The effectiveness of ratio analysis as indicator of financial position

Post on: 27 Май, 2015 No Comment

Abstract

We will examine the effectiveness of ratio analysis as a financial indicator of an organization’s performance. The wider uses of the ratio analysis is not only use to predict or analyse the performance of the industrial businesses (large or small organization), but also applicable to the medical sector primarily hospitals and the public sector namely government institution. Apart from corporate sector, ratio analysis can also be applied to measure the financial position of an individual or a family financial position.

The objective of this paper is to illustrate the usefulness and effectiveness of the ratio analysis as an indicator of financial performance or position in order to improve an organization performance and to implement corrective action to ensure its survival.

Introduction

According to Pink, Holmes, Strunk etc (2005) financial statement analysis is important to board of directors, managers, payers, lenders and others who make judgements on the company financial position. They agreed that by assessing financial statements, ratio analysis can be derived from the assessment which in turn will be able to produce values for these decision makers.

Apart from this, the analysis is also able to assist economists, both academicians and practitioners in their research and studies, such as gauging company’s performance, stock price movement and also signs of financial distress. Qualitative and quantitative are types of data that are being used as basis for the analysis. These data can be derived from the Financial Statement. Financial statements are formalized, comparable, publicly available and free. (Barac, 2010). Examples of quantitative data are figures and numbers that can be extracted from a company’s financial statements. Through this, ratios can be easily computed. Ratios can be derived by comparing current and previous year figures. Through this, we can compare the company performance with other companies, or between the industry benchmark. There are many ratios that can be calculated from the financial statements relating to a company’s performance such as operating, liquidity, financing and investing ratio.

Through the use of ratio analysis, it is able to tell us how profitable a business is or whether the organization is capable to pay its financial obligations and also its future sustainability. Besides that, ratio analysis can also assist us in checking whether a business is doing better this year than it was a last year and also whether the business is doing better or worse (profitable or not profitable). Other than that, ratio analysis can tell us whether the organization business is using its asset efficiently or is there potential for the company to invest on, merge, liquidate or auction out before the company situation worsen. Hence, we must decide on want ratio analysis should be computed from the financial statement in order to solve the problem we are facing.(Investopedia)

The ratios that we used were put into different categories that are designed to help in solving the problem and answering the questions. There are three categories. First, profitability, which is to analyse whether the business has made a good profit compared to its turnover. Second category is liquidity which would enable us to know whether the business have enough money to pay its bills and the final category is gearing or solvency which through ratio analysis would enable us to know whether the company has a lot of debt or is it financed mainly by shares. These are basic ratios normally used in analysis. There are additional ratio that can be used in analysing a business in a more detail and specific manner (Biz.co).

In performing the analysis process we need to know what in particular do we want to find out about the company? We have already discussed earlier that there are various ratios that can be computed from the data provided by the financial statement. Anyone can read and ask questions about the accounts of a business; therefore the same way that we can put ratios into groups, we should put readers and users of accounts into convenient groups too. The first group is investor where analysis is able to help them in deciding on whether they should buy shares or sell the shares they already own. Ratio analysis can also assist them to assess the company capabilities to fulfil shareholder’s right particularly in making dividend payout.

Another group of user is lenders or bankers and suppliers or creditors. This group of user would normally want to know as to whether the company is able to pay its loan and interest and also its outstanding bills. Therefore, through ratio analysis, they would be able to identify as to whether their debtors would be able to service their debt accordingly. In such case prompt action can be taken against errant debtor before the amount in their debtors account would become irrecoverable. Other external users are government and their agency. This group normally need the analysis to determine the taxation policy on charging the company.

From the group of users mentioned above, the most important users are the internal users such as the company’s managers and executive officers which need the analysis to understand the company stability and current profitability or financial position. From the analysis, top-level management would be able to implement the improvement strategy or corrective action in order to bring about greater efficiency within the company. For the other employees of the company the analysis would be able to provide them with well informed information on the company’s ability to provide them with better remuneration, retirement benefits and career advancement.(Biz.co)

Literature Review

As we are informed, different financial indicators measure different dimensions of financial performance, such as profitability and liquidity. Apart from that, it can also help to make an informed judgment about the financial health or performance of an organization. Our finding revealed that ratio analysis plays a very important indicator for gauging a company or an institution’s performance.

In our review of Italian Zeli and Mariani (2009) article, the Italian companies will recognise the productivity and profitability path of their companies and their competitive advantage as well as their asset financing policies by considering three unique frameworks. There are productivity ratios, profitability ratios and the company financial condition. In this review, the article emphasizes the importance of profitability ratio. They found that in order to measure the company performance, the profitability ratio was used for this analysis. This ratio can measure the potential or capability to achieve a minimum profit share level after covering its costs. The most important profitability ratio for them is the ROE and ROI. which can be used to assess the companies ‘economics health and position.

We can see from the result on analysis of Italian companies, which show that there are positive impacts for large-size firms in terms of productivity indexes (value added per head) and profitability. Similar with small-size firm, they also showed of the negative impact to the debt level (leverage). The study shows that companies that performed or efficient will get high profitability as they are good in productivity or sales performances or low uses of the debt. The writer suggested that when there are high leverage value and low ROE, it would be best that they focus on corporate financial strategy. In order to avoid lower profitability, the companies should try to improve financial resources management by decreasing leverage value and ensure also the high productivity. (Zeli & Mariani,2009)

In the article written by Sueyoshi (2003), he also highlighted the importance of financial analysis ratio which can be very useful to avoid company to fall into bankruptcy. This article discusses on the use of ratio to measure the performance of company in electric power industry. He also same about the suggestion by Zeli & Mariani(2009),that performance of the companies are should give more attention when there are high leverage value and low ROE.

In the article,Sueyoshi (2003) highlighted that the relation between liquidity and bankruptcy are separable. This is based on the origin of the early literature by Modigliani and Miller (M-M) (1958, 1963) theory where a firm is independent of debt maturity because operating and investment decisions are completely distinguishable from the financial decisions. The article also highlighted that the leverage ratio is an important factor to predict and avoid bankruptcy in the competitive US power or energy industry .

In his study, he noted there is high degree of correlation between long term debt to equity and return on equity. It is important for us to understand that forecasting corporate bankruptcy for large organization such the power/energy firms is a essential as the liquidation of such organization would cause a collateral negative impact to the economy. Based on the writer, the most important ratio for this forecast is the leverage (long term liability and interest coverage) and profitability (return on equity) ratio. He identified that it is true that many power or energy firms are using the risk debt, preferred stock or other securities in determining their current financial position. He noted that these firms agreed if they have a high leverage in capital structure, it is prominent that they will face the potential of bankruptcy. This will truly affect the firms going concern. This is in contra to the objective of the company which is their inception is to focus on their profitability in order to produce a monetary benefit to the shareholder and to fulfil the obligation to pay dividend. As you can see, it clearly shows that ratio analysis is very useful and important in overseeing the performance of the company so as to ensure the continuity of the company and to avoid from financial distress and also from being bankrupt.

In another article written by Saini and Sharma (2009) which focuses on the steel industry in India, they highlighted that there was a very high correlation between liquidity and profitability. Based on the article, a positive ratio would reflect a positive impact on profitability which means that the company is able to service its debt and on top of that signify healthy financial position. In another hypothesis written in the article, they highlighted of a negative association between the risk and profitability. Such case would result in a negative effect on profitability by adopting the high degree of aggressive policy in financing the working capital.

They stated that a firm deemed high risk is when it fails to meet their current obligations because of the lack of sufficient liquidity. The high risk will affect the confidence of creditor or investor and this will result in a bad credit image thus will affecting its profitability. Therefore, the goals of adequate liquidity, minimisation of risk and also maximising the profitability can be achieved by designing or applying liquidity policies in the firm’s management. There are three types of liquidity policies that inter-related. There are liquidity, risk and also profitability. The first is applying the conservative policy that will lead to lower profitability but it will result in lower risk of failure to meet the current obligations. Second is the aggressive policy which will result in high profitability but high riskiness to meet its financial obligations and third policy is when the investment in current asset is neither too high nor too low thus we can say that the moderation of profitability and risk.

In their study, we noted that profitability and liquidity have a strong relationship between each other due to the result of high percentage of correlation coefficient between profitability and liquidity. In his computation of 5% level of significance based on probability or hypothesis calculation, he noted of that the result from the value computed is higher than the critical value, therefore signifying the strong relationship between liquidity and profitability. Their studies also revealed that the companies that are efficient in liquidity management are those that take into account the computation of current assets to total asset. In this computation we would want to identify how well the company has utilized their funds for working capital purposes and the result from this would confirm how efficient the company has manage its liquidity. Therefore by placing high investment in current assets would certainly increase liquidity will also affect the profitability of the company. This article also found the negative relationship between risk (involved debt or loan in finance their asset) and profitability. Thus they come out with their two hypothesis by using their two different policy which are the profitability will high when risk is high (aggressive policy) and profitability is low when risk is low (conservative policy) .The result was shown the decrease of profitability when they adopted aggressive policy (high degree of debt or leverage) which high risk will may affect their financial condition or position of the companies.

Apart from its applicability in those areas mentioned beforehand. We also can use ratios analysis to evaluate the performance of healthcare organization such as the hospital. One should realise that hospital is also regarded as a business organization as there are transactions taking place in these institution such as the purchasing of medicines and medical equipment. From the article written by Pink, Holmes, Strunk & etc (2005), he showed that the use of ratio through comparison between different medical institution. By comparing the ratio values among the healthcare organization, it helps to determine any differences that could indicate weaknesses or opportunities for improvement and enhancement of the institution performance.

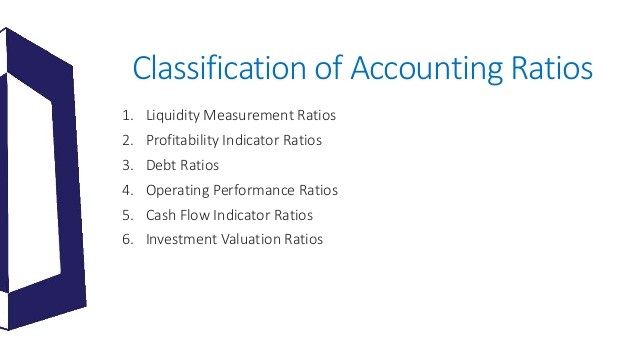

According to Pink, Holmes, Strunk etc al. (2005), they agreed that ratio analysis is the best financial indicator for performance assessment. Besides using the indicators commonly for identifying level of profitability, liquidity and capital structure, they can also utilize other financial indicators that suitable for their industry, which are revenue, cost, and utilization indicator. According to the writer, they had established six dimensions in evaluating financial performance.

One example for identification of relevant financial indicator is profitability indicator. This indicator may show an organization is profitable but at the same time may be facing with the difficulty to pay its bills and on top of that the capital structure may also show that the debt was increasing. An example of ratio analysis for revenue is total outpatient revenue/total patient revenue. In this ratio, the management is able to identify what is the ratio between the two categories of patients admitting into their hospital or clinic. At this point, management can formulate better strategy to cater this group of patients. Another ratio is to identify medical care revenue per day which is to measure the amount and mix of different sources of revenue through the various medical care provided by the organization.

This same goes for the cost indicator which can be used to measure the amount and mix of different types of cost or expenses incurred by the hospital such as salaries expenses, medical equipment maintenance and etc. Apart from the above, utilization indicator can be used to measure the average daily utilization of its fixed assets normally beds to determine the level of occupancy. Apart from quantitative analysis, qualitative analysis is also important such as having feedback or response from the hospital and healthcare organization administrators. From the writer’s study, we agreed that most financial indicators that were calculated and their interpretation can immensely assist the top level management to improve their financial management and activity performance.

In an article written by Wang and Liou (2009) they noted in their analysis of a case study of government of United States that financial conditions of an institution changes over time. Knowing this fact, ratio analysis computed from the financial statement would be best used to identify the company current condition which can be use to formulate better strategy and decision making in order to anticipate the future condition. Based on this article, the change in a financial condition of a government would cause a chain effect towards the whole economy. For example, it would hinder socio economic development in term of personal income and employment. Hence, by performing analysis it would help the government to develop effective strategies to improve its financial conditions.

The writer stated that there are four dimensions of financial solvency ratio to define condition specifically. First is cash solvency ratio that demonstrates the ability to generate sufficient resources to meet the current obligation,which is directly related to the effectiveness of the organization’s cash management. Second is budgetary solvency ratio which is use to examine the institution capabilities in generating sufficient revenue to pay its expenses. Third is long run solvency ratio where the implication of existing long term obligations would affect future resources. Lastly, service solvency ratio which measures the capabilities to provide and sustain a service level that citizens require or desire.

The writers found that the relationship between the different dimensions. Among these dimensions, writer focuses more on budgetary solvency due to several reasons. Firstly, budgetary solvency is most important as it reflects combined effect of revenue collection and expense control. Revenue and expense management is a core element of financial management practises in governments. They highlighted that an improvement in budgetary solvency means the organization have lower level of liabilities due to the effectiveness in controlling expenses, this in turn resulting to positive impact towards the cash solvency. This can be agreed because if revenue increases, the available cash will also increase.

Apart from the above, the article also mentioned that the change in budgetary solvency is associated with the change in long-term solvency. As mentioned in the article, government’s long-term liabilities are normally a result of the demand for long period, high-priced and durable capitals. Therefore the change in budgetary solvency can affect long-term solvency in several ways. For example, an increase in budgetary surplus can be used to pay off an organization’s long-term liabilities such as bonds and debts. This is co related in an event that there was a significant surge in spending which may force a government to borrow.

This is most useful when the government have to consider any changes in state’s financial condition such as in budgeting process, consideration in political and policy changes and the management of the government institutions. This helps to determine the level of revenue and expenses that government incurred or will incur in the future. Other than that, the changes in financial situation of the government can also cause changes in the labour market, economic growth and so on. According to Wang and Liou (2009) financial ratio analysis is a useful tool to monitor and analyse the performance of the states or government. The writer pointed out that the states should monitor their use of the revenue and control their expenses in order to ensure that they can meet their financial obligation and at the same time providing and maintaining quality services for their citizens.

The application of the ratio analysis is not only applicable for businesses or institution, but also applicable to personal in order to oversee the specific strengths and weaknesses of a family‘s financial position. Based on an article by Griffith (1985), he suggested 16 ratios in providing detailed information of a family financial position focusing on liquidity of their net worth, their solvency, and their financial position. Each of the 16 ratios was separated into three different views which are liquidity characteristic, solvencies characteristic the evaluation of their net worth in achieving financial goals of the families.

There are a few examples of ratio of liquidity. One example is liquid asset/ monthly expenditure. This ratio analyses on the adequacy of liquidity asset to cover monthly expenses. which means identifying a family current liquidity position. Another example is liquid asset/ total debt. This ratio helps to determine the financial ability of a family to retire some of its outstanding debt using liquid assets in an unexpected event that would affect the family financial position.

The second characteristic is solvency. An example of solvency ratio is liquid assets/ one year’s payment on debt. This ratio helps to determine a family capability to meet their obligation to pay debt on time. When a debt is required to be settled at a specific period, this ratio helps to determine whether the family is able to make payment accordingly. Therefore, it helps the family to make the necessary plan in order to service its debt. Another example is total debt/net worth. This ratio helps to assess the position of debt in relation between total liabilities to total net worth value. The purpose of this ratio is to determine the family’s current debt position as to whether debt has overrun the current family assets.

The example of the third group of ratios is evaluation of net worth. The evaluation is derived from the formula net equity plus net tangible assets minus home/net worth, Griffith (1985). This ratio helps to assess on the ‘investment aspect’ of tangible and equity assets such as house or automobile. Another ratio is income generating assets / net worth. This ratio helps to determine the proportion of total net worth invested in assets which can generate future income and can be reinvested to increase future net worth.

Example for this class of asset is those that are able to earn interest, payout dividend and increase profits. As you can see if a family maintain a monthly or annual financial statement, ratios such as those mentioned above can greatly helped family to formulate better future plan.

In our last finding, we find that ratio analysis can also prove to be helpful in the overview of strength and weaknesses of a family financial position (Prather, 1990). Even though the application of ratio analysis in family financial statement is still in its infancy stage, but we noted that the result from the writer’s study shows that the ratios value calculated can be used to reassess a particular family household expenses and income level. In the study conducted from the sample size of 3824 families, result shows that the most families from the sample do not have enough funds to cover themselves in any emergency situation such as unemployment or inflation. Other than that, we also found that in the age variable analysis, it shows of the strong correlation between age and financial factor. The study proved that the increase in age will also increase the asset and decrease the liabilities.

Conclusion

We found that ratio analysis is very important to analyse the success, failure or progress of an organization. Ratio analysis has proven to be able to assist owner of resources to compare their performance with the average performance in same industry. The very important aspect of ratio analysis is to provide an early warning for an organization in order to allow them to react and solve the problem promptly. When corrective action has been taken the continutty of the organization can be established.

However, we also have to look at some disadvantages of the ratio. As we are informed, ratio analysis is mostly based on numbers and that ratio is not a definitive form of measurement. Thus ratios need to be carefully interpreted because it normally provides clues/ hints of the company’s performance. Another disadvantage of ratio analysis is that the information is based on a summarised financial statement which in this case may left out some important information that be relevance to the user in decision making.

As a conclusion, although ratio analysis has their own drawback but we cannot deny their contribution to the users such as investor or government. It is very important to see the efficiency and profitability in ratio so that we can make a compare current with previous year performance or the average market. This is better than looking at the figure of profit or loss in the financial statement.