The Best Time to Sell Mutual Funds

Post on: 16 Март, 2015 No Comment

Other People Are Reading

When You Need Money

If you need money for other purposes, you might want to sell one or more of your mutual funds to raise the money. That is why it is a good idea to invest in stock mutual funds only with money you do not expect to need within the next five years. That five-year time horizon gives you time to ride out the inevitable bear (downturn) markets without having to raid your funds and suffer a loss. You can, however, keep short-term money in more stable investments like money market and government bond funds.

To Rebalance Your Portfolio

To Trim Your Holdings

Investing in mutual funds is easy, and as a result, many investors end up with a large number of mutual funds. In some cases this leads to duplication, especially for investors who hold several large cap or small cap mutual funds. You might want to sell a mutual fund to trim your holdings and make managing your portfolio easier. If you go through the annual reports you receive from each fund, you might find that several of your funds own a lot of the same stocks. If this is the case, you could sell the one that has been performing the worst and move the money into a better performing fund.

References

More Like This

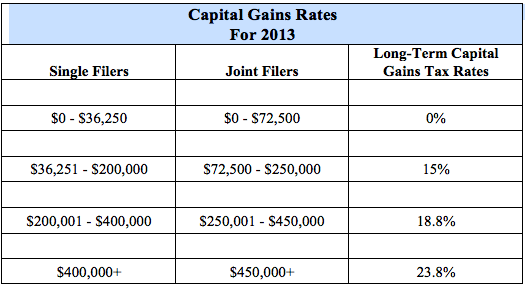

Tax Implications of Cashing in Your Mutual Funds

Should I Use Mutual Funds to Pay Debt?

You May Also Like

Bond funds contain thousands of individual bonds issued by governments, corporations and mortgage companies. Investors who primarily seek income from their investment.

10 Best Performing Mutual Funds. Mutual funds are available with a wide range of investment objectives. Funds can be broadly divided into.

If you want to acquire a broad range of investments with just one purchase, mutual funds are the way to go. They're.

As a mutual fund investor, you have many different choices at your disposal. You can invest in equity mutual funds and profit.

Buying and selling mutual funds requires researching each fund and assessing the level of risk one is willing to take when investing.

Mutual funds are an investment vehicle that allows a large group of investors to pool their money and allow a team of.

Morning Star lists over 13,000 mutual funds available in the U.S. markets. Mutual fund performance changes dramatically from year to year as.

When you invest a set amount of money in a mutual fund at regular intervals, you are buying shares at fluctuating prices.

Evaluating the best mutual funds over the last three years can isolate investment opportunities that have out-performed others during a difficult market.

Investing in mutual funds incurs fees and expenses. Fess are commonly referred to as shareholder fees that a fund charges shareholders on.

Stock market statistics — and results — bear out many things. While there is no holy grail or crystal ball with which.