To succinctly illustrate what drew our attention to this issue, below we show our proprietary 10-year return forecasts for the S&P 500 relative to numerous international equities. These forecasts, by valuation environment, are simply the returns that would result from equity valuations reaching various percentiles during the next decade. As you can see, international equities should handily outperform domestic equities over the next decade.

Equity Forecasts by Strength of Absolute Valuation Environment

Forecasted returns are only one way to look at this issue. This approach involves various valuation assumptions, which is why we also need to look at implied returns for equities, or their earnings and dividend yield, on the basis of current valuations to get a more objective analysis. In the charts below, you can see not only that implied returns for global equities are much higher than the S&P 500 but also that their return premiums have jumped significantly during 2014, quite possibly because of growing military tensions and the political chaos that goes along with them.

Implied Equity Returns (Earnings and Dividend Yield)

Implied Equity Return Premia for Global Equities to S&P 500

Even though there is a clear jump in return premiums for global equities, we must ask: Was this really the result of the global instability premium?

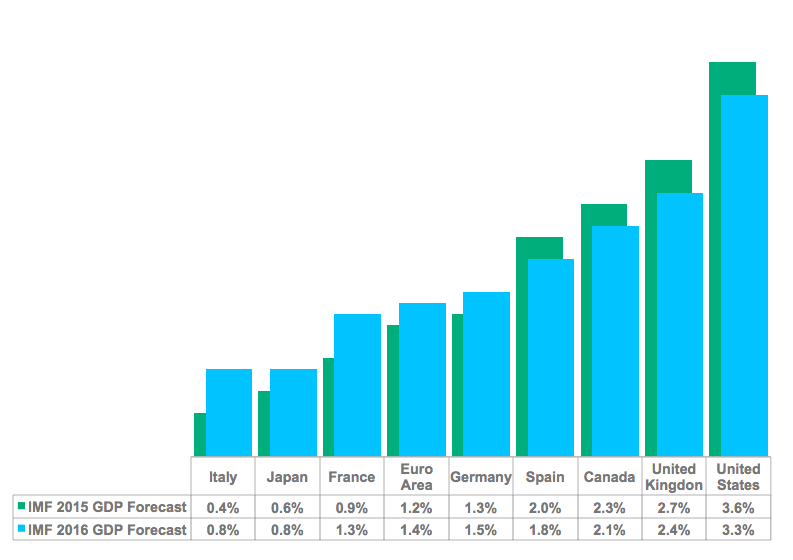

At first glance, that might very well be the case, because implied returns for the S&P 500 dropped 1% last year while global equity implied returns remained unchanged. Therefore, it is arguable that most of the new money flowing into equities last year went mostly into domestic markets instead of their global counterparts. This outcome could be the result of a flight to safety of sorts for equity investors — or the result of global GDP expectations for developed nations strongly favoring the U.S. economy (see chart below).

IMF GDP Forecasts (as of January 2015)

With this in mind, we believe the next logical step in determining whether these return premiums are the result of GDP expectations is to take a look at historical return premiums and relative valuations between U.S. and global markets.

Is There a Premium from a Historical Perspective?

Before getting into historical valuations, we must keep in mind that the value of the U.S. dollar is of material consideration because it can dramatically affect international returns for domestic investors. This is especially true when the U.S. dollar is near historic highs, as it is now, because a falling U.S. dollar means stronger international equity returns for U.S. investors.

As posited earlier, we see evidence that money is pouring into U.S. equities from abroad given the value of the U.S. dollar, which shot up in 2014 and is now about 10% away from its historic highs. This thought, of course, is based on the notion that not all the money coming into U.S. capital markets from abroad is going into bonds. So, from this perspective, international equities look even better if you believe the U.S. dollar’s value will fall from its highs over time as the world works through its problems.

S&P 500 Price vs. U.S. Dollar Major Currencies Index

The next and most important step in determining whether a global instability premium exists is to historically examine return premiums to the S&P 500 on both an absolute and a relative basis. In the chart below, we examine absolute implied return premiums for international equities and find that current levels are actually lower than the last five years’ average.

Implied Return Premia of Global Equities to S&P 500 (Shiller)

This is clearly not in line with our original hypothesis that global equity return premiums were materially affected by worsening global conditions last year. So, let’s take a look at valuations on a relative basis over time and see whether international equities hold any advantage from this perspective.

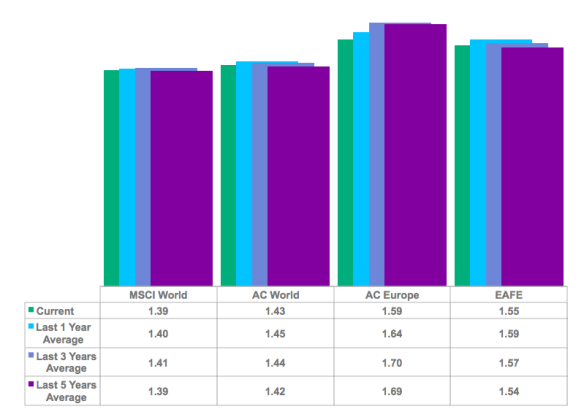

In the chart below, we show average relative valuations over recent periods by looking at the ratio between implied returns for global equities and the S&P 500. Again, we find no evidence of any significant return premiums for global equities over domestic markets. It seems that relative valuations for global equities are in line with their historical averages.

Ratio of Implied Return of Global Equities/S&P 500 (Shiller)

Do International Equities Represent a Strategic Opportunity?

In short, the answer is no, at least for now. On the one hand, we have an apparent absolute return advantage for global equities; on the other hand, history tells us these valuation differences are nothing special.

Picking up an extra 2-3% return on marginal global equity investments over time is not necessarily an unattractive prospect, especially if the U.S. dollar loses strength when global GDP growth prospects return to more normative levels. So, there is definitely a long-term argument for the attractiveness of global equities if you are trying to pick up a marginal return on equities.

Strategically, there is no compelling reason to pour assets into global equities for a short- to intermediate-term return horizon. However, that does not mean an opportunity will not present itself in the near term. The world is becoming a much messier and more dangerous place and seems unlikely to change course anytime soon. Even though our original hypothesis that the events of 2014 resulted in a global instability premium for global equity markets turned out to be a false alarm, that does not mean such a premium cannot or will not exist.

The ongoing shifts in U.S. and global equity valuations are worth watching until the world calms down (global military tensions could easily get much worse than they currently are). If and when that occurs, global equities could become compellingly cheaper in short order, presenting a potential strategic opportunity, at least if you believe in the basic premise of this article.

Although there may be no actionable global instability premium today, it would behoove investors to keep an eye out for it in the near future. You never know what opportunities capital markets may present, but you’re more likely to find them if you’re looking in the right direction.

Disclaimer: Please note that the content of this site should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.