The Economy State of the Economy Economic Indicators GDP CPI Unemployment Consumer

Post on: 16 Март, 2015 No Comment

The Current State of the Economy — CPI, GDP, Unemployment, Stock Prices

You can opt-out at any time.

Please refer to our privacy policy for contact information.

After the end of every quarter of the year, you hear many statistics quoted on the news, called economic indicators, which are supposed to describe the condition of our economy. Those statistics seem especially important right now since business owners are so tuned in to the condition of the economy.

We are in the middle of the deepest and most profound economic downturn since the Great Depression. The problem is that it’s tough to put all these statistics into some sort of true picture of the economy unless you’re an economist. Here’s that picture for you.

There are three types of economic indicators. Leading indicators predict the future of the economy. Lagging indicators describe what has happened in the past in the economy. Coincident indicators describe what’s happening in the economy right now. All are important in describing the total economic picture and trying to predict future economic activity.

Here is an explanation of some of the most important economic indicators:

Gross Domestic Product

The Gross Domestic Product (GDP) is the total market value of all goods and services produced, including total consumer, investment, and government spending, plus the value of exports, minus the value of imports. The GDP is a coincident indicator. It moves with the economy and describes what’s happening right now.

In the first quarter of 2009, GDP declined by 6.1%. In the fourth quarter of 2008, it declined by 6.3%. Those are profound declines. This means that since September, 2008, the U.S. economy contracted or shrunk by a total of 12.4%. A decline in the GDP is the best indicator of recession.

A large component of this decline was due to a significant decline in automobile production. We also exported fewer products and built fewer structures, both residential and non-residential. Imports decreased as well. The difficulties in the automobile industry are really affecting our economic output.

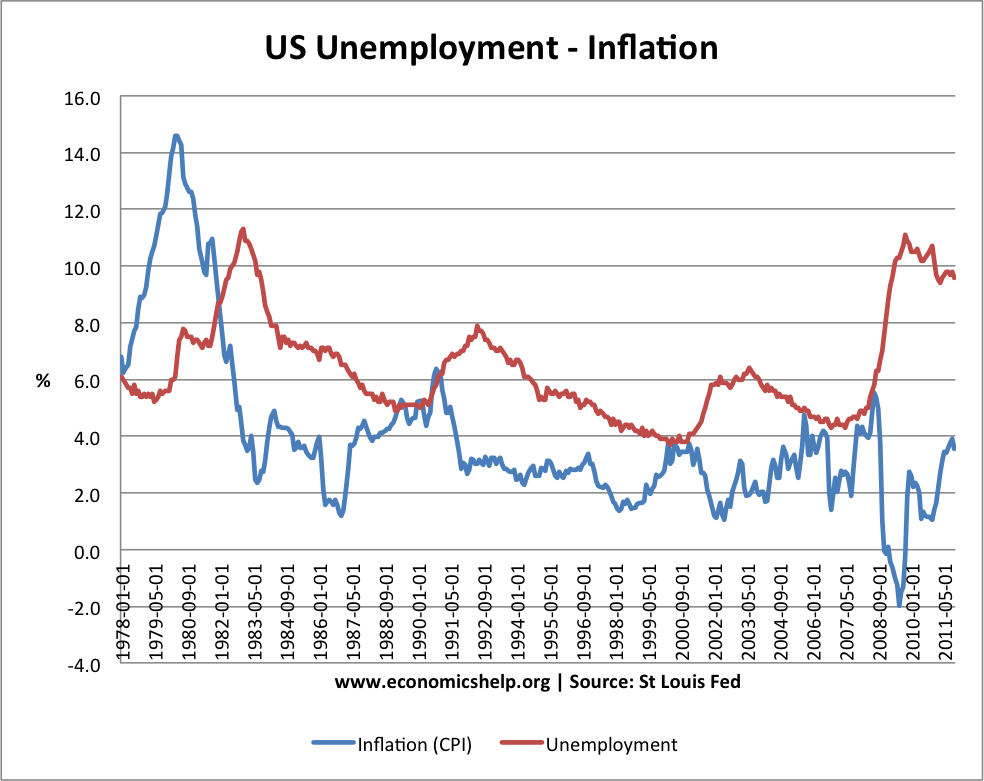

Consumer Price Index

The Consumer Price Index (CPI) is a measure of the change in the purchasing power of currency and the rate of inflation. It shows the current price of a “basket” of goods and services in terms of the prices during the same period during the previous year. The purpose of the CPI is to show the effect of inflation on purchasing power. The “basket” of goods and services includes energy (gas prices) and food as we;; as other goods and services.

In March, 2009, the CPI fell 0.1% after a 0.4% increase in February. If we compare March, 2009 to March, 2008, the CPI fell 0.4%. That is the first year-over-year decline since August, 1955. Energy prices dropped 3.3% in March and food prices dropped 0.1%. A decline in consumer prices leads to fears of deflation instead of inflation.

Deflation occurs when consumers hold off on purchases in hopes of lower prices. When this happens, producers can’t sell their inventory and houses don’t sell. Even though a drop in prices may sound good, in the long-term, it is not for those reasons. The CPI is a lagging indicator since it describes past economic activity.

Producer Price Index

Think of the Producer Price Index (PPI) like you do the CPI. The difference is that the PPI is a measure of the change in the wholesale prices of goods and some services at the manufacturer or producer level instead of at the consumer level. It is usually used as a predictor of the Consumer Price Index and is extensively used by investors. Producer prices dropped 1.2% in March, 2009 after small increases in January and February, 2009. The Producer Price Index is a coincident indicator that describes economic activity as it happens.

Unemployment Rate

In April, 2009, the unemployment rate rose from 8.5% to 8.9% according to the Bureau of Labor Statistics. Since the recession began in December, 2007, 5.7 million jobs have been lost. Private sector employment fell by 611,000 in April 2009. The unemployment rate is a lagging indicator of the economy, describing economic activity after it happens.

Stock Prices

Stock prices are leading indicators of economic activity. If the market goes up and sustains upward activity, that is usually a good economic sign. In March, 2009, stock prices fell 0.24%. There has seemed to be a rally in stock prices in April and May. However, it seems that it may be what is called a “sucker’s rally.” In other words, the rally may not be sustainable. Only time will tell. The measure of stock prices used is not the Dow Jones Industrial Average. Instead, it is the Standard and Poor’s 500 Index.

The Consumer Confidence Index is a measure of how well the average American thinks the economy is doing and will do in the short-term. The sample includes 5,000 households. This index improved slightly in March, 2009 and improved more in April, 2009. It seems that consumers feel that the economy is nearing a bottom and may start to improve in the near term. However, the consumer confidence index still remains well below levels that indicate consumers feel strong economic growth is ahead.

The employment outlook was less pessimistic. Consumers’ outlook on the future was less pessimistic and their assessment of current conditions was better. The consumers that anticipated that their income would increase edged up slightly.

The Current Economic Picture – May 2009

If you look back at these economic indicators, you will see a mixed picture for our economy. We have a Gross Domestic Product that fell hard in first quarter 2009 and a Consumer Price Index that also fell in March, after an increase in the previous month. Neither of those statistics are good news. The Producer Price Index also fell so manufacturers are having trouble selling their products. These numbers mean that deflation could be on the horizon. Deflation, or falling prices, during a recession is a troubling sign and could lengthen the recession.

We have to look at unemployment, which is still rising. We know from past recessions, however, that unemployment often keeps rising even after a recession reaches its peak and the economy starts to turn around.