The Federal Reserve System

Post on: 5 Август, 2015 No Comment

The Fed’s Structure

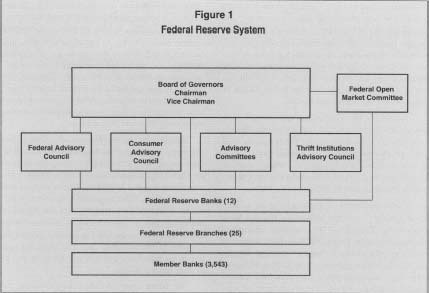

The Federal Reserve system consists of a seven-member board of directors in Washington, D.C. and 12 regional banks, each controlled by its own directors. These regional institutions, owned by commercial banks within their jurisdictions, only do business with the Treasury and their member banks, not with the public at large. They do not lend money for automobiles or homes, and their main assets are U.S. government securities (such as Treasury bonds). The Federal Reserve banks also perform a variety of services for other banks such as check processing and storing and distributing cash. All national and state chartered banks are subject to Federal Reserve supervision and regulation.

The Federal Reserve Board of Governors oversees the entire system. The president appoints six of the governors (subject to Senate confirmation) to 14-year terms and the board’s chair to a 4-year term. (The president’s and chair’s terms of office do not overlap, however.) Alan Greenspan is the current chair.

The Fed’s Operations

Even though the Constitution authorizes the government to coin money, it would be impractical to control its supply by speeding up or slowing down the printing presses. After all, if enough were printed it would soon be worthless. It is also impractical to tie the value of paper money to precious commodities such as gold or silver, since the supply of these commodities does not always keep pace with economic growth. Governments discovered that when these metals didn’t keep pace with growth there was usually insufficient currency to finance investment and consumption. Therefore, the Fed relies on its legal authority to manipulate fiat money: paper currency, coins, funds in checking and savings accounts, and other legally accepted forms of exchange.

The Federal Reserve System manages the money supply in three ways:

Reserve ratios. Banks are required to maintain a certain proportion of their deposits as a reserve against potential withdrawals. By varying this amount, called the reserve ratio. the Fed controls the quantity of money in circulation. Suppose, for example, it orders banks to hang on to an extra 1 percent of their deposits. They would then have 1 percent less to lend. One percent may not sound like a lot, but it translates into billions of dollars that are siphoned out of the economy.

Discount rate. When banks temporarily overcommit themselves, they occasionally have to borrow from the Fed to secure the necessary funds to meet their reserve requirements. The interest rate charged for these loans is the discount rate, and it too affects the money supply. If the Fed raises the discount rate, banks cannot afford to borrow as heavily as before and have to curtail their lending and raise their own interest rates. That results in less money flowing into the economy. Conversely, if the Fed relaxes its discount rate, financial institutions have more dollars for their customers. Seen from this perspective, the discount rate has a snowball effect: Raising it means that other interest rates go up as well and, other things being equal, economic activity slows down; lowering it has the opposite effect.

Open-market operations. By far the most important of the Fed’s activities are open-market operations. the buying and selling of government securities. After Congress approves an increase in the national debt, the Treasury Department prepares a mix of bonds, bills, and notes that it auctions to private dealers who are authorized to trade government securities. When it wants to influence economic activity, the Fed buys or sells these assets through its Federal Open Market Committee (FOMC) or open-market desk, as it is commonly known.

The process works this way: If the Fed decides to increase the money supply, its open-market manager buys back treasury securities from private dealers, paying for them by simply crediting their bank accounts. It does not transfer any actual cash. (This power distinguishes it from all other financial institutions and gives it its clout.) The dealers’ banks now have more money to lend, and these loans ultimately find their way into more banks, which pass a portion of them on to additional borrowers. The Fed’s initial purchase thus has a multiplier effect as money ripples throughout the economy. Of course, the process is reversed when the Fed sells off some of its securities, because it in effect deducts the price from the purchasers’ accounts, leaving their banks with fewer deposits.

The main idea is that the Fed’s accounting maneuvers, not switching the printing presses on and off, produce increases or decreases in the money supply.

The Fed and the Political System How one interprets the Fed in relation to various models of who governs, such as pluralism or the power elite. depends on how much independence from political influence one thinks the system has. On paper the Federal Reserve System appears to be relatively autonomous, since it receives its operating revenues from its constituent banks, not from congressional appropriations, and since its governors, once in office, cannot be dismissed by the president. The governors’ long terms mean that an occupant of the White House cannot expect to pick a majority of the governors. The Fed, moreover, conducts its meetings in private and is under no legal obligation to report to the executive branch. Given these conditions, one might think it could escape public accountability altogether.

Yet the Fed is also the creation of Congress, which takes a strong interest in its work and can always amend its charter. Furthermore, as a practical matter, the Fed’s officers have to interact daily with senior executives in the Treasury Department, the OMB, and other agencies. The chair frequently testifies before legislative committees and regularly consults with the president’s staff. All members of the board of governors realize the value of maintaining support at both ends of Pennsylvania Avenue because they know determined political opposition can undercut their policies. In short, the Federal Reserve’s statutory independence does not immunize it from political pressures.

The ill-defined boundaries between the Fed and the rest of the Washington establishment leads to endless debates about its autonomy. Some observers emphasize the Fed’s political nature, arguing that it pays close attention to the desires of the White House. Presidents normally want the money supply to flow freely enough to keep the economy booming and will pressure the Fed to achieve that result. Members of the board do not want to antagonize the chief executive and, if pressed, often cave in.

Some political economists go even further: They detect a political monetary cycle (PMC), during which the Fed relaxes monetary policy in the months before a presidential or congressional election, hoping that business will pick up and thus make the incumbent president’s party shine in the eyes of the electorate. As soon as the campaign ends, however, it tightens the screws again to hold down inflation. According to this interpretation, the Fed rhythmically starts and stops the economy for partisan purposes. If true, the existence of a PMC would suggest that the Fed is at least indirectly accountable to the people, as democratic theorists hope.

Others, however, doubt the Fed’s susceptibility to presidential influence and question the whole PMC concept. It seems unlikely, they claim, that the Fed would act so blatantly on anyone’s behalf because such partisan behavior would tarnish its reputation in financial circles for competence and objectivity. It is also doubtful whether the Fed has sufficient data and knowledge to fine-tune the supply of money on short notice. Monetarism, in the last analysis, is a broadsword, not a scalpel, and cannot be wielded with the precision assumed by the PMC hypothesis. Finally, several empirical studies dispute the existence of a political monetary cycle. One economist said that he could not uncover a single episode. in the Fed’s history to suggest that [it] had bowed to presidential election pressures, and a lot of episodes to suggest that it resists them.

If the Federal Reserve System avoids the tugs of partisanship, what factors do affect its actions? It could be argued that it has many of the trappings of a power elite. In the first place, monetary policy is by any reasonable standard a trunk decision. The availability of money and magnitude of interest rates affect employment, prices, savings, investment, growth, and productivity and hence touch the lives of everyone from the smallest consumer to the largest corporation. These policies are developed and enforced by the Fed’s board of governors and its operating arm, the FOMC, two tiny, nonelected groups of men and women with close connections to the banking and financial communities. Indeed, the background of the Fed’s highest officers is one of its most distinguishing features. Though many of them come from modest origins, they have spent the bulk of their careers in major banks and Wall Street investment firms and many, like former Fed Chairman Paul Volcker and the present chair, Alan Greenspan, have shuttled back and forth between jobs in these private financial institutions and important positions in the U.S. government.

Spending one’s life in banking, business, and commerce creates the sorts of loyalties the power elite school predicts. One expert, who does not necessarily accept the power elite thesis, nonetheless lends it credibility when he writes that Federal Reserve officials work in a milieu that is significantly shaped by the interests and concerns of the commercial banks.

In brief, as much as fiscal policymaking seems to conform to the pluralist interpretation of American politics, monetary policy approximates the power elite model. Yet before accepting either of these theories, we need to see what influence the public as a whole exerts.