The Bond Bear

Post on: 24 Июль, 2015 No Comment

Below is an extract from a commentary originally posted at www.speculative-investor.com on 19th April 2007.

Intermediate-term Outlook

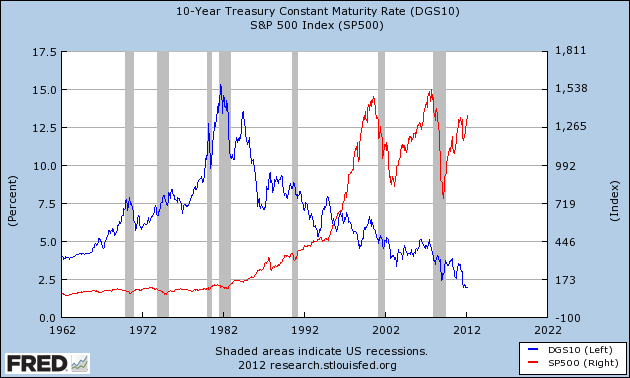

We’ve been long-term bearish on bonds since their June-2003 peak. Actually, we turned long-term bearish well before June of 2003 and have always considered the final run-up to the 2003 peak to be an irrational response to the threat of deflation. We say irrational because such a threat never existed. Extraordinarily — but perhaps not inexplicably given that hardly anyone seems to know what inflation is let alone how it operates within an economy — the fear of DEFLATION, and, consequently, the investment demand for bonds, peaked shortly after the rate of INFLATION (the rate of money supply growth) hit its highest level since the 1970s.

Since June of 2003 the inevitable EFFECTS of inflation have come home to roost and this has put some downward pressure on the bond market. The surprise, from our perspective, is that bond prices have held up as well as they have. After all, evidence of an inflation problem has been blatantly obvious in the commodity and real estate markets for a few years now and the continuing high rate of growth in the global money supply guarantees that the problem will get bigger. And yet, although T-Bond futures remain well below their June-2003 peak they also remain well above their August-2003 trough. Rather than a bear market, what we’ve seen over the past 4 years is a wide trading range.

Despite what we perceive to be crystal-clear evidence of an inflation problem, a number of factors have combined to prevent the bond market from breaking-out to the downside. These factors include: a) the large-scale purchasing of bonds by the central banks of Asia as part of their currency manipulation schemes; b) arbitrage related to Japan’s zero — or near-zero, as is now the case — interest rate policy; c) the Japanese public’s search for yield outside Japan; d) the downward pressure on the prices of finished goods exerted by the huge increase in productivity within emerging-market economies; and e) the general lack of understanding of what inflation is (most people, including many people who should know better, mistakenly believe that the CPI represents inflation).

Because there appeared to be no way of coming up with a high-confidence guess as to when the above-mentioned factors would lose their collective ability to support the bond market, about two years ago we stopped trying to predict the timing of a major bond market decline. We have maintained the view that a secular bond bear commenced in June of 2003, but have, since the third quarter of 2005, shied away from forecasting WHEN the inevitable break below the August-2003 bottom would occur. The situation is changing, however, and although at least some of the above-mentioned support factors are likely to remain in place, the story is unfolding in a way that points toward a bond market breakdown occurring with the next 14 months.

One of the key ingredients in the recipe for the coming large decline in bond prices (large rise in bond yields) is the irresistible upward pressure on food prices discussed in TSI commentaries over the past few months. It’s important to understand, though, that if the supply of money doesn’t grow then increases in food prices have to be offset by decreases in other prices. (By the way, if you understand this simple fact then you will be a step ahead of some of the smartest analysts in the financial world). Or, to put it another way, a broad-based increase in prices of sufficient magnitude to push bonds sharply lower can only occur in response to increased money supply.

At the end of the day, inflation is 100% about what’s happening to money; and over the past few years the global supply of money has been growing at a rapid pace. Furthermore, the trend shows no sign of abating in that: the supplies of US dollars, euros, British Pounds, Canadian dollars and Australian dollars are presently growing at 10-15% per year; the supplies of Chinese Yuan and Indian Rupee are expanding at around 20% per year; and the Russian Ruble supply is growing at the rate of almost 50% per year. Therefore, there continues to be more than enough money-supply growth to allow food prices to rise to much higher levels without putting downward pressure on other prices.

In a nutshell: the potential significance of a substantial across-the-board rise in food prices occurring alongside continued firmness in most other prices is that it could catalyse widespread RECOGNITION of an inflation problem in an otherwise inflation-blind world.

Now, it is certainly possible that the knock-on effects of weakness in the US residential property market will postpone the start of a major decline in the bond market until the first half of next year, but there’s little chance of it being postponed any longer than that. This is because central banks and governments can be relied upon to respond to every economic problem by promoting more inflation as long as they have the freedom to do so. And they will have the freedom to do so until bonds break below major support and begin to accelerate downward. In other words, if things get bad enough on the economic front to underpin the bond market during the second half of this year then the monetary authorities will undoubtedly take actions that set the stage for an even bigger inflation problem thereafter.

But while a bond market breakdown COULD be delayed until next year, signs are beginning to emerge that it will happen this year. In particular and as noted in our 16th April commentary, the Bank Stock Index (BKX) recently hit a new multi-year low relative to the S&P500 Index. Over timeframes of up to a few months it is not uncommon for the BKX/SPX ratio and the bond market to go their separate ways, but the following chart shows that over the long-term they tend to move together. Therefore, it will be a decidedly bearish omen for the bond market if the current downward trend in the BKX/SPX ratio persists.

Short-term Outlook

We are long- and intermediate-term bearish on bonds, but the short-term outlook is beginning to turn bullish. In particular, the following daily chart shows that 10-year T-Note futures have just reversed upward after spiking to a new multi-week low on Monday. The downward-sloping channel hasn’t yet been breached, but the price action of the past three days suggests that a short-term bottom is in place.

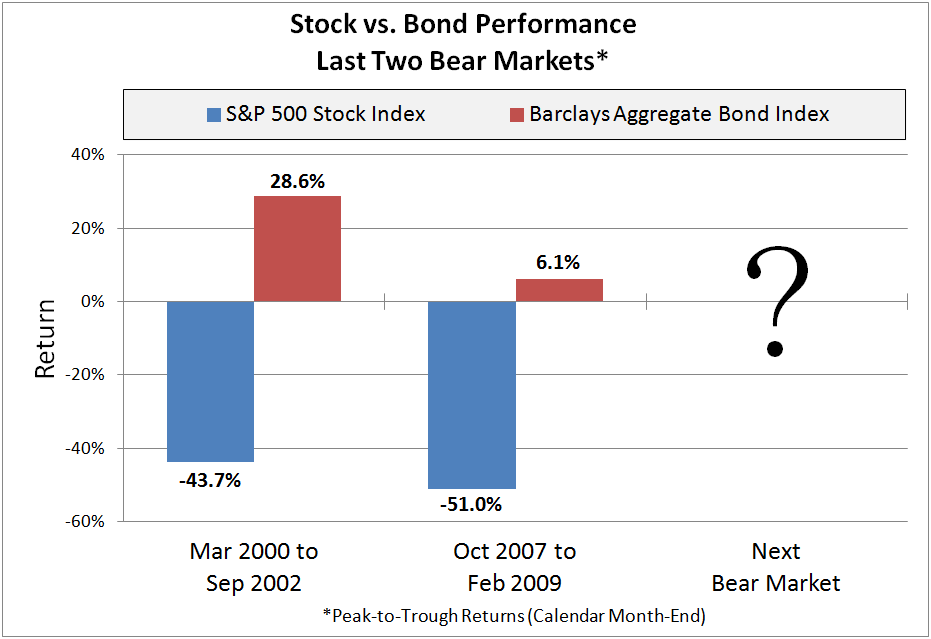

If bonds have just embarked on a 1-2 month rebound it would be a positive development for the stock market and could help to extend the stock market’s upward trend by a few months.