The Difference Between Fiscal Policy and Monetary Policy

Post on: 26 Май, 2015 No Comment

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Investors hear frequent references to monetary policy and fiscal policy, but what do these two terms mean exactly? Understanding the difference may be more important for investors today than ever before given the government’s growing influence on market performance.

What is Monetary Policy?

“Monetary policy” is the blanket-term used to describe the actions of a central bank – in the United States, the U.S. Federal Reserve. or “the Fed.” The Fed sees to pursue policies that maximize both employment and price stability, and it is independent from the influence of policymakers (i.e. Congress and the President).Within the Federal Reserve, monetary policy is set by the Federal Open Market Committee. which meets eight times a year to assess policy.

The primary tool central banks use to set monetary policy short-term interest rates. In the United States, this is referred to as the federal funds rate. or “fed funds” for short. By raising interest rates, a central bank can increase the cost of loans and thereby slow the pace of economic activity, which should – in theory – help contain inflation pressures. By cutting interest rates, a central bank lowers the cost of money. This stimulates the economy by making it easier for individuals and businesses to borrow money, which in turn fuels economic activity by making it less expensive to buy a house or fund a project.

Traditionally, central banks haven’t sought to control long-term rates, but the unique circumstances that followed the 2008 financial crisis prompted the Fed to engage in policies known as quantitative easing (QE) and Operation Twist. With rates already at zero, the Fed was forced to take this route in order to suppress longer-term rates and help the economy recover from its post-crisis recession.

What is Fiscal Policy?

Fiscal policy refers to the actions of a government – not a central bank – as related to taxation and spending. The debate about the impact of fiscal policy on the economy has been raging for over a century, but in general it’s believed that higher government spending helps stimulate the economy, while lower spending acts a drag. At the same time, higher taxes are thought to limit economic growth. whereas lower taxes help stimulate it. Again, this is a matter of debate and opinions often vary based on an individual’s location on the political spectrum.

How does government spending influence the economy? As an example, consider the case of a sluggish economy in which the government opts to increase spending in certain areas; for instance, building new bridges. This activity puts people to work, and they in turn spend money on goods and services, which helps put more people to work, and so on. This type of policy is referred to as “expansionary.” Conversely, the decision to reduce government spending is “contractionary.”

Between monetary and fiscal policy, the former is generally viewed as having the largest impact on the economy, while fiscal policy is seen as being the less efficient way to influence growth trends.

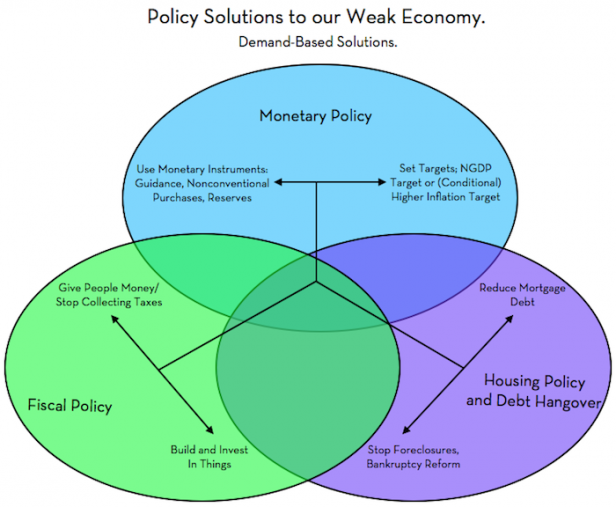

How Monetary and Fiscal Policy Interact to Affect the Economy

An important aspect of monetary and fiscal policies is that neither occurs in a vacuum. Instead, the two work together to influence economic conditions. In terms of monetary policy, central banks such as the Fed need to assess how fiscal policy will affect the economy so they can adjust their approach accordingly. Along the same line, the economic results of central bank actions – higher growth and/or higher inflation vs. slower growth and/or lower inflation – can affect policymakers’ approach to taxation and government spending.

In Europe, for instance, the fallout from the region’s debt crisis required governments to engage in fiscal belt-tightening, which in turn contributed to the highly stimulative policies of the European Central Bank. Similarly, the U.S. Federal Reserve cited concerns about reduced government spending as one of the reasons it chose to continue its quantitative easing policy through the fourth quarter of 2013, even as many investors expected it would begin to “taper ” the extent of QE.

How Government Policy Impacts Your Investments

The ideal investment strategy involves a hands-off approach in which decisions are based on an investor’s time horizon and risk tolerance. Having said that, it pays to be aware of trends in both fiscal and monetary policy given the increasing influence of both factors in financial-market performance. More than ever, the prices of both stocks and bonds are being driven by investors’ interpretation of government and central-bank policy rather than traditional, fundamental factors. It therefore pays to keep an eye on the headlines in order to have a full understanding of why your investments are performing as they are. For a look at the issues affecting the bond market, see my special section, Issues in the News .