The G7 Communique and the Dollar

Post on: 16 Август, 2015 No Comment

Figure 1: Log nominal value of US dollar against other major currencies. NBER defined recession dates shaded gray. Source: Federal Reserve Board via FRED II.

Lagarde Says G-7s Dollar Shift on Par With 1985 Pact (Update2)

By Christopher Swann and Kathleen Hays

April 14 (Bloomberg) French Finance Minister Christine Lagarde said investors havent grasped the magnitude of the Group of Sevens shift in stance on exchange rates, likening its significance to the 1985 Plaza Accord.

Its a strong statement which I am not sure the markets have yet fully understood and appreciated, Lagarde said in an interview on Bloomberg Television in New York.

Lagardes remarks indicate she may be frustrated that the dollar failed to rally today after the G-7 warned that recent sharp fluctuations in exchange rates risk hurting the global economy. The group of seven major industrial nations issued their statement after the dollar slid 8 percent against the euro and 6 percent versus the yen since they last met in February.

The April 11 statement was not very different from the importance of the 1985 Plaza Accord, she said. The Group of Five at the time agreed to coordinated intervention to drive down the dollar. The G-5 then included the U.S. U.K. France, Germany and Japan. It later expanded to add Canada and Italy.

The article continues, documenting widespread skepticism among financial market participants. This view is summarized by this quote from todays IDEAGlobal newsletter (April 15):

The FX markets digested the latest G7 statement with relative ease on Monday, with EUR/USD eventually retracing all its losses posted soon after the statement was first issued. The wording changed significantly, but there no little [sic] meaning behind the change of syntax. The more things change, the more they stay the same. The environment still remains one of very negative sentiment towards the greendbackMondays US economic outlook release calender did nothing to change this outlook.This supports the notion US continues to be in a recession, leaving the US vulnerable to further losses.

I think this quote does provide several reasons for skepticism, but also highlights why these pronouncements could matter.

First, reasons for skepticism. Policymakers, especially finance ministers, have limited means to affect exchange rates directly. In the case of the United States, the Treasury can intervene in foreign exchange markets, purchasing foreign currency with dollars, and sterilizing the increase in the dollar money supply by selling Treasuries.

Admittedly, the evidence that sterilized intervention works is actually more mixed than is commonly allowed. For certain, there do not seem to be persistent effects on the level of exchange rates from sterilized intervention for major currencies. This is true even when the intervention is in the amount of hundreds of billions of dollar, as in the Japanese experience during 2003-04 ($315 billion to be exact). But they do seem to exist. [0]. [1]. [2] .

When effects of intervention have been identified, they typically (although not always) seem to be of a short term nature, affecting the direction of the exchange rates movement over a few days.

On the other hand, Chinas ability to manage the exchange rate by accumulating hundreds of billions of dollars of reserves has led to some revision. But of course, this is a case where the intervention is not fully sterilized, and is supported by a panoply of capital controls. Whether such an effect would apply for developed country currencies depends upon (in part) whether a portfolio balance channel exists (i.e. whether bonds denominated in different currencies are perfectly substitutable), even if the intervention is coordinated.[3]. [4] .

Hence, I think this paragraph from Owen Humpages Government Intervention in the Foreign Exchange Market (2003) summarizes the professions thinking on the subject, insofar as intervention on developed country currencies is concerned:

Sterilized intervention affords monetary policy makers a means of occasionally

pushing an exchange rate in a desired direction. The alternative level then serves as a

new starting point for a random walk process compatible with existing fundamentals.

The empirical support for this conclusions seems consistent with the idea that monetary

authorities periodically possess better information than other market participants and, in

these instances, can sometimes can affect market expectations through intervention. This

description does not preclude intervention as a signal of future monetary policy, but

interpreting intervention as solely or even primarily such a signal is probably wrong. The likelihood that a given intervention will have the desired effect increases if the

transaction is large and coordinated with the foreign monetary authority whose currency

is involved.

Nevertheless, because sterilized intervention does not affect market fundaments, it

does not afford monetary authorities a means of routinely guiding their exchange rates

along a path that they determine independent of their monetary policies. While monetary

authorities in large developed countries certainly can affect nominal exchange rates

through non-sterilized foreign exchange intervention, doing so either will conflict with

their domestic policy objectives or it will be entirely redundant to open market operation

in domestic securities. The outcome depends on the nature of the underlying economic

shock to their exchange market.

This highlights the one point where I think G7 pronouncements can matter. If policy makers view the exchange rate as a variable of primary interest, then they will try to alter the fundamentals (tax revenues and government spending, when the finance ministers make the pronouncements). Even if these fundamentals dont change at the time of announcements, if the commitment to change the expected path in the fundamentals is credible, then the exchange rate should change at the time of the announcement.

However, no such commitment seemed to have been made, at least on the fiscal side. What about the monetary side? To the extent that the central bank governors (including Bernanke) were also there, then there could be some informational content in the communique.

Yet, this would require more weight on the exchange rate (separate from its influence on output) than has previously been evident in the Fed and ECB reaction functions (estimated weights are fairly small, e.g. [5]. and it is hard to determine whether that is the direct effect, or the exchange rate gap is standing in for an effect working through aggregate demand; see the framework in Chinn and Meredith (2004) ). Thats possible. Likely? Well, these are extraordinary times.

Bottom Line: If the Fed perceives that the dollar has dropped far enough to keep the U.S. economy out of a deep recession, and the ECB perceives the euro has risen enough to adversely impact euro area economic activity at a time of a pronounced slowdown (see here ), then the stars will be aligned for a change in the path of (monetary) fundamentals, and hence the value of the dollar. Until then, the dollar will be buffeted by news about output, incomes, and credit markets (a different portfolio balance channel [6] ).

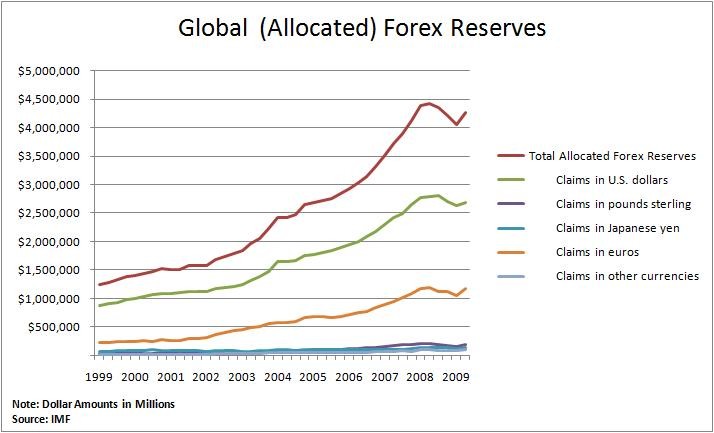

Oh, and by the way, the euro may supplant the dollar as the worlds key reserve currency by 2015 if we maintain the policies of the past 7 years. [7] [pdf], Jeff Frankels blog .

www.technorati.com/tags/euro>euro,