The Best Fidelity Funds for Your 401(k)

Post on: 24 Июнь, 2015 No Comment

Recent Posts:

The Best Fidelity Funds for Your 401(k)

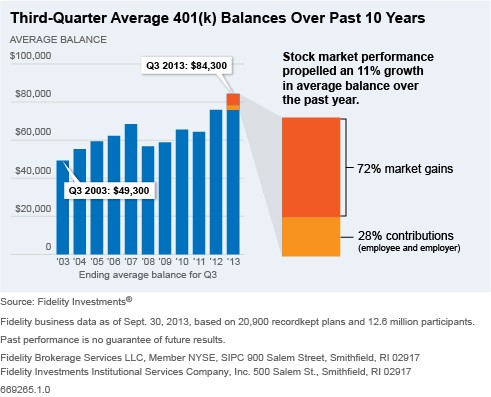

Last year was a white-knuckle ride for folks with a 401(k) or IRA plan. Though the markets finished basically flat, the full-year returns ignore the peak and troughs created by some extreme volatility.

If you’ve gotten nauseous from these kind of antics which seem par for the course since the financial crisis of 2008 and resulting recession it’s tempting to throw in the towel. But don’t do it! Stock-focused mutual funds are a crucial part of your retirement portfolio, and you shouldn’t give up on your 401(k) in 2012.

For starters, if you get your contributions matched, that’s free money from your employer. Even if your account loses a little, you still wind up making out.

And most important, while some funds underperformed last year, it’s vital to understand that a properly built portfolio can deliver much better returns.

If you mutual funds from the Fidelity family are available to you from your 401(k) provider, take heart because you have a lot of great options. Here are some of the best Fidelity funds for your 401(k) in 2012.

A Strong Foundation with Contrafund and Large Caps

Protecting your money is crucial in a choppy stock market. However, you can’t sacrifice too much growth just for stability. Your safest bet is to not invest a dime in the market – but the sad reality is that many of us don’t have the luxury of just sitting on our hands. Our retirement funds need to grow for us to live comfortably and maintain our current lifestyle when we stop collecting a paycheck.

Perhaps the best mix of growth and stability that Fidelity has to offer is its flagship Contrafund (MUTF:FCNTX ). Manager William Danoff invests in companies whose value is unrecognized by the public. Foreign investments make up 16.3% of the holdings, so this is largely a domestic fund that isn’t exposed to emerging market volatility. Top holdings include Apple (NASDAQ:AAPL ), Google (NASDAQ:GOOG ), Berkshire Hathaway (BRK.A ), McDonalds (NYSE:MCD ) and Coca Cola (NYSE:KO ).

The fund has no transaction fees, and its 0.93% expense ratio is a reasonable cost for an actively managed fund with a proven track record. Contrafund gets four stars from Morningstar, and has returned almost 7% annually over the last 10 years compared with a little more than 1% annually for the S&P 500. Or put another way, you would have doubled your money in Contrafund since 2002 while seeing only a 10% gain if you tracked the broader stock market.

Another powerful option if you don’t have Contrafund at your disposal is Large Cap Core Enhanced (MUTF:FLCEX ). This is technically an indexed fund, but it’s “enhanced” by a computer-driven analysis from Geode Capital to spit out the worst stocks in the S&P 500 and overweight the best ones. With a 0.45% expense ratio, it’s a cheap way to try to beat the market through selecting the best stocks instead of settling for precisely tracking major indexes like the S&P 500.

Go for Growth in Stock Funds

So now you have your base. How do you corral the biggest winners, however, without taking on undue risk?

Blue Chip Growth (MUTF:FBGRX ) is perhaps the best option Fidelity offers in this category. Manager Sonu Kalra invests in companies with a market cap of $1 billion or higher, so you’re not chasing tiny picks that carry greater risk. And foreign investments make up 9.4% of the holdings, so you’re insulated from volatility in Europe, risks in China and other global troubles. Top holdings right now include Amazon (NASDAQ:AMZN ), Qualcomm (NASDAQ:QOM ) and MasterCard (NYSE:MA ) to name a few.

If you have sector funds in your portfolio, however, you may want to make a more focused play on one of the biggest growth areas right now: Health care. The aging baby boomer population has created a demographic trend that’s impossible to ignore, and companies that make prescription drugs and medical devices are set to soar.

Fidelity Select Health Care (MUTF:FSPHX ) is perfect to play this trend. Top holdings are biotech firm Amgen (NASDAQ:AMGN ), medical device firm Covidien (NYSE:COV ) and diversified health care company Baxter (NYSE:BAX ).

You’re obviously taking on a bigger risk if you bulk up on a specific sector, because your portfolio lives and dies on a specific industry instead of the broader economy and stock market. However, for growth-focused investors this is a calculated risk that could yield big profits in 2012.

Getting Paid With Income Investments

Last but not least, all investors should hedge their bets with mutual funds that offer reliable income streams. While stock-based funds are an important part of your 401(k) because that’s where the lion’s share of your growth comes from, you can’t ignore the power of investments that pay you even if the market moves sideways or down.

The best income investment that Fidelity offers is Fidelity High Income (MUTF:SPHIX ). This fund focuses on buying debt from some big corporations and preferred stocks that pay a good rate of return annually. It’s more aggressive because it relies on high-yield bonds from companies with less than perfect records US Airways (NYSE:LCC ) and Sprint Nextel (NYSE:S ), for instance. But the yields are significant, as much as 8% or 9% annually.

If you’re more on the conservative side and want good income investments in your 401(k), take a hard look at Fidelity Total Bond (MUTF:FTBFX ). This taxable bond fund focuses on Treasuries and investment-grade corporate bonds but if you buy it in your 401(k), you’re sheltered from the tax burden and can really get powerful returns. The fund offers returns closer to 5% to 6% annually, but is less risky.

If you’re more on the aggressive side, you can supplement the High Income fund with Fidelity Dividend Growth (MUTF:FDGFX ). This is a stock-focused fund like your growth investments, but its top holdings like General Electric (NYSE:GE ), Philip Morris (NYSE:PM ) or Coca-Cola (NYSE:KO ) pay decent dividends to hedge against volatility.

Putting the Pieces Together

Whether you focus on aggressive growth in stocks or rely mainly on income investments in your 401(k), Fidelity has some of the best options in the mutual fund industry. If you have an IRA, you can also get into these funds easily, with most accessible through a modest $2,500 buy-in instead of some huge hurdle that shuts out individual investors.

Even if some of the funds aren’t available to you, use this as a guide to building a strong, diversified retirement portfolio. The funds discussed here can be “replicated” through other providers, since most folks are limited to what their employer offers in their 401(k).

But whatever options you have, you should take note of this list and make a commitment to build a better portfolio in 2012. It’s your retirement after all, and it’s up to you to plan for it.