The end of quantitative easing is good news The Washington Post

Post on: 28 Март, 2015 No Comment

By Editorial Board July 13, 2014

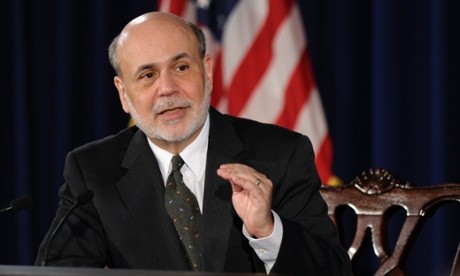

THE FEDERAL Reserve’s unconventional “quantitative easing” strategy will not turn into a “QE-ternity” after all. Many a Wall Street wag had suggested that might happen after then-Fed Chairman Ben S. Bernanke announced an indefinite program of $40 billion per month in asset purchases in September 2012. But on Wednesday the Fed released minutes of its internal discussions showing that the central bank, under new chair Janet L. Yellen, plans to stop quantitative easing in October.

The conclusion of the Fed’s bond-buying, which had increased its balance sheet to $4.4 trillion from $900 billion before the financial crisis, is good news in two ways. It is a sign that the Fed believes growth and job creation have finally achieved enough momentum to continue without the stimulus that comes from adding to the Fed’s balance sheet — while the stimulus of near-zero interest rates and the expanded balance sheet remain in place. And it is a much-needed recognition that easy monetary policy may be breeding asset bubbles not unlike those that contributed to the crash.

Signs of possibly dangerous froth in the markets have multiplied in recent weeks, from unusually low yields on risky corporate junk bonds to soaring luxury real estate prices to record highs for the New York stock market indexes. As the Fed’s minutes put it: “Low implied volatility in equity, currency and fixed-income markets as well as signs of increased risk-taking were viewed as an indication that market participants were not factoring in sufficient uncertainty about the path of the economy and monetary policy.” Translation: Investors’ “search for yield,” spurred by the Fed’s own prolonged low-interest rate policy, may have become so frenzied that they are paying asset prices that no longer convey accurate information about the economic costs and benefits of various investments.

An irony of this situation is that the Fed is reaping what it sowed. One goal of quantitative easing was precisely to create a rally in asset prices at a time when a panicked market was unduly risk averse. The “wealth effect” also made consumers more eager to spend. All the more reason to praise the Fed’s latest action, which shows that the central bank is aware of its responsibilities to counter speculative bubbles before they get too big — if it can. Financial markets are now on notice that near-zero interest rates won’t necessarily last forever either.

Yet Ms. Yellen also has explained that suddenly jacking up rates would unduly hamper growth, at least given present conditions. In a recent Washington speech. she argued instead for using the Fed’s “regulatory or supervisory ” powers to make sure that financial institutions are well-capitalized enough to withstand any bubble-popping that might occur. In its own way, this approach — like the entire business of engineering a safe exit from quantitative easing — is as unconventional and untested as quantitative easing itself. It suggests the Fed chair aims to limit the damage that bubbles do rather than deflate them in the first place.

Given Ms. Yellen’s track record, she is entitled to the benefit of the doubt. But given the uncertainties, Congress should explore her thinking in detail when she appears for

semi-annual hearings on monetary policy this week.

Read more from Opinions: