The Capital Asset Pricing Model (CAPM)

Post on: 29 Июль, 2015 No Comment

Download The Capital Asset Pricing Model (CAPM) Powerpoint Presentation

The Capital Asset Pricing Model (CAPM) Outline

The Capital Asset Pricing Model (CAPM) Chapter 10

Individual Securities The characteristics of individual securities that are of interest are the: Expected Return Variance and Standard Deviation Covariance and Correlation

Expected Return, Variance, and Covariance Rate of Return Scenario Probability Stock fund Bond fund Recession 33.3% -7% 17% Normal 33.3% 12% 7% Boom 33.3% 28% -3% Consider the fol owing two risky asset world. There is a 1/3 chance of each state of the economy and the only assets are a stock fund and a bond fund.

Expected Return, Variance, and Covariance Stock fund Bond Fund Rate of Squared Rate of Squared Scenario Return Deviation Return Deviation Recession -7% 3.24% 17% 1.00% Normal 12% 0.01% 7% 0.00% Boom 28% 2.89% -3% 1.00% Expected return 11.00% 7.00% Variance 0.0205 0.0067 Standard Deviation 14.3% 8.2%

Expected Return, Variance, and Covariance Stock fund Bond Fund Rate of Squared Rate of Squared Scenario Return Deviation Return Deviation Recession -7% 3.24% 17% 1.00% Normal 12% 0.01% 7% 0.00% Boom 28% 2.89% -3% 1.00% Expected return 11.00% 7.00% Variance 0.0205 0.0067 Standard Deviation 14.3% 8.2% 1 1 1 E(r ) S = ×( 7 − %) + × 1 ( 2%) + ×(28%) 3 3 3 E(r ) S =11%

Expected Return, Variance, and Covariance Stock fund Bond Fund Rate of Squared Rate of Squared Scenario Return Deviation Return Deviation Recession -7% 3.24% 17% 1.00% Normal 12% 0.01% 7% 0.00% Boom 28% 2.89% -3% 1.00% Expected return 11.00% 7.00% Variance 0.0205 0.0067 Standard Deviation 14.3% 8.2% 1 1 1 E(r ) B = × 1 ( 7%) + ×( % 7 ) + ×(− % 3 ) 3 3 3 E(r ) B = 7%

Expected Return, Variance, and Covariance Stock fund Bond Fund Rate of Squared Rate of Squared Scenario Return Deviation Return Deviation Recession -7% 3.24% 17% 1.00% Normal 12% 0.01% 7% 0.00% Boom 28% 2.89% -3% 1.00% Expected return 11.00% 7.00% Variance 0.0205 0.0067 Standard Deviation 14.3% 8.2% (− % 7 −11%)2 = 3 2. 4%

Expected Return, Variance, and Covariance Stock fund Bond Fund Rate of Squared Rate of Squared Scenario Return Deviation Return Deviation Recession -7% 3.24% 17% 1.00% Normal 12% 0.01% 7% 0.00% Boom 28% 2.89% -3% 1.00% Expected return 11.00% 7.00% Variance 0.0205 0.0067 Standard Deviation 14.3% 8.2% 1 ( 2% −11%)2 = 0. 1%

10.2 Expected Return, Variance, and Covariance Stock fund Bond Fund Rate of Squared Rate of Squared Scenario Return Deviation Return Deviation Recession -7% 3.24% 17% 1.00% Normal 12% 0.01% 7% 0.00% Boom 28% 2.89% -3% 1.00% Expected return 11.00% 7.00% Variance 0.0205 0.0067 Standard Deviation 14.3% 8.2% 1 2 0. 5% = 3 ( 2. 4% + 0.01% + 2 8. 9%) 14 % 3. =. 0 0205 3

The Return and Risk for Portfolios Stock fund Bond Fund Rate of Squared Rate of Squared Scenario Return Deviation Return Deviation Recession -7% 3.24% 17% 1.00% Normal 12% 0.01% 7% 0.00% Boom 28% 2.89% -3% 1.00% Expected return 11.00% 7.00% Variance 0.0205 0.0067 Standard Deviation 14.3% 8.2% Note that stocks have a higher expected return than bonds and higher risk. Let us turn now to the risk-return tradeoff of a portfolio that is 50% invested in bonds and 50% invested in stocks.

The Return and Risk for Portfolios Rate of Return Scenario Stock fund Bond fund Portfolio squared deviation Recession -7% 17% 5.0% 0.160% Normal 12% 7% 9.5% 0.003% Boom 28% -3% 12.5% 0.123% Expected return 11.00% 7.00% 9.0% Variance 0.0205 0.0067 0.0010 Standard Deviation 14.31% 8.16% 3.08% The rate of return on the portfolio is a weighted average of the returns on the stocks and bonds in the portfolio: r = w r + w r P B B S S 5% = 50%× (−7%) + 5 % 0 × 1 ( % 7 )

The Return and Risk for Portfolios Rate of Return Scenario Stock fund Bond fund Portfolio squared deviation Recession -7% 17% 5.0% 0.160% Normal 12% 7% 9.5% 0.003% Boom 28% -3% 12.5% 0.123% Expected return 11.00% 7.00% 9.0% Variance 0.0205 0.0067 0.0010 Standard Deviation 14.31% 8.16% 3.08% The expected rate of return on the portfolio is a weighted average of the expected returns on the securities in the portfolio. E(r ) = w E(r ) + w E(r ) P B B S S 9% = 50%× 11 ( %) + 5 % 0 × (7%)

The Return and Risk for Portfolios Rate of Return Scenario Stock fund Bond fund Portfolio squared deviation Recession -7% 17% 5.0% 0.160% Normal 12% 7% 9.5% 0.003% Boom 28% -3% 12.5% 0.123% Expected return 11.00% 7.00% 9.0% Variance 0.0205 0.0067 0.0010 Standard Deviation 14.31% 8.16% 3.08% The variance of the rate of return on the two risky assets portfolio is 2 2 2 σ = (w σ ) + (w σ ) + 2(w σ )(w σ )ρ P B B S S B B S S BS where ρ is the correlation coefficient between the returns BS on the stock and bond funds.

10.3 The Return and Risk for Portfolios Rate of Return Scenario Stock fund Bond fund Portfolio squared deviation Recession -7% 17% 5.0% 0.160% Normal 12% 7% 9.5% 0.003% Boom 28% -3% 12.5% 0.123% Expected return 11.00% 7.00% 9.0% Variance 0.0205 0.0067 0.0010 Standard Deviation 14.31% 8.16% 3.08% Observe the decrease in risk that diversification offers. An equally weighted portfolio (50% in stocks and 50% in bonds) has less risk than stocks or bonds held in isolation.

10.4 The Efficient Set for Two Assets % in stocks Risk Return P o rtfo lo R isk a nd R e tu rn C o m b in a tio n s 0% 8.2% 7.0% 5% 7.0% 7.2% 1 2 .0 % 10% 5.9% 7.4% 1 1 .0 % 15% 4.8% 7.6% 1 0 .0 % 100% 20% 3.7% 7.8% 9. 0 % stocks 25% 2.6% 8.0% 8. 0 % 30% 1.4% 8.2% 7. 0 % 35% 0.4% 8.4% Portfolio Return 100% 6. 0 % 40% 0.9% 8.6% bonds 5. 0 % 45% 2.0% 8.8% 0 .0 % 2 .0 % 4. 0 % 6 .0 % 8. 0 % 1 0. 0 %1 2 .0 %1 4 .0 %1 6 .0 % 50.00% 3.08% 9.00% 55% 4.2% 9.2% P o rtfo lio R isk (sta nd a rd d e v ia tio n ) 60% 5.3% 9.4% 65% 6.4% 9.6% We can consider other 70% 7.6% 9.8% 75% 8.7% 10.0% portfolio weights besides 50% 80% 9.8% 10.2% in stocks and 50% in bonds … 85% 10.9% 10.4% 90% 12.1% 10.6% 95% 13.2% 10.8% 100% 14.3% 11.0%

10.4 The Efficient Set for Two Assets % in stocks Risk Return P o rtfo lo R isk a n d R e tu rn C o m b in a tio n s 0% 8.2% 7.0% 1 2 .0 % 5% 7.0% 7.2% 1 1 .0 % 10% 5.9% 7.4% 1 0 .0 % 15% 4.8% 7.6% 100% 9 .0 % 20% 3.7% 7.8% stocks 25% 2.6% 8.0% 8 .0 % 30% 1.4% 8.2% 7 .0 % Portfolio Return 100% 35% 0.4% 8.4% 6 .0 % bonds 40% 0.9% 8.6% 5 .0 % 45% 2.0% 8.8% 0 .0 % 2 .0 % 4 .0 % 6 .0 % 8 .0 % 1 0 .0 %1 2 .0 %1 4 .0 %1 6. 0 % 50% 3.1% 9.0% P o rtfo lio R isk (sta n d a rd d e v ia tio n ) 55% 4.2% 9.2% 60% 5.3% 9.4% 65% 6.4% 9.6% Note that some portfolios are 70% 7.6% 9.8% “better” than others. They have 75% 8.7% 10.0% 80% 9.8% 10.2% higher returns for the same level 85% 10.9% 10.4% of risk or less. 90% 12.1% 10.6% 95% 13.2% 10.8% 100% 14.3% 11.0%

TwoSecurity Portfolios with Various Correlations return 100% ρ = -1.0 stocks ρ = 1.0 ρ = 0.2 100% bonds σ

Portfolio Risk/Return Two Securities: Correlation Effects Relationship depends on correlation coefficient -1.0 < ρ < +1.0 The smaller the correlation, the greater the risk reduction potential If ρ = +1.0, no risk reduction is possible

The Efficient Set for Many Securities return Individual Assets σ Consider a world with many risky assets;P we can stil identify the opportunity set of risk- return combinations of various portfolios.

The Efficient Set for Many Securities return minimum variance portfolio Individual Assets σ P Given the opportunity set we can identify the minimum variance portfolio.

The Efficient Set for Many Securities return efficient frontier minimum variance portfolio Individual Assets σ P The section of the opportunity set above the minimum variance portfolio is the efficient frontier.

Optimal Risky Portfolio with a RiskFree Asset 100% return stocks rf 100% bonds σ In addition to stocks and bonds, consider a world that also has risk-free securities like T-bil s

Riskless Borrowing and Lending CML 100% return stocks Balanced fund rf 100% bonds σ Now investors can al ocate their money across the T-bil s and a balanced mutual fund

The Capital Market Line Assumptions: Rational Investors: More return is preferred to less. Less risk is preferred to more. Homogeneous expectations Riskless borrowing and lending. 2 2 2 σ = (w σ ) + (w σ ) + 2(w σ )(w σ )ρ ⇒ σ = w σ P F F A A F F A A FA P A A

Riskless Borrowing and Lending L return CM efficient frontier rf σ P With a risk-free asset available and the efficient frontier identified, we choose the capital al ocation line with the steepest slope

Market Equilibrium L return CM efficient frontier M rf σ P With the capital al ocation line identified, all investors choose a point along the line—some combination of the risk-free asset and the market portfolio M. In a world with homogeneous expectations, M is the same for all investors.

The Separation Property L return CM efficient frontier M rf σ P The Separation Property states that the market portfolio, M, is the same for al investors—they can separate their risk aversion from their choice of the market portfolio.

The Separation Property L return CM efficient frontier M rf σ P Investor risk aversion is revealed in their choice of where to stay along the capital al ocation line—not in their choice of the line.

Market Equilibrium CML 100% return stocks Balanced fund rf 100% bonds σ Just where the investor chooses along the Capital Market Line depends on his risk tolerance. The big point though is that allinvestors have the same CML.

Market Equilibrium CML 100% return stocks Optimal Risky Porfolio rf 100% bonds σ Al investors have the same CML because they al have the same optimal risky portfolio given the risk-free rate.

The Separation Property CML 100% return stocks Optimal Risky Porfolio rf 100% bonds σ The separation property implies that portfolio choice can be separated into two tasks: (1) determine the optimal risky portfolio, and (2) selecting a point on the CML.

Optimal Risky Portfolio with a RiskFree Asset CML 0 CML1 100% return stocks 1 First Second Optimal rf Optimal Risky Portfolio Risky 0 r Portfolio f 100% bonds σ The optimal risky portfolio depends on the risk-free rate as wel as the risky assets.

Expected versus Unexpected Returns Realized returns are general y not equal to expected returns There is the expected component and the unexpected component At any point in time, the unexpected return can be either positive or negative Over time, the average of the unexpected component is zero

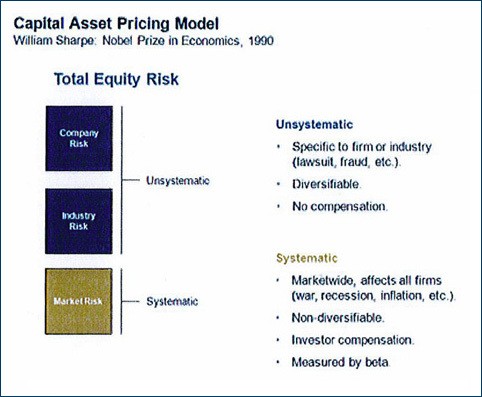

Returns Total Return = expected return + unexpected return Unexpected return = systematic portion + unsystematic portion Therefore, total return can be expressed as follows: Total Return = expected return + systematic portion + unsystematic portion

Total Risk Total risk = systematic risk + unsystematic risk The standard deviation of returns is a measure of total risk For well diversified portfolios, unsystematic risk is very smal Consequently, the total risk for a diversified portfolio is essentially equivalent to the systematic risk

Portfolio Risk as a Function of the Number of Stocks in the Portfolio In a large portfolio the variance terms are effectively σ diversified away, but the covariance terms are not. Diversifiable Risk; Nonsystematic Risk; Firm Specific Risk; Unique Risk Portfolio risk Nondiversifiable risk; Systematic Risk; Market Risk n Thus diversification can eliminate some, but not all of the risk of individual securities.

Definition of Risk When Investors Hold the Market Portfolio The best measure of the risk of a security in a large portfolio is the beta (β )of the security. Beta measures the responsiveness of a security to movements in the market portfolio. Cov(R R ) i, M β = i 2 σ (R ) M

Total versus Systematic Risk Consider the following information: Standard Deviation Beta Security C 20% 1.25 Security K 30% 0.95 Which security has more total risk? Which security has more systematic risk? Which security should have the higher expected return?

Estimating β with regression srn etu rity R ecuS Characteristic Line Characteristic Lin Slope = β i Return on market % R = α + β R + e i i i m i

Beta Reuters Yahoo

The Formula for Beta Cov(R R ) i, M β = i 2 σ (R ) M Your estimate of beta will depend upon your choice of a proxy for the market portfolio.

Beta of a Portfolio Stock Amount Portfolio Beta Invested weights IBM $6,000 50% 0.90 0.450 GM $4,000 33% 1.10 0.367 Walmart $2,000 17% 1.30 0.217 Portfolio $12,000 100% 1.03 The beta of a portfolio is a weighted average of the beta’s of the stocks in the portfolio. Mutual Fund Betas

Relationship of Risk to Reward The fundamental conclusion is that the ratio of the risk premium to beta is the same for every asset. In other words, the reward-to-risk ratio is constant and equal to: E(R ) − R Re ward / i F Risk = βi

Market Equilibrium In equilibrium, al assets and portfolios must have the same reward-to-risk ratio and they all must equal the reward-to-risk ratio for the market E(R ) − R E(R ) − R A f M f = β β A M

Relationship between Risk and Expected Return (CAPM) Expected Return on the Market: RM = RF + Market R isk P remium • Expected return on an individual security: Ri = R + β × (RM − R ) F i F Market Risk Premium This applies to individual securities held within well-diversified portfolios.

Expected Return on an Individual Security This formula is called the Capital Asset Pricing Model (CAPM) Ri = R + β × (RM − R ) F i F Expected Risk-free Beta of the Market risk return on = + × rate security premium a security • Assume β = 0, then the expected return is R. i F • Assume β = 1, then Ri = RM i

Relationship Between Risk & Expected Return Ri = R + β × (RM − R ) F i F RM xpected return RF E 1.0 β The slope of the security market line is equal to the market risk premium; i.e. the reward for bearing an average amount of systematic risk.

Relationship Between Risk & Expected Return xpected E return 13.5% βi =1.5 % 3 RF = % 3 1.5 β RM = 10% Ri = 3% +. 1 5× 1 ( % 0 − 3%) = 13.5%

Total versus Systematic Risk Consider the following information: Standard Deviation Beta Security C 20% 1.25 Security K 30% 0.95 Which security has more total risk? Which security has more systematic risk? Which security should have the higher expected return?

Summary and Conclusions This chapter sets forth the principles of modern portfolio theory. The expected return and variance on a portfolio of two securities A and B are given by E(r ) = w E(r ) + w E(r ) P A A B B 2 2 2 σ = (w σ ) +(w σ ) + 2(w σ )(w σ )ρ P A A B B B B A A AB • By varying w. one can trace out the efficient set of portfolios. We A graphed the efficient set for the two-asset case as a curve, pointing out that the degree of curvature reflects the diversification effect: the lower the correlation between the two securities, the greater the diversification. • The same general shape holds in a world of many assets.

Summary and Conclusions The efficient set of risky assets can be combined with riskless borrowing and lending. In this case, a rational investor wil always choose to hold the portfolio of risky securities represented by the market portfolio. L • Then with return CM efficient frontier borrowing or lending, the M investor selects a point along the rf CML. σ P

Summary and Conclusions The contribution of a security to the risk of a wel diversified portfolio is proportional to the covariance of the securitys return with the market’s return. This contribution is cal ed the beta. Cov(R R ) i, M β = i 2 σ (R ) M • The CAPM states that the expected return on a security is positively related to the security’s beta: Ri = R + β × (RM − R ) F i F

Expected (Exante) Return, Variance and Covariance Expected Return: E(R) = Σ (p x R ) s s Variance: σ 2 = Σ s s Standard Deviation = σ Covariance: σ = Σ B Correlation Coefficient: ρ = σ / (σ σ ) AB AB A B

Risk and Return Example State Prob. T-Bills IBM HM XYZ Market Port. Recession 0.05 8.0% (22.0%) 28.0% 10.0% (13.0%) Below Avg. 0.20 8.0 (2.0) 14.7 (10.0) 1.0 Average 0.50 8.0 20.0 0.0 7.0 15.0 Above Avg. 0.20 8.0 35.0 (10.0) 45.0 29.0 Boom 0.05 8.0 50.0 (20.0) 30.0 43.0 E(R)=σ =

Expected Return and Risk of IBM E(R )= 0.05*(-22)+0.20*(-2) IBM +0.50*(20)+0.20*(35)+0.05*(50) = 18% σ 2 = 0.05*(-22-18)2+0.20*(-2-18)2 IBM +0.50*(20-18)2+0.20*(35-18)2 +0.05*(5018)2 = 271 σ =16.5% IBM

Covariance and Correlation COV = 0.05*(-22-18)(10-12.5)+ IBM&XYZ 0.20*(-2-18)(-10-12.5)+0.50*(20-18)(7-12.5)+0.20*(35-18)(45-12.5)+0.05*(50-18)(30-12.5) =194 Correlation = 194/(16.5)(18.5)=.6355

Risk and Return for Portfolios (2 assets) Expected Return of a Portfolio: E(R ) = X E(R) + X E(R) p A A B B Variance of a Portfolio: σ 2 = X 2σ 2 + X 2σ 2 + 2 X X σ p A A B B A B AB