The Capital Asset Pricing Model An Overview_2

Post on: 29 Июль, 2015 No Comment

Part 11

What is CAPM Capital Asset Pricing Model?

Every investment comes up with certain risk. Even equity has risk that there might be difference in the actual and the expected return. The cost of equity is, essentially, the discount rate applied to expect equity cash flows which helps an investor determine the price he or she is willing to pay for such cash flows. Investors being conservative by nature decide on taking the risk only when they can foresee the return they are expecting from an investment. Investors can calculate and get an idea of the required return on an investment, based on the assessment of its risk using Capital Asset Pricing Model i.e. CAPM.

Calculation of CAPM

The cost of equity (Ke) is the rate of return expected by shareholders. It can be calculated using the formula

Cost of equity = Risk free rate + Beta X Risk premium

where:

Cost of equity (Ke) = the rate of return expected by shareholders

Risk free rate (rrf ) = the rate of return for a risk-free security

Risk premium ( Rp) = the return that equity investors demand over a risk-free rate

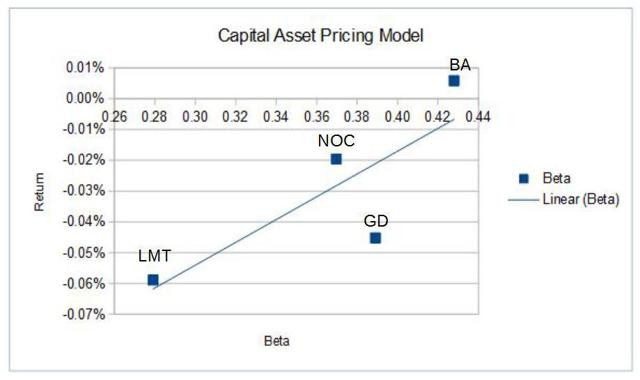

Beta (Ba) = A measure of the variability of a company’s stock price in relation to the stock market overall

Now let’s understand these key terminologies of the formula:

Risk free rate – It is the minimum rate of return that an investor will receive if they in invest in a risk free security. Government bonds are known as risk free securities. For a security to be risk free security they should not have any default risk and re investment risk. Default risk is the risk where companies or individuals fail to repay their debt obligations. Re investment risk is the risk faced by an investor where the yield of the bonds are falling. As in this situation the investors have to reinvest their future income their yield or the final return of principal in securities which are lower yielding. So, not all governments securities are risk free securities

Beta – Risk can be classified as systematic risk and unsystematic risk. Unsystematic risk is the risk that can be diversified. This risk arises due to the internal factors prevailing in an organization. For example workers have gone for a strike, customer’s commitments are not fulfilled, regulatory framework has a conflict with government policy etc.

Systematic risk is the risk that cannot be diversified. It is caused due to the external factors that affect an organization. It is uncontrollable in nature. For example, interest rate raises suddenly, Fluctuations of trading price of a security impacts the entire market etc. This risk can be measured with beta.

Beta measures the volatility of a security in comparison with the market as a whole.

- If beta of security is equal to 1 this means that if the market is moving upward by 10% the stock having beta equal to 1 will also move up by 10% and vice versa.

- If beta of a security is less than 1 it means that the security is less volatile as compared to the market. For example a company has a beta of 0.5 this means that if the market has an upward movement of 10% the company will have an upward movement of 5% and vice versa.

- If the beta of a company security is more than 1 this means that the security has high volatility. For example if the company security has a beta of 1.5 and the stock market moves up by 10% then the security moves up by 15 % and vice versa

Risk premium

It is calculated using the formula Stock market return minus Risk free rate of return. It is the return that an investor expects above risk free rate of return in order to compensate for the risk of volatility that a person is taking by investing in the stock market. For example, if the investor gets a return of 20% and the risk free rate is 7% then the risk premium is 13%.

Assumptions for CAPM model

- Investors don’t like to take risk. They would like to invest in a portfolio which has low risk. So if a portfolio has higher risk the investors expects a higher return.

- While making the investment decision investors take into consideration only single period horizon and not multiple period horizons.

- Transaction cost in the financial market is assumed to be low cost and the investors can buy and sell the assets in any number at the risk free rate of return.

- In CAPM, Values needs to be assigned for the risk free rate of return, risk premium and beta.

- Risk free rate – The yield on the government bond is used as a risk free rate of return but it changes on a daily basis according to the economic circumstances

- Beta – The value of beta changes over time. It is not constant. So the expected return might also differ.

- Market Return – The stock market return can be calculated as the sum of the

Average capital gain and the average dividend yield. If the Shares prices falls and outweighs the dividend yield a stock market can provide a negative rather than a positive return